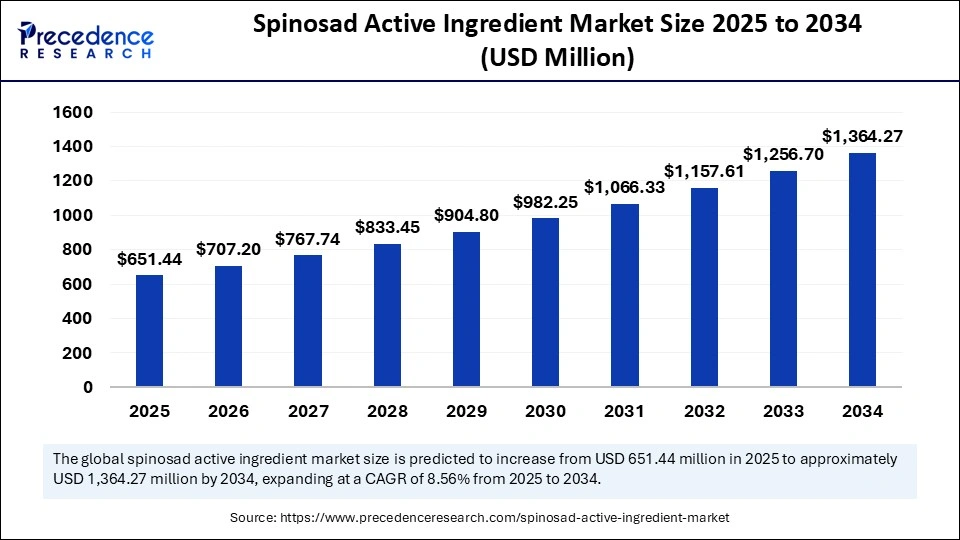

The global spinosad active ingredient market, valued at USD 600.07 million in 2024, is projected to climb to approximately USD 1,364.27 million by 2034, growing robustly at a CAGR of 8.56% between 2025 and 2034.

This growth momentum is propelled by soaring demand for environmentally friendly pest management solutions, expanding organic farming practices, and increasing regulatory endorsements for bio-based insecticides.

Spinosad Active Ingredient Market Key Insights

-

The market was worth USD 600.07 million in 2024 and is forecasted to reach USD 1,364.27 million by 2034.

-

North America leads the market with the highest share, while Asia Pacific is the fastest-growing region.

-

Large commercial farms dominate consumption, but the fastest growth is seen among smallholder farmers.

-

Technical grade formulations are the primary product type, with suspension concentrates rapidly gaining market traction.

-

Foliar sprays account for the largest share of application methods.

-

The fruits and nuts segment remains the dominant crop/end-use.

-

Business-to-business (B2B) sales channels predominate, though e-commerce is quickly emerging.

-

Key market drivers include eco-friendly pest control demand, organic agriculture surge, and regulatory support.

-

Tough regulatory pathways and cost pressures remain significant challenges.

What Is Driving the Strong Growth Trajectory of the Spinosad Active Ingredient Market?

The shift towards sustainable and organic farming emerges as the prime catalyst, with spinosad’s natural origin from Saccharopolyspora spinosa fermentation making it a preferred insecticide in organic crop protection. Its efficacy against a broad spectrum of pests combined with low residue and pollinator safety meets the burgeoning demand for green and residue-free crop management solutions. Moreover, regulatory agencies in many regions have started prioritizing bio-based insecticides over synthetic chemicals, further bolstering market expansion.

How Is AI Enhancing the Spinosad Market?

Artificial intelligence is revolutionizing agricultural pest management by optimizing the use of bio-insecticides like spinosad through precision agriculture technologies. AI-powered predictive analytics and drone-based monitoring enable targeted application of spinosad, reducing waste and enhancing effectiveness.

Furthermore, AI-driven formulation research accelerates the development of improved spinosad blends and application methods that maximize pest control while maintaining environmental safety.

Report Coverage

| Metric | Data (2024) |

|---|---|

| Market Size | USD 600.07 Million |

| Projected Market Size (2034) | USD 1,364.27 Million |

| CAGR (2025 to 2034) | 8.56% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Dominant Product Form | Technical Grade Formulation |

| Largest Application Method | Foliar Spray |

| Largest Crop End-Use Segment | Fruits and Nuts |

| Dominant Sales Channel | Business-to-Business (B2B) |

What Market Opportunities and Trends Are Emerging in Spinosad Use?

Is the boom in organic farming fueling spinosad adoption?

Yes, the rapid global transition to organic farming has significantly increased spinosad usage, as it is approved for organic crops and offers an effective, low-residue insect control alternative that aligns with sustainability goals.

Could spinosad’s unique mode of action help manage resistant pests better?

Indeed, spinosad exhibits a distinct mode of action that combats pests resistant to conventional insecticides, positioning it as a potent tool for Integrated Pest Management (IPM) systems.

How is product form evolving in this market?

Technical-grade spinosad remains dominant for large-scale agribusiness formulation, while suspension concentrates are growing swiftly due to ease of use, safety, and precise application benefits.

Spinosad Active Ingredient Market Companies

- Corteva Agriscience

- FMC Corporation

- BASF SE

- Bayer CropScience

- Syngenta Group

- UPL Limited

- Nufarm Limited

- ADAMA

- Sumitomo Chemical/Certis entities

- Marrone Bio Innovations

- Andermatt Biocontrol

- Koppert Biological Systems

- Isagro S.p.A.

- Gowan Company

- Certis

How Are Regions Performing in the Spinosad Active Ingredient Market?

North America leads the market with a 31% share in 2024, driven by stringent regulations on synthetic pesticides, consumer demand for residue-free food, and a large organic crop base. The U.S. is a key driver within the region due to robust regulatory frameworks and extensive research supporting spinosad use.

Asia Pacific is the fastest-growing region, propelled by integrated supply chains, increasing protected cultivation, and expanding regulatory acceptance for biopesticides.

What Challenges and Cost Pressures Affect Market Growth?

Despite its potential, spinosad adoption faces challenges including regulatory complexities, long approval timelines, and stringent Maximum Residue Level (MRL) policies in some jurisdictions. Production costs associated with fermentation and formulation also exert pricing pressures. Moreover, educating farmers on best practices and building distribution channels, especially in emerging markets, remain ongoing hurdles.

Can You Share a Practical Case Study Showcasing Spinosad Success?

A comprehensive case study from 24 EU member states demonstrated spinosad’s efficacy to be 70%-80% against specialty crop pests—a performance rivaling traditional insecticides. This success improved pest resistance management and supported growers in meeting organic certification standards, highlighting spinosad’s growing role in sustainable agriculture.

Read Also: Lithium Sulfides Market

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025