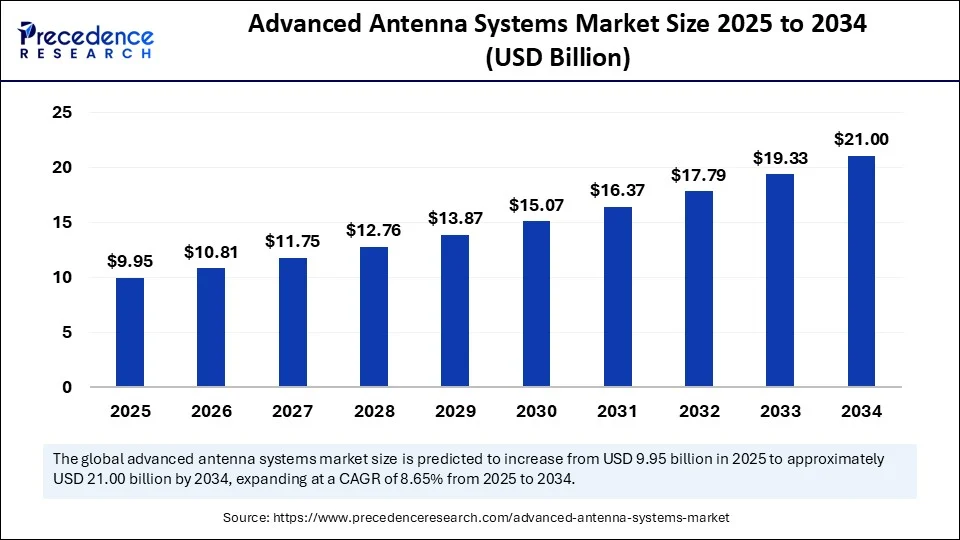

The global advanced antenna systems market was valued at USD 9.16 billion in 2024 and is forecast to grow to approximately USD 21.00 billion by 2034. Driven by a robust compound annual growth rate (CAGR) of 8.65% between 2025 and 2034, this market’s growth is propelled by increasing demand for high-speed data connectivity, expansive 5G network rollouts, surging investments in smart city infrastructure, and rapid proliferation of Internet of Things (IoT) technologies across industries.

The evolution of antenna technology combined with AI enhancements is creating smarter and more efficient wireless networks worldwide.

Advanced Antenna Systems Market Key Insights

-

Market valuation stood at USD 9.16 billion in 2024 and is expected to nearly double to USD 21.00 billion by 2034.

-

North America dominated the market in 2024, led by US investments reaching USD 2.18 billion in market size, projecting to USD 5.11 billion by 2034.

-

Asia Pacific is the fastest-growing region due to rapid urbanization, industrial automation, and 5G adoption.

-

Massive MIMO (64T64R) technology held the largest market share in 2024, supporting high-capacity mobile networks.

-

Key players include Ericsson, Fujitsu, Qualcomm, and other telecom and antenna system innovators focusing on next-gen product deployment.

-

The telecom operators segment commands the highest market share, spurred by expanding 5G infrastructure rollouts.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6695

Advanced Antenna Systems Market Scope

| Parameter | Value (USD) |

|---|---|

| Market Size in 2024 | 9.16 Billion |

| Market Size in 2025 | 9.95 Billion |

| Projected Market Size 2034 | 21.00 Billion |

| CAGR (2025-2034) | 8.65% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

Artificial intelligence (AI) serves as a transformative catalyst in the advanced antenna systems market by optimizing antenna design and performance. AI-driven machine learning algorithms enable real-time network management and adaptive beamforming, improving spectral efficiency and coverage. This approach replaces expensive electromagnetic simulations with automated design workflows that generate and optimize antenna layouts for targeted performance goals.

Moreover, AI integration enhances network resource allocation and wireless communication effectiveness, contributing significantly to the operational efficiency of 5G and beyond wireless networks. The adoption of AI accelerates innovation in antenna array management and amplifies capabilities in massive MIMO and beamforming technologies, fostering smarter, self-optimizing wireless ecosystems.

What Factors Are Driving Market Growth?

-

Expanding 5G network deployments globally require advanced antenna technologies to support higher data rates, ultra-reliability, and low-latency communications.

