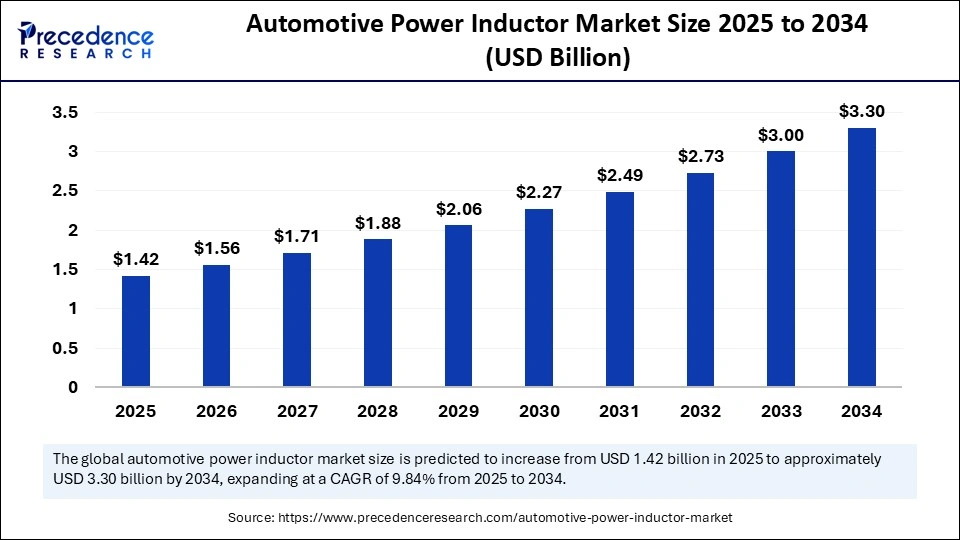

The global automotive power inductor market size was valued at USD 1.29 billion in 2024 and is projected to surge to approximately USD 3.30 billion by 2034, growing at a robust CAGR of 9.84% from 2025 to 2034. This rapid expansion is driven by the accelerating shift toward electric vehicles (EVs) and the increasing adoption of advanced power electronics in modern automotive applications.

Automotive Power Inductor Market Growth and Key Drivers

The automotive power inductor market is experiencing significant momentum fueled by the global rise of electric mobility. In 2024, worldwide sales of electric vehicles increased by about 25%, with China being a major contributor, accounting for nearly half of this growth. Power inductors play a crucial role in EV technology, facilitating current flow, voltage regulation, and minimizing energy losses within high-voltage battery packs, inverters, and onboard charging systems.

Additionally, the adoption of novel materials such as silicon carbide (SiC) and gallium nitride (GaN) in power electronics has intensified the need for high-frequency, high-current inductors optimized for 400V and 800V platforms.

Automotive Power Inductor Market Key Insights

-

The global automotive power inductor market was valued at USD 1.29 billion in 2024.

-

It is forecasted to reach USD 3.30 billion by 2034, with a CAGR of 14.77% between 2025 and 2034.

-

Asia Pacific remains the dominant region in revenue share, with Europe identified as the fastest growing market.

-

Leading manufacturers include Bosch, Infineon, and TDK, focusing on nanocrystalline and powdered iron inductors.

-

The automotive segment with the highest inductor content is powertrain and drivetrain electronics.

-

Wire-wound inductors hold the largest market share based on product type.

-

Surface-mount inductors dominate the mounting segment due to compact design and manufacturing efficiency.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6830

Revenue Breakdown and Market Segmentation

| Metric | Value |

|---|---|

| Market Size 2024 | USD 1.29 Billion |

| Market Size 2025 | USD 1.42 Billion |

| Market Size Forecast 2034 | USD 3.30 Billion |

| CAGR (2025-2034) | 14.77% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

AI’s Role in the Automotive Power Inductor Market

Artificial intelligence (AI) is revolutionizing the design and manufacturing of automotive power inductors by enabling more precise product development and enhanced performance simulation. Machine learning algorithms optimize magnetic material behavior and winding structures, resulting in inductors that operate efficiently under the high-frequency demands of contemporary automotive electronics. AI-driven modeling reduces traditional R&D cycles, boosts thermal stability, and supports the integration of inductors in electric vehicles, hybrids, and advanced driver-assistance systems (ADAS).

Moreover, AI enhances manufacturing efficiency by predicting faults and refining production processes, thereby ensuring higher quality and reliability in inductors used in critical automotive power conversion and voltage regulation functions.

Automotive Power Inductor Market Growth Factors

The rapid proliferation of electric vehicles, hybrid mobility, and stringent emission regulations are primary growth catalysts. Increasing EV sales, particularly in regions like China, Europe, and the US, demand power inductors that support fast charging and high efficiency. The rise of smart charging infrastructure, bi-directional charging systems, and integrated power modules additionally propel automotive power inductor adoption.

Market expansion is further supported by the integration of ADAS features requiring precise power supply to sensors and processors, elevating demand for inductors with superior electromagnetic interference (EMI) suppression and thermal robustness.

Opportunities and Trends: What Are the Key Questions Driving Market Evolution?

Why Is EV Adoption Expected to Accelerate Demand for Power Inductors?

