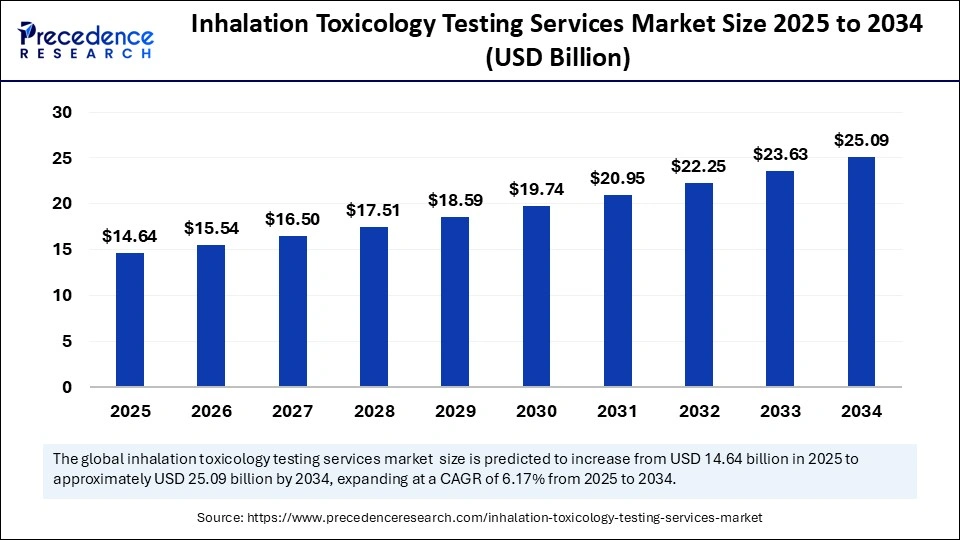

The global inhalation toxicology testing services market is forecast to surge from $14.64 billion in 2025 to an impressive $25.09 billion by 2034, advancing at a strong CAGR of 6.17% over the period. This growth is powered by rapid advancements in alternative testing methods, large-scale government funding, and the relentless drive for regulatory compliance in drug safety.

Notably, the market has expanded from $13.80 billion in 2024, with North America contributing the largest regional share, while Asia Pacific emerges as the fastest-growing market segment.

Key Market Introduction: Innovation, Safety, and Demand

As the demand for safer pharmaceutical, chemical, and consumer products continues to intensify, the inhalation toxicology testing services sector is seeing widespread adoption of automated testing systems, molecular imaging, and pioneering non-animal alternatives.

The sector benefits from increased government and corporate R&D investments, focused on developing advanced therapeutic solutions and minimizing late-stage drug failures through predictive technologies and standardized protocols.

Inhalation Toxicology Testing Services Market Key Insights

-

The global market was valued at $13.80 billion in 2024 and will reach $25.09 billion by 2034.

-

CAGR from 2025 to 2034 stands at 6.17%.

-

North America holds a dominant 45% share, led by the U.S. market at $4.35 billion in 2024.

-

Asia Pacific is the fastest-growing region, driven by pharmaceutical expansion.

-

Top segment: Repeated-dose inhalation toxicity studies (short-term, sub-chronic, chronic).

-

Second-largest segment: In vitro inhalation assays and new approach methodologies (NAMs).

-

Device-specific dosing for nebulizers, DPI, and pMDI is expected to be the fastest expanding exposure mode.

-

Pharmaceutical industry is the leading end-market, with China and Germany as key growth engines in Asia and Europe.

-

Histopathology and pulmonary pathology are most demanded endpoints.

Inhalation Toxicology Testing Services MarketScope

| Report Coverage | Details |

| Market Size in 2024 | USD 13.80 Billion |

| Market Size in 2025 | USD 14.64 Billion |

| Market Size by 2034 | USD 25.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.17% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service/Study Type, Exposure Mode/Atmosphere, Biological Model, Endpoint/Output, End-Market/Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial intelligence continues to revolutionize inhalation toxicology testing services, driving automation, predictive modeling, and advanced risk assessment in ways never seen before. AI algorithms now support robust predictive models for chemical toxicity, streamline safety evaluations, and prioritize substances requiring further investigation. With deep expertise in analyzing massive datasets from omics technologies and high-throughput screens, AI allows researchers to detect subtle toxicity patterns, fostering smarter drug development processes.

AI integration is also accelerating the shift toward personalized medicine. By analyzing genetic variations that impact drug metabolism and toxicity profiles, AI-powered inhalation toxicology testing helps companies design therapies tailored for individual patients. The bonus of automation and enhanced pattern recognition means faster innovations and more accurate regulatory submissions.

What Drives Market Growth for Inhalation Toxicology Testing?

High R&D investment and stricter regulatory standards across the pharmaceutical, biotechnology, and chemical sectors are the prime growth engines. With regulatory bodies worldwide demanding advanced safety assessments and compliance for new drugs and formulations, companies must continually adopt more sophisticated inhalation toxicity testing protocols. Consumer awareness regarding chemical safety, combined with a wave of innovative biologics and device-specific therapies, keeps pushing the need for rigorous preclinical testing services.

Which Trends Create New Opportunities?

Is animal testing becoming obsolete?

Regulatory moves to reduce and replace animal testing are driving innovations such as in vitro, in-silico (computational), and air-liquid interface assays. Technologies like Quantitative Structure-Activity Relationship (QSAR) and Quantitative Read-Across (QRA) models are improving toxicity prediction accuracy and regulatory acceptance.

Can alternative testing methods fulfill regulatory needs?

Advances in molecular imaging, 3D cell culture, and automated dosing systems have enabled more predictive, relevant, and ethical inhalation toxicology protocols. These methods align with the global push for effective alternatives that comply with regulatory standards without sacrificing accuracy.

What impact does device innovation have?

Significant. The emergence and rapid adoption of specialized inhalers, nebulizers, and automated actuation systems necessitate highly tailored testing services, particularly relevant for the booming respiratory drug product market in Asia and North America.

Regional and Segment Analysis: A Press-Ready Breakdown

North America: Largest regional market, driven by advanced R&D facilities, strict drug safety regulations, and a robust pharmaceutical industry. U.S. market is particularly dynamic, with FDA guidelines promoting alternatives to animal testing and broad regulatory coverage of chemicals, devices, and consumer products.

Asia Pacific: Fastest-growing region, led by China’s vast pharmaceutical R&D pipelines and prominent government support. Early toxicity detection and adoption of 3D cell culture and computational modeling are driving growth.

Europe: Strong regulatory framework, emphasis on biologics, personalized medicine, and AI integration. Germany stands out as the regional leader, boasting large laboratory networks and major investment in R&D for innovative toxicology solutions.

Market Segmentation

-

Service/Study Type: Dominated by repeated-dose toxicity studies; in vitro assays rapidly gaining ground for replacing animal tests.

-

Exposure Mode/Atmosphere: Aerosol-controlled MMAD/PSD and device-specific dosing are critical for regulatory compliance and product development.

-

Biological Model: In vivo studies (rodent, non-rodent, NHP) still dominant, but in vitro assays rising fast due to lower cost and ethical alignment.

-

Endpoint/Output: Histopathology/pulmonary pathology essential for safety evaluations, while omics/biomarkers see fastest growth due to mechanism-based insights.

-

End-Market/Application: Pharmaceuticals lead, with increased outsourcing to CROs for cost-effective, high-complexity testing services.

Inhalation Toxicology Testing Services Market Companies

- Laboratory Corporation of America Holdings

- Charles River Laboratories, Inc.

- Eurofins Scientific

- Bureau Veritas

- Envigo

- Evotec AG

- Merck KGaA

- SGS Group

- Pharmaceutical Product Development

- LLC (PPD)

- WuXi AppTec

Challenges and Cost Pressures

Despite strong growth, the industry faces high costs due to the need for sophisticated equipment, professional expertise in biology, toxicology, and chemistry, and compliance with increasingly stringent regulatory requirements. The investment required to both develop and validate new approach methodologies, along with the need for comprehensive reporting and global harmonization, remains a notable restraint on market expansion.

Case Study Highlight

Consider a leading U.S. pharmaceutical firm that recently outsourced its safety testing to a specialized CRO. By adopting AI-powered inhalation toxicity and advanced in vitro alternatives, the company reduced animal tests by 60% and cut regulatory review time by 30%, improving drug approval rates while lowering operational costs—a prime example of how innovation-driven service providers are shaping the future.

Read Also: Voluntary Carbon Credit Trading Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025