-

Widespread adoption of IoT across sectors like healthcare, automotive, aerospace, and smart cities increases demand for reliable wireless connectivity.

-

Government incentives and digital transformation initiatives in emerging economies encourage smart infrastructure investments.

-

Technological innovations such as Massive MIMO (including 64T64R and Ultra Massive MIMO) and beamforming improve network capacity and efficiency.

-

Growing consumer demand for high-speed mobile internet and connected devices drives antenna system upgrades and deployment.

What Opportunities and Trends Are Shaping the Market?

-

How will the rapid adoption of Ultra Massive MIMO (128T and beyond) redefine network capacity and latency in the 6G era?

-

Can AI-enhanced antennas significantly reduce power consumption in telecom infrastructure while boosting performance?

-

Will expanding IoT device penetration in smart cities lead to new customized antenna system solutions?

-

How are next-generation antenna designs adapting to support AR/VR, autonomous vehicles, and holographic communication?

-

What role do local manufacturing initiatives—like Ericsson’s India-based antenna production—play in accelerating global supply chains?

How Does Market Segmentation Provide Insight?

Technology segmentation highlights the dominance of Massive MIMO (64T64R) systems, capable of delivering speeds between 3 to 6 Gbps per sector, pivotal in today’s 5G infrastructure. The Sub-6 GHz (Low & Mid-Band) frequency segment leads due to compatibility with existing LTE infrastructure, making it cost-effective for widespread rollout.

Meanwhile, mmWave (24–100 GHz) antenna systems are rapidly gaining traction for applications demanding ultra-low latency and multi-gigabit speeds such as industrial automation and AR/VR.

Component-wise, antenna array elements hold the largest market share, with software and control algorithms predicted to be the fastest-growing category due to their role in optimizing antenna performance and network efficiency. Deployment trends show outdoor antenna systems prevailing, particularly distributed antenna systems (DAS) for large public venues, although indoor antenna systems are witnessing accelerated growth to meet increasing wireless gadget needs inside buildings.

The telecom operator segment dominates end-user markets, while the automotive and transportation sectors present growing opportunities fueled by advanced connectivity in electric and autonomous vehicles.

What Are the Latest Breakthroughs and Who Are the Key Players?

Notable advancements include Ericsson’s launch of its first India-manufactured antenna for global export, emphasizing local production and innovation.

Fujitsu introduced a 64TR Massive MIMO radio unit tailored for Open RAN 5G networks, enhancing scalability and power efficiency while lowering operational costs.

Qualcomm’s QRU100 platform underpins emerging Massive MIMO solutions, supporting the swift deployment of high-speed 5G networks. These developments exemplify the cutting-edge innovations shaping the advanced antenna market.

Advanced Antenna Systems Market Leading companies

- Ericsson

- Huawei Technologies

- Nokia

- Samsung Electronics

- ZTE Corporation

- CommScope

- Kathrein (now part of Ericsson)

- Airspan Networks

- Mavenir

- NEC Corporation

- Qualcomm

- Intel Corporation

What Challenges and Cost Pressures Affect the Market?

High initial investments in procurement, specialized workforce training, system integration, and infrastructure upgrades pose barriers, especially for small to mid-sized enterprises. Additionally, a shortage of skilled personnel limits faster deployment and innovation.

Cost pressures persist as telecom operators seek to balance ultra-high-performance demands with energy efficiency and budget constraints, necessitating ongoing technological advancements to maintain competitive positioning.

Case Study Highlight: Fujitsu’s 64TR Massive MIMO Radio Unit

In August 2024, Fujitsu unveiled a 64TR Massive MIMO Radio Unit designed for 5G Open RAN networks, based on Qualcomm’s cutting-edge platform.

This product boosts scalability and power efficiency while cutting deployment and operational costs, supporting telecom operators in rapid 5G rollout. The innovation reflects how integrating advanced antenna technology accelerates network performance improvements and cost management simultaneously.

Read Also: Military 3D Printing Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Distributed Energy Resources Technology Market Size to Gain USD 293.59 Billion by 2034 - September 4, 2025

- Advanced Antenna Systems Market Size to Cross USD 21.00 Billion by 2034 - September 4, 2025

- Military 3D Printing Market Size to Surpass USD 4.24 Billion by 2034 - September 4, 2025