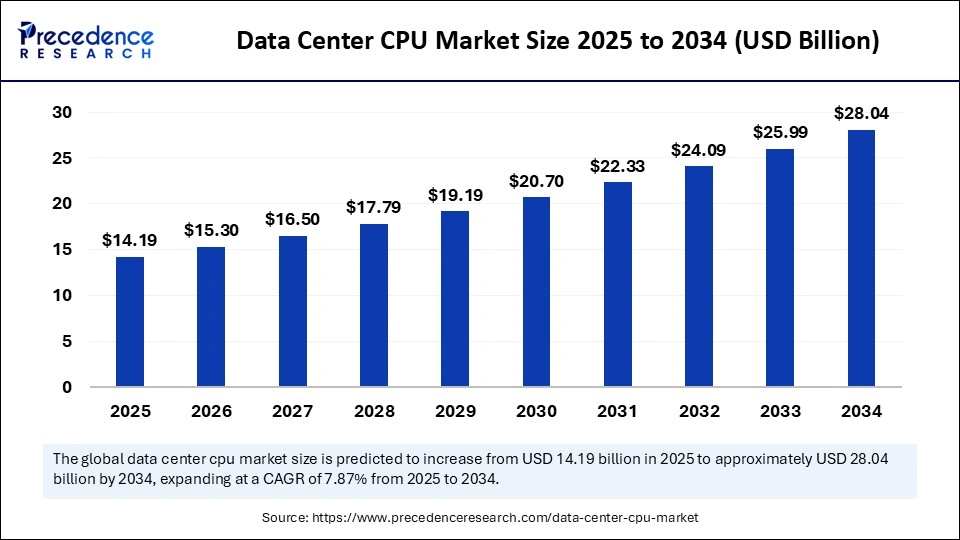

The global data center CPU market, valued at USD 13.16 billion in 2024, is poised for significant expansion, expected to reach approximately USD 28.04 billion by 2034. This growth is driven by an annual CAGR of 7.87% from 2025 to 2034, underpinned by the rising demand for high-performance processing in cloud computing, artificial intelligence (AI) workloads, and big data analytics.

Innovations in CPU architectures, such as AMD’s EPYC processors and Intel’s Xeon 6 series, combined with surging investments in digital infrastructure and 5G expansion, form the cornerstone of this market’s rapid momentum.

Data Center CPU Market Key Insights

-

The data center CPU market was valued at USD 13.16 billion in 2024 and is forecasted to grow to USD 28.04 billion by 2034.

-

North America dominates the market, with the U.S. alone expected to reach USD 5.63 billion by 2034.

-

Asia Pacific stands as the fastest-growing region, driven by rapid digital transformations and cloud adoption.

-

Leading players driving innovation include Intel, AMD, and ARM-based CPU providers.

-

The market is growing at a CAGR of 7.87% from 2025 to 2034, reflecting robust demand for AI-ready and energy-efficient CPUs.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6769

Data Center CPU Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.04 Billion |

| Market Size in 2025 | USD 14.19 Billion |

| Market Size in 2024 | USD 13.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.87% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Processor Architecture, Server Form Factor, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial intelligence is a major catalyst driving the demand for advanced data center CPUs. The explosion of AI workloads — from generative AI and large language model (LLM) training to real-time inference — has heightened the need for CPUs that are not only powerful but also energy efficient. Manufacturers are responding with architectures that integrate AI accelerators and enhanced memory subsystems optimized for mixed workloads.

Moreover, hyperscale cloud providers and AI-driven enterprises require CPUs capable of managing hybrid compute environments that combine GPUs, CPUs, and specialized AI chips seamlessly. This evolving ecosystem has accelerated the adoption of custom silicon solutions that boost AI performance while maintaining operational efficiency.

What Are the Primary Factors Driving Market Growth?

The data center CPU market growth is propelled by several converging factors:

-

Cloud Computing Expansion: Hyperscale data centers’ growing appetite for scalable CPU power to support virtual machines, containerized apps, and analytics.

-

Innovation in CPU Architecture: Introductions of chiplets, smaller process nodes, and integrated AI accelerators improving performance and power efficiency.

-

Energy Efficiency Focus: Rising demand for low-power CPUs, especially ARM-based processors, to reduce data center power consumption and heat generation.

-

5G and Edge Computing: Networks and edge infrastructures require compact, high-performance CPUs to handle distributed workloads with low latency.

What Are the Emerging Opportunities and Trends in the Market?

How are new CPU architectures shaping the data center landscape?

Innovations like AMD’s EPYC and Intel’s Xeon 6 series offer higher core counts and improved AI integration, enabling data centers to manage complex, multi-tenant cloud workloads more efficiently.

Why is ARM architecture gaining rapid traction in data centers?

ARM CPUs offer superior energy efficiency and scalability, making them ideal for cloud-native apps, AI workloads, and edge computing, with increasing adoption by leading cloud hyperscalers.

What role do server form factors play in market growth?

Rackmount servers currently dominate due to their versatility and scalability for large-scale cloud deployments, but microservers are rapidly growing, driven by edge computing and compact, energy-efficient solutions.

Regional and Segment Analysis

North America holds the largest market share thanks to its concentration of hyperscale cloud providers, advanced IT infrastructure, and supportive government policies fostering innovation. The U.S. market alone was valued at USD 2.58 billion in 2024 with an 8.12% CAGR forecast. Meanwhile, Asia Pacific is the fastest-growing region, benefiting from expanding cloud adoption, AI investments, and telecom infrastructure.

The predominant CPU architecture remains x86, favored for its broad software compatibility and enterprise workload reliability. However, ARM architecture is the fastest growing segment due to its energy efficiency and scalability. In server form factors, rackmount servers dominate, favored for their high compute density and ease of maintenance; microservers are rapidly expanding particularly in edge and distributed cloud environments.

By application, cloud computing workloads constitute the largest segment, driven by virtualization and multi-tenant environments. AI and machine learning segments are growing swiftly as industries demand processors optimized for training and inference tasks. End-user industries leading the market include IT & telecommunications, which benefit from extensive data center infrastructures, followed by healthcare & life sciences increasingly relying on high-performance computing for AI diagnostics and genomics.

Data Center CPU Market Companies

- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

- Amazon Web Services (AWS)

- Google LLC

- Broadcom Inc.

- Arm Holdings plc

- Qualcomm Incorporated

- IBM Corporation

- Microsoft Corporation

- Alibaba Group Holding Limited

- Meta Platforms, Inc.

- Tencent Holdings Limited

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Monolithic Power Systems, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies Inc.

- Super Micro Computer, Inc.

What Challenges and Cost Pressures Does the Market Face?

The market contends with supply chain constraints, including semiconductor shortages and manufacturing delays, exacerbated by geopolitical tensions and natural disasters. Intense competition among incumbents and newcomers compresses pricing margins. Furthermore, the commoditization risk in certain CPU segments pressures vendors to continuously innovate to retain differentiation. Energy consumption remains a cost pressure, necessitating investment in energy-efficient designs without compromising performance.

Possible Case Study: Optimizing CPU Selection for AI Workloads in a Hyperscale Data Center

A leading hyperscale cloud provider recently upgraded its data center CPU architecture to AMD EPYC processors, capitalizing on their high core counts and AI acceleration capabilities. This transition reduced overall power consumption by 15% while boosting AI inferencing speed by 25%, resulting in lower operational costs and improved service reliability across AI and cloud workloads.

Read Also: Storage Area Network (SAN) Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Multi-Tenant Data Centers Market Size to Surge USD 189.59 Billion by 2034 - September 15, 2025

- Data Center Containment Market Size to Attain USD 8.10 Billion by 2034 - September 15, 2025

- Rare Disease Small-Batch CDMO Market Accelerate orphan drug production with flexible manufacturing and tailored CDMO partnerships - September 15, 2025