The voluntary carbon credit trading market is experiencing rapid expansion as global corporations and investors intensify efforts to achieve climate goals beyond regulatory mandates. The market is fueled by increasing corporate sustainability pledges, ESG-driven investor demand, and technological advancements such as AI and blockchain enhancing market transparency and trust. This dynamic ecosystem supports a diverse range of projects—from renewable energy and forestry to advanced carbon capture offering participants measurable and credible pathways to offset their carbon footprints.

Voluntary Carbon Credit Trading Market Key Insights

-

North America dominates the market due to advanced financial infrastructure and corporate sustainability commitments.

-

Asia Pacific is the fastest-growing region, driven by large renewable and reforestation projects in countries like India and China.

-

Corporations form the largest buyer group, with institutional investors rapidly emerging as significant participants.

-

Over-the-counter (OTC) trading remains the dominant transaction method but is complemented by growing digital and blockchain-based platforms.

-

The Verified Carbon Standard (VCS) and Gold Standard lead as the primary verification frameworks, ensuring credibility and transparency.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6837

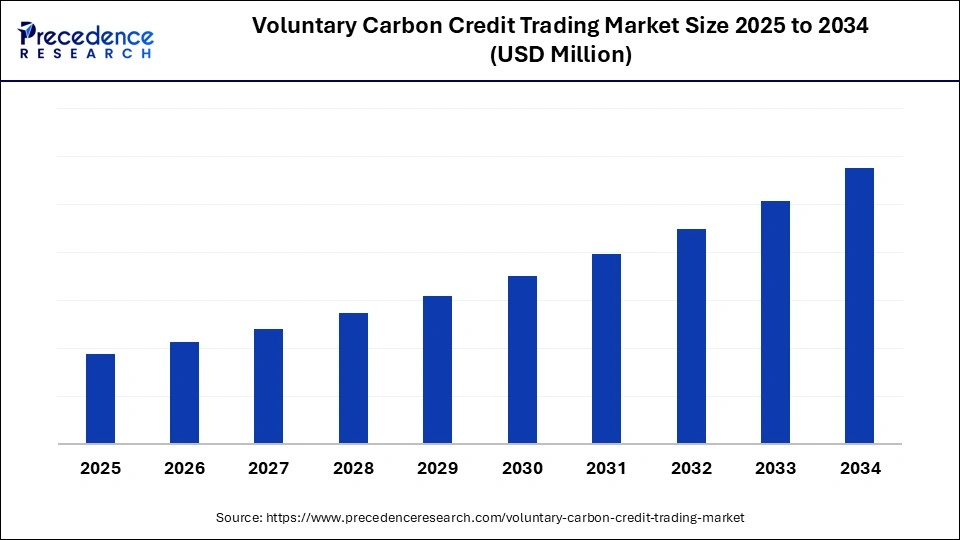

Voluntary Carbon Credit Trading Market Revenue Breakdown

| Segment | Key Details |

|---|---|

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Dominant Credit Type | Avoidance and Reduction Credits |

| Fastest Growing Credit Type | Removal Credits |

| Leading Project Category | Forestry and Land Use |

| Fastest Growing Project | Carbon Capture, Utilization, and Storage (CCUS) |

| Trading Platform | OTC trading dominant, Blockchain rising |

| Leading Buyer Type | Corporations and Institutional Investors |

| Leading End-Use Industry | Energy and Utilities |

| Leading Verification Standard | Verified Carbon Standard (VCS) |

Artificial intelligence (AI) is revolutionizing the voluntary carbon credit trading landscape by improving project monitoring, verification, and transaction efficiency. AI-powered satellite imagery and machine learning algorithms provide accurate measurement of carbon sequestration across forests, soils, and wetlands, greatly enhancing transparency and accountability. Predictive analytics enable market participants to better forecast supply and demand dynamics, optimizing pricing and liquidity on trading platforms.

Smart contracts, supported by AI, further bolster transaction trust by ensuring automation and reducing fraud risks, such as double-counting credits. Companies can align credit purchases more precisely with individual sustainability goals using AI-driven insights, making AI an invisible but indispensable enabler in scaling and legitimizing this evolving market.

Voluntary Carbon Credit Trading Market Growth Drivers

The market’s expansion is propelled by several key factors:

-

Increasing corporate net-zero commitments and sustainability targets under ESG frameworks.

-

Growing investor interest in climate-aligned portfolios, raising demand for credible and transparent offsets.

-

Consumer preference for brands with demonstrable climate action, pushing businesses to adopt voluntary credits.

-

Technological innovations including AI, blockchain, and digital monitoring platforms enhancing project credibility.

-

Supportive policies and NGO initiatives promoting forestry, renewable energy, and carbon capture projects globally.

Voluntary Carbon Credit Trading Market Opportunity and Trend Insights

Why are avoidance and reduction credits dominating the market?

Avoidance and reduction credits, attributable to renewable energy, energy efficiency, and deforestation prevention, dominate because they offer scalable, cost-effective solutions that integrate smoothly into corporate ESG reporting. They provide immediate emission mitigation benefits, making them attractive first steps for many companies on their sustainability journeys.

How are removal credits shaping market evolution?

Removal credits, representing permanent carbon sequestration through reforestation and advanced technologies like direct air capture, are the fastest-growing segment. They appeal to corporations seeking long-term climate impact and premium-quality offsets, driven by technological breakthroughs and enhanced verification tools.

What is the significance of forestry projects?

Forestry and land-use initiatives remain foundational to the market, delivering large credit volumes and added social and ecological co-benefits. Their global scalability, policy support, and compelling narratives make them preferred by corporates focused on holistic climate responsibility.

Voluntary Carbon Credit Trading Market Regional and Segment Analysis

North America leads, supported by a strong corporate sustainability culture and financial innovation hubs. Asia Pacific’s rapid industrialization and abundant project opportunities make it the fastest growth region. Europe remains a major buyer, especially of nature-based solutions from developing nations, complementing Asia’s supply focus.

Segment-wise, OTC trading dominates due to flexibility and tailored agreements, while blockchain platforms gain ground by addressing trust and accessibility issues. Corporations, especially in energy and utilities, remain the largest buyers, while institutional investor interest accelerates market professionalization.

Voluntary Carbon Credit Trading Market Companies

- Verra

- Gold Standard Foundation

- Climate Action Reserve

- American Carbon Registry

- South Pole Group

- ClimatePartner

- EcoAct (an Atos company)

- 3Degrees Group

- Natural Capital Partners

- Emergent Forest Finance Accelerator

- Carbon Credit Capital

- Carbon Trade Exchange

- Sylvera

- Pachama

- AirCarbon Exchange

- XPansiv CBL (Carbonplace)

- Climate Impact X

- Compensate

- NativeEnergy

- Moss Earth

Challenges and Cost Pressures

Market fragmentation and lack of unified standards pose transparency and quality concerns, risking greenwashing. High costs of project implementation and verification limit smaller players’ access.

Demand volatility due to changing corporate priorities adds uncertainty, while permanence of sequestration remains a critical question for some investors. Addressing these challenges is essential for sustained growth.

Case Study: Corporate Transition Using Voluntary Credits

A Fortune 500 energy company leveraged a mix of avoidance and removal credits to meet its ambitious net-zero target. By combining forestry projects in Latin America with direct air capture credits, the company enhanced ESG profiles and secured long-term credit supply through OTC agreements.

The use of AI-driven platforms enabled real-time monitoring and transparent reporting, helping sustain stakeholder confidence and regulatory anticipation.

Read Also: Recycled ABS Resins Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025