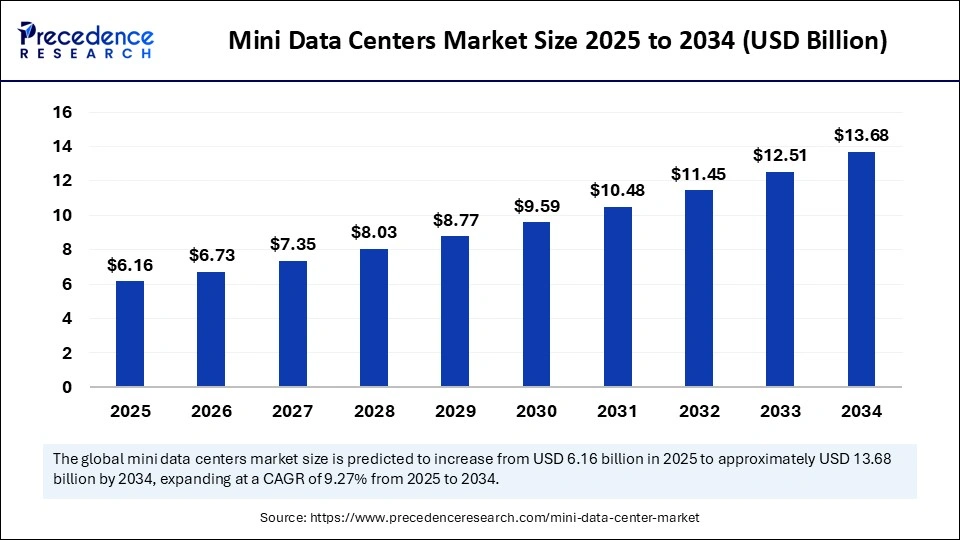

The mini data centers market is entering a phase of accelerated expansion, set to climb from USD 6.16 billion in 2025 to an impressive USD 13.68 billion by 2034. This journey is powered by robust demand for edge computing, the exploding volume of digital services, and the transformative role of artificial intelligence in data management. North America takes the top spot as the largest regional market, with Asia Pacific showcasing the fastest growth, backed by digital transformation policies and government support.

Introduction: Compact Data Solutions Reshaping the Industry

Mini data centers represent a new generation of modular infrastructure, providing flexible, fast, and efficient solutions for organizations that need small-scale data processing and storage. Their agility, scalability, and portability—from half-rack setups to multi-rack modular pods—make them ideal for remote offices, SMEs, campuses, and even industrial deployments. A projected CAGR of 9.27% signals significant industry momentum, with edge computing, AI and ML integration, and the need for reliable, distributed data storage all driving adoption.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6788

Mini Data Centers Market Key Insights

-

Global market value expected to hit USD 13.68 billion by 2034.

-

CAGR from 2025–2034 stands at 9.27%.

-

North America is the dominant region, led by the U.S..

-

Asia Pacific is the fastest-growing region.

-

Rack-based segments commanded the largest market share in 2024.

-

Enterprise edge deployments are the primary growth driver.

-

Leading players are embracing AI-managed and cloud-integrated solutions for smarter management.

Mini Data Centers Market Revenue Table

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 5.64 |

| 2025 | 6.16 |

| 2034 | 13.68 |

Artificial Intelligence (AI) is fundamentally reshaping mini data center operations. Integration with management tools enables predictive maintenance, optimizes resource allocation, and boosts energy savings. AI-driven anomaly detection enhances security and reliability, while intelligent monitoring systems proactively prevent disruptions. This results in lower operational costs, reduced downtime, and infrastructure longevity—critical for competitive enterprises .

AI also plays a pivotal role in data-driven decision-making as mini data centers evolve. Automated workflows, smart cooling, and predictive analytics facilitate efficient operation in edge settings, supporting applications like IoT, smart cities, and autonomous vehicles. AI’s seamless integration ensures mini data centers are not just compact, but hyper-efficient and future-ready.

Mini Data Centers Market Market Growth Factors

Several key trends underpin market growth:

-

Expansion of edge computing and real-time processing needs .

-

Rapid adoption of IoT and smart devices demanding low-latency infrastructure.

-

Digital transformation across industries, especially in emerging regions.

-

Integration of AI and hybrid cloud solutions for increased efficiency and scalability.

-

Supportive sustainability initiatives, including uptake of energy-efficient cooling and renewable power.

Are Sustainability Initiatives Accelerating Market Expansion?

Absolutely. Governments and leading operators are channeling investments into sustainable, energy-efficient mini data centers, incorporating renewable energy and modern cooling to lower carbon footprints. These green data centers offer cost-effective options for SMEs and help organizations align with global environmental goals .

What Drove the Dominance of Rack-Based Deployments in 2024?

Rack-based mini data centers captured the largest market share due to rapid digitalization and the growth of IoT, AI, and edge computing. Their compact, self-contained design combines all large data center functionalities in one enclosure—ideal for flexible and localized deployments. Prefabricated pods/enclosures are catching up swiftly, favored for hospitals, schools, and other on-site IT needs.

Which Cooling Technology Led the Market in 2024?

Air-cooled systems dominated, leveraging CRAHs, CRACs, fans, and vents for temperature stability. However, liquid-cooled systems are growing fast, driven by efficiency demands and high heat output from modern hardware. Liquid cooling is increasingly adopted for AI and high-performance computing, slashing power use and costs .

How Is the Mini Data Centers Market Segmenting by Power, Management, and Application?

-

6–50 kW power capacity ruled 2024, catering to edge deployments in diverse environments.

-

Above 50 kW capacity is set to boom, providing alternatives to mega data centers for low-latency and scalable needs.

-

Remote-managed units are dominant, enabling 24/7 monitoring and proactive maintenance, while cloud-integrated and AI-managed designs promise reliability and reduced costs.

-

Enterprise edge corporate offices and SMBs led deployment, while telecom edge (5G, base stations, MEC) is the fastest growing segment.

What Regional Trends Stand Out?

North America remains a growth powerhouse, with a well-developed IT landscape, investment influx, government support, and rapid expansion of 5G.

The U.S. alone was valued at USD 1.50 billion in 2024, projected to reach USD 3.71 billion by 2034. Asia Pacific, driven by digital policies and rapid transformation, sets the pace as the fastest-growing region.

Mini Data Centers Market Companies

- Schneider Electric

- Vertiv

- Eaton

- Huawei

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM

- Lenovo

- Rittal

- APC by Schneider

- Panduit

- ABB

- Delta Electronics

- Legrand (Server Technology division)

- Fujitsu

- ZTE Corporation

- EdgeMicro

- Cannon Technologies

- Iceotope

What Challenges and Cost Pressures Persist?

High initial investment and total ownership costs remain major hurdles, especially for SMBs in lower-income regions. Expenses related to hardware, cooling, power, staffing, security, and maintenance can limit adoption rates. Skill shortages and integration complexity further pressurize margins.

Case Study: Edge Deployment for Real-Time Analytics

A mid-sized retail chain leveraged a rack-based mini data center to deploy real-time analytics directly at its stores. This drastically reduced latency for inventory and customer data, yielding improved service quality and operational efficiency without the need for expansive centralized infrastructure .

Read Also: Data Center Monitoring Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Data Center Substation Market Size to Cross USD 20.74 Billion by 2034 - September 17, 2025

- Mini Data Centers Market Size to Surge USD 13.68 Billion by 2034 - September 17, 2025

- Data Center Server Rack Market Size to Worth USD 470.88 Billion by 2034 - September 17, 2025