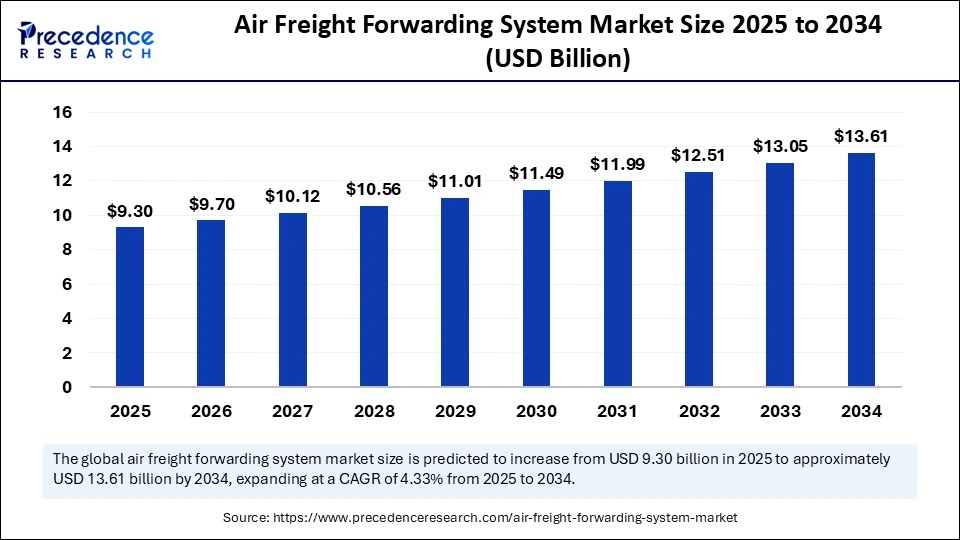

The global air freight forwarding system market size reached USD 9.30 billion in 2025 and is forecasted to grow to USD 13.61 billion by 2034, representing a steady CAGR of 4.33% from 2025 to 2034.

This growth is driven by the surging demand for faster, highly efficient, and technology-driven logistics solutions worldwide, fueled largely by the exponential rise in e-commerce and global trade volumes.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6970

Air Freight Forwarding System Market Key Highlights

-

The market was valued at USD 9.30 billion in 2025 and is expected to reach approximately USD 13.61 billion by 2034.

-

North America dominated the market in 2024, supported by a mature manufacturing sector and advancements in AI and IoT-based cargo tracking.

-

Asia Pacific is the fastest-growing region, driven by booming e-commerce, cross-border trade, and infrastructural upgrades in key airports.

-

The freight management software segment commanded a 35-40% market share in 2024, reflecting the need for real-time shipment visibility.

-

Cloud-based deployment led with 50% market share in 2024, favored for scalability and cost-effectiveness.

-

Top global players include FedEx, DHL Global Forwarding, Kuehne + Nagel, CEVA Logistics, Amazon Air, and Alibaba.

What Is Propelling Market Growth?

Market expansion is largely tied to rising global trade volumes, which hit $33 trillion in 2024, driven by emerging economies and services sector growth. The rapid development of e-commerce, with business sales surging 60% from 2016 to 2022, has significantly increased demand for expedited delivery services. Digitalization and automation in logistics, including AI and IoT, are enhancing operational efficiency and transparency, becoming vital for modern freight forwarding systems.

How Is AI Transforming Air Freight Forwarding?

Artificial intelligence is revolutionizing the sector by delivering improved logistics efficiency through predictive analytics for cargo demand forecasting and flight path optimization. AI-powered fleet management and real-time cargo tracking create a more interconnected, responsive, and sustainable logistics network.

For instance, industry leaders like Emirates SkyCargo and DