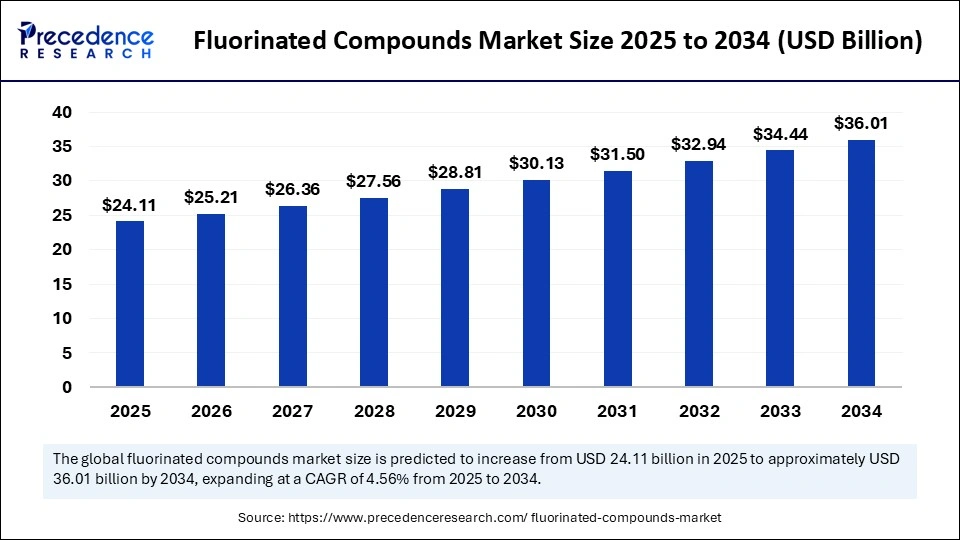

The global fluorinated compounds market is projected to grow from USD 24.11 billion in 2025 to approximately USD 36.01 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.56%. Fueled by increasing demand from the pharmaceutical, electronics, automotive, and renewable energy sectors, this growth embodies the critical role fluorinated compounds play in modern industrial and healthcare applications.

Besides enhancing drug formulations and enabling advanced electronics, these compounds’ unique chemical properties offer heat resistance, durability, and performance benefits that drive sustained adoption worldwide.

Fluorinated Compounds Market Key Insights

-

The market size was USD 23.06 billion in 2024 and is forecasted to grow at a 4.56% CAGR to USD 36.01 billion by 2034.

-

Asia Pacific remains the dominating region in production and consumption, largely due to strong chemical manufacturing, pharmaceutical output, and electronics sectors.

-

North America is the fastest-growing region, led by innovation in pharmaceuticals, semiconductors, and sustainable chemistry.

-

Fluoropolymers dominate the product type segment, prized for thermal stability and resistance in automotive, aerospace, and energy industries.

-

Electrochemical fluorination remains the leading manufacturing process, valued for scalability and production of high-purity compounds.

-

Key industry players investing in R&D include Chemours, Daikin, Solvay, Arkema, AGC Chemicals, and 3M.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6820

Market Valuation and Revenue Breakdown

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 23.06 |

| 2025 | 24.11 |

| 2034 | 36.01 |

Artificial intelligence (AI) is increasingly integrated into fluorinated compounds R&D and manufacturing. Machine learning algorithms accelerate molecular design by predicting properties and optimizing compound performance, especially in pharmaceuticals and agrochemicals.

AI-driven simulations reduce experimental timelines, cutting costs while boosting innovation. In production, AI-enabled monitoring enhances process efficiency, ensuring consistent quality and minimizing waste in fluorination operations. Predictive analytics also help stakeholders stay ahead of regulatory dynamics and rapidly evolving market demands, positioning the industry on a path toward more sustainable and technologically advanced products.

What Factors Are Driving the Market Growth?

The market growth is primarily driven by heightened demand in pharmaceuticals and electronics. Fluorine-containing molecules improve drug bioavailability, metabolic stability, and targeted therapeutic efficacy, vital in oncology and specialty therapies development. In electronics, fluoropolymers and gases are key to semiconductors, displays, and cooling systems—critical components for emerging technologies such as 5G and electric vehicles (EVs).

Energy storage innovations, including lithium-ion and solid-state batteries, use fluorinated materials to enhance electrolyte performance and safety. Additionally, expanding agricultural needs for fluorinated agrochemicals support improved crop resilience and yields. This cross-industry dependence underscores the market’s steady expansion.

What Are the Latest Opportunities and Trends in the Market?

-

Why are fluoropolymers the dominant product type in this market?

Fluoropolymers lead due to their unmatched thermal stability, chemical resistance, and durability, essential for automotive, aerospace, and renewable energy applications. Their use in coatings, gaskets, seals, and high-performance insulation continues to expand with the rise of electric vehicles and smart devices. -

How are manufacturing methods evolving in fluorinated compounds production?

Electrochemical fluorination remains the dominant method for large-scale, high-purity output. However, direct fluorination is the fastest-growing due to streamlined synthesis and cost efficiencies, especially in pharmaceuticals and agrochemicals. Advances in catalytic and safer fluorine-handling technologies enable this shift. -

What impact does sustainability have on this industry?

Regulatory scrutiny on persistent fluorinated chemicals like PFAS pressures the industry to innovate greener alternatives and eco-friendly fluorination processes. Sustainable fluoropolymers and bio-based fluorination methods are emerging to meet these demands, balancing performance with environmental responsibility.

Fluorinated Compounds Market Regional and Segmentation Overview

Asia Pacific dominates globally, driven by robust chemical manufacturing hubs in China, Japan, South Korea, and India, alongside rapidly expanding pharmaceutical and electronics sectors. Government incentives and cost-competitive labor bolster production efficiencies.

Conversely, North America leads in growth rate, propelled by technological innovation, regulatory frameworks, and green chemistry investments centered in the U.S. and Canada.

Product-wise, fluoropolymers are market leaders by volume and value, while fluorinated pharmaceuticals show the fastest CAGR, supported by AI-fueled drug discovery. Manufacturing is predominantly by electrochemical fluorination, with direct fluorination gaining momentum.

Application segments led by automotive, electronics, and pharmaceuticals highlight the versatile and essential nature of fluorinated compounds in modern industry.

Leading Companies and Breakthroughs

Top companies advancing the market include Chemours, Daikin, Solvay, Arkema, AGC Chemicals, and 3M. Recent breakthroughs focus on sustainable fluoropolymer production, low-GWP refrigerants, and novel fluorinated APIs for oncology and antiviral therapies.

Collaborative efforts toward greener fluorination processes and AI-driven molecular design are positioning these players for future growth and regulatory compliance.

Market Challenges and Cost Pressures

Despite the promising outlook, the market faces challenges due to stringent environmental regulations on PFAS chemicals, increasing compliance and disposal costs. The high energy requirements of manufacturing methods like electrochemical fluorination raise production costs.

Additionally, the availability of safer substitutes in some applications and public scrutiny over chemical persistence introduce pressure to innovate rapidly, pushing manufacturers to balance cost, performance, and sustainability.

Case Highlight

A leader in the pharmaceutical sector recently leveraged AI-based molecular design to accelerate the development of a fluorinated antiviral drug candidate, reducing R&D time by 30% and improving therapeutic efficacy. This case illustrates the transformative potential of digital tools combined with fluorine chemistry to meet urgent healthcare demands sustainably.

Read Also: Virtual Commissioning Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025