The transition to electric mobility requires highly efficient power electronics capable of handling higher switching frequencies and thermal loads, which pushes demand for advanced inductors tailored for 400V and 800V EV platforms. High-volume EV production centers, especially in China and Europe, foster large-scale component demand with rapid innovation cycles.

How Do ADAS Technologies Influence In-Ductor Requirements?

ADAS functions such as adaptive cruise control and automated braking necessitate stable, noise-free power delivery. This leads to demand for inductors that meet stringent safety standards and operate reliably under high-frequency switching, contributing to market growth.

What Segment Leads Product Choices and Why?

Wire-wound inductors dominate due to their ability to manage high currents and withstand extreme automotive conditions. Surface-mount inductors are preferred for compact footprint and automated assembly compatibility, essential for mass production.

Automotive Power Inductor Market Regional Analysis

-

Asia Pacific (APAC): Asia Pacific leads the automotive power inductor market in terms of revenue share and volume. The region’s dominance stems from its extensive automotive manufacturing base, particularly in China, Japan, South Korea, and India. China plays a pivotal role in the EV surge, supported by government subsidies and infrastructure development, boosting demand for power inductors used in electric and hybrid vehicles. Growing electronics manufacturing capabilities and investments in next-gen automotive electronics also contribute significantly.

-

Europe: Europe is identified as the fastest-growing region in this market. The region’s stringent emission and fuel efficiency regulations are driving automotive manufacturers to adopt electric and hybrid vehicle technologies aggressively. This transition is fueling demand for high-performance inductors suited for advanced powertrains and 48V mild hybrid systems. Key countries leading growth include Germany, France, and the UK, where automotive R&D and electrification investments are substantial.

-

North America: The North American market is also witnessing steady growth, driven by the increasing penetration of electric vehicles and the deployment of advanced driver assistance systems (ADAS). The US is a focal point for technological innovation in automotive power electronics, propelled by both government initiatives and private sector investments to promote sustainable transportation solutions.

-

Rest of the World (RoW): Emerging markets in Latin America, Middle East & Africa are showing gradual adoption of EVs and hybrid vehicles. These regions present potential growth opportunities as infrastructure expands and vehicle electrification gains pace.

Automotive Power Inductor Market Segmentation Analysis

The automotive power inductor market is segmented across various dimensions, allowing detailed insights into product types, mounting technologies, voltage classes, vehicle types, applications, and materials:

-

By Product Type:

-

Wire-Wound Inductors: These inductors hold the largest market share due to their capacity to handle high currents and withstand harsh automotive environments.

-

Powdered Iron Inductors: Popular for their frequency range and robustness.

-

Nanocrystalline Inductors: Growing rapidly, particularly in applications requiring miniaturization and high-frequency performance.

-

-

By Mounting Type:

-

Surface-Mount Inductors: Dominant due to their compact design, ease of manufacturing, and compatibility with automated assembly lines.

-

Through-Hole Inductors: Used where higher power ratings and durability are required.

-

-

By Power Rating / Voltage Class:

-

12V Platform: Mainly for traditional combustion engine vehicles and mild hybrid applications.

-

48V Platform: Gaining traction in mild hybrid electric vehicles (MHEVs) to improve fuel efficiency.

-

400V and 800V Platforms: Essential for battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) to support high power and fast charging capabilities.

-

-

By Vehicle Type:

-

Passenger Vehicles: Largest end-user segment due to consumer demand for EVs and hybrids.

-

Commercial Vehicles: Growing adoption of electric buses, trucks, and delivery vehicles boosts demand.

-

Off-Highway Vehicles: Niche but growing segment focusing on electrification and power electronics.

-

-

By Application:

-

Powertrain and Drivetrain Electronics: Highest usage of power inductors due to critical role in power conversion and energy efficiency.

-

Body Electronics: Includes infotainment, lighting, and comfort systems.

-

ADAS and Safety Systems: Increasingly dependent on stable power supply for sensors and control systems.

-

-

By Material Type:

-

Ferrite: Most commonly used material due to cost-effectiveness and magnetic properties.

-

Nanocrystalline and Powdered Iron: Preferred for high-frequency and high-current applications.

-

Automotive Power Inductor Market Companies

- Würth Elektronik eiSos GmbH & Co. KG

- Vishay Intertechnology, Inc.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Sumida Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Pulse Electronics Corporation

- Panasonic Industry Co., Ltd.

- Murata Manufacturing Co., Ltd.

- KEMET (Yageo Group)

- Delta Electronics, Inc.

- Coilcraft, Inc.

- Chilisin Electronics Corp.

- Bourns, Inc.

- Bel Fuse Inc.

Challenges and Cost Pressures

Raw material price volatility, particularly in copper, ferrite, and rare earth elements, poses supply chain challenges that could hinder market growth. Meeting stringent automotive qualification standards requires significant investment in testing and quality assurance processes. Cost management pressures exist amidst increasing technical demands for high-performance inductors supporting rapid charging and dense power electronics.

Case Study: Germany’s 1.5 Million EV Production and Inductor Supply Resilience

In 2024, Germany surpassed 1.5 million EV units produced domestically, emphasizing the need for local automotive power inductor manufacturing to mitigate supply chain risk. German OEMs collaborated with component suppliers to develop inductors optimized for high-frequency switching in fast-charging applications, securing a resilient supply chain and reinforcing Germany’s leading position in EV manufacturing

Read Also: Fluorinated Compounds Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025