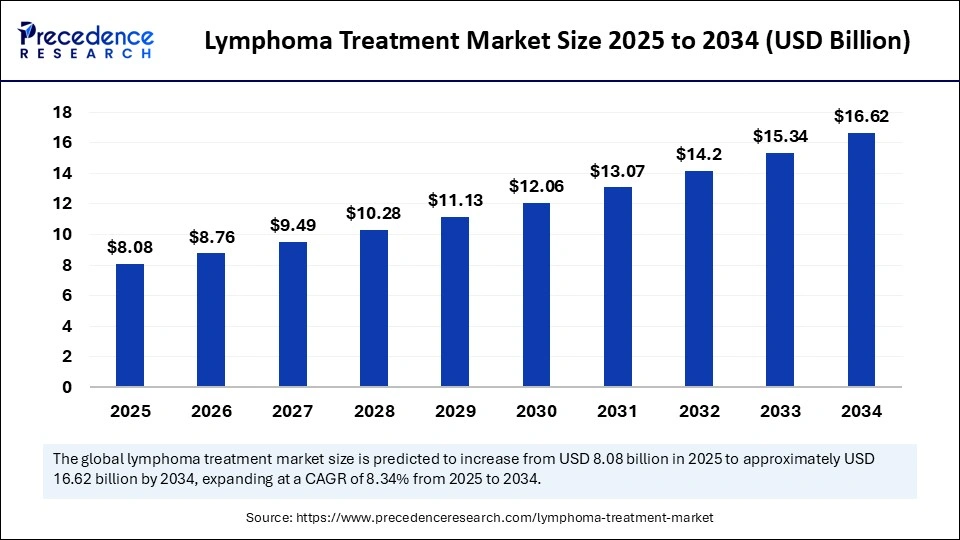

The global lymphoma treatment market is predicted to surge in value from USD 8.08 billion in 2025 to USD 16.62 billion by 2034, expanding at a compelling CAGR of 8.34% over the forecast period, as breakthrough therapies and AI-driven innovation shift cancer care to new heights.

Fueled by the demand for precision treatments and technological advances, the lymphoma treatment market is entering an era defined by personalized care and record investment. With a projected CAGR of 8.34% from 2025 to 2034, key drivers include monoclonal antibodies, CAR-T cell solutions, and the transformative role of artificial intelligence in diagnostics, trial selection, and patient monitoring. The world’s major healthcare economies are racing to improve access and patient outcomes, while new regions like Asia Pacific rapidly bridge the innovation gap.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6778

Lymphoma Treatment Market Key Insights

-

The global lymphoma treatment market size will rise from USD 8.08 billion in 2025 to USD 16.62 billion by 2034.

-

North America is the leading regional market, driven by prevalence, R&D, and rapid therapy adoption.

-

Asia Pacific is the fastest-growing region, led by China, Japan, and India’s healthcare investments and new drug approvals.

-

The U.S. market alone will expand from USD 2.61 billion in 2024 to USD 5.92 billion by 2034, at 8.53% CAGR, backed by clinical trials and favorable regulation.

-

Non-Hodgkin lymphoma (NHL) accounts for the largest disease segment due to higher incidence and broader treatment options.

-

Anti-CD20 therapies and CAR-T represent dominant drug classes, with cellular therapies fastest in growth.

Lymphoma Treatment Market Revenue Forecast

| Year | Market Size (USD Billion) | Key Region |

|---|---|---|

| 2024 | 7.46 | North America |

| 2025 | 8.08 | North America |

| 2034 | 16.62 | Asia Pacific fastest-growing |

Artificial intelligence is reshaping lymphoma treatment faster than any previous innovation. Advanced algorithms analyze medical imaging such as PET/CT with greater precision, flagging hidden lymphomatous lesions that escape traditional methods. AI platforms enable physicians to match patients with targeted therapies and clinical trials more rapidly, ensuring truly individualized care.

Beyond diagnosis, AI is entering trial design and drug development, as global investment surges—witnessed by the $25 million raised in January 2025 to support AI-based cancer prevention and care, targeting breast, prostate, and lymphoma. The integration of AI is expected to drive up survival rates, accelerate regulatory approvals, and push the industry towards a vision of “precision oncology,” where every treatment is tailored and outcomes are optimized.

Lymphoma Treatment Market Growth Factors: What’s Driving Expansion?

Lymphoma treatment growth is propelled by the following major forces:

-

Ongoing uptick in early diagnosis and rising global prevalence of lymphoma, especially non-Hodgkin types.

-

Accelerated R&D in targeted drugs (monoclonal antibodies, antibody-drug conjugates, small molecule inhibitors) and immunotherapies (CAR-T, checkpoint inhibitors, bispecific antibodies).

-

Increased accessibility and reimbursement, especially in North America, which funds the largest volume of clinical trials.

-

Asia Pacific’s surge, led by China’s regulatory support for breakthrough therapies, including sintilimab and orelabrutinib.

-

Supportive hospital infrastructure and evolving supply chains ensuring innovative therapies reach more patients.

Are Unmet Needs Creating Opportunities for Innovation?

The relentless rise in lymphoma cases demonstrates a global unmet need and is a catalyst for innovation. Nearly 80,350 Americans are projected to be diagnosed with NHL in 2025, highlighting gaps in existing therapies and a market hungry for better, longer-lasting solutions. Pharma companies are responding with next-gen therapies, as clinical trials and FDA approvals for novel CAR-T and immunotherapies accelerate. This landscape creates ample long-term growth opportunities for industry players who can deliver true patient-centric value.

Does Cost Pressure Threaten Global Uptake of New Therapies?

The soaring price of advanced treatments is a prime challenge for market expansion. CAR-T cell therapy, while transformative, can cost over USD 400,000 per infusion, with the U.S. alone projected to spend an extra $6.8 billion over five years if CAR-T becomes the new standard. Geographic disparities persist: high-income regions move fast, while middle-income countries lag in adoption. Recent advances in pricing agreements and policy advocacy are helping, but affordability remains a persistent barrier.

Will Armored CAR-T Change Outcomes for Hard-to-Treat Patients?

Emerging evidence suggests so Armored CAR-T therapies, engineered to secrete interleukin-18 (IL-18), show promise for patients with refractory lymphoma, overcoming resistance to classic CAR-T. A 2025 Phase I trial reported an 81% overall response rate and 52% durable complete remission in heavily pretreated patients, with manageable side effects. Clinical readiness and rapid manufacturing (as short as three days) enhance the feasibility, positioning armored CAR-T as a game-changer for advanced-stage and relapsed/refractory cases.

Regional Analysis: Who Leads and Who’s Rising?

North America sits atop the global market, leveraging robust healthcare investment, top-tier R&D, and regulatory pathways that speed market entry for new therapies like ADCETRIS® by Pfizer. Clinical trial networks and rapid approvals drive innovation.

Asia Pacific is the fastest-growing, with China leading in new therapy adoption and regulatory approvals for drugs like sintilimab and orelabrutinib. Regional governments support early diagnosis and breakthrough therapies, swiftly expanding market access and patient outcomes.

Segmentation Breakdown: Disease, Therapy, Drug, and Delivery

-

Disease Type: Non-Hodgkin lymphoma (NHL) is the largest segment, supported by broad therapeutic availability; Hodgkin lymphoma is fastest-growing as new therapies expand.

-

Therapy Type: Immunotherapy and targeted therapies dominate due to superior efficacy and safety; cellular therapies (CAR-T) are the fastest-growing, especially in relapsed/refractory settings.

-

Drug Class: Anti-CD20 drugs (e.g., rituximab) remain the cornerstone for NHL; cell therapies are surging in popularity.

-

Line of Therapy: First-line regimens combine chemotherapy and monoclonal antibodies; R/R (relapsed/refractory) segment sees rapid growth from CAR-T and bispecific antibodies.

-

Mode of Administration: Intravenous/infusion is dominant, while oral small molecule and subcutaneous formulations represent growth areas for patient convenience and compliance.

Who’s Breaking Through? Top Companies and Recent Innovations

Recent approvals and product breakthroughs include:

-

Pfizer: ADCETRIS® received FDA clearance for refractory diffuse large B-cell lymphoma—reduced risk of death by 37%.

-

InnoCare Pharma: Gained approval for BTK inhibitor orelabrutinib and sintilimab for classical Hodgkin’s lymphoma in China.

-

Other leaders: R&D powerhouses and clinical trial sponsors driving CAR-T and immunotherapy advances globally.

Companies

-

Pfizer

-

InnoCare Pharma

Challenges & Pressures: High Cost and Equitable Access

Costs for advanced therapies, especially CAR-T, threaten broad uptake due to affordability and reimbursement hurdles, with geographic disparities in access. Even in developed markets, negotiations over pricing and reimbursement are crucial for bringing lifesaving drugs to patients and ensuring rapid adoption of next-gen solutions.

Case Study: Armored CAR-T in Refractory Lymphoma

The armored CAR-T trial at Penn Medicine underscores how next-generation immunotherapy is changing the paradigm. In 2025, 21 previously treated patients were given IL-18-secreting CAR-T cells, achieving an 81% response, over half reached lasting remission for over two years, with fast manufacturing and manageable safety.

Read Also: Rare Disease Small-Batch CDMO Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Lymphoma Treatment Market Size to Skyrocket USD 16.62 Billion by 2034 - September 16, 2025

- PDU Power Cords Market Size to Soar USD 3.00 Billion by 2034 - September 16, 2025

- Intelligent Platform Management Interface Market Size to Cross USD 2.88 Billion by 2034 - September 16, 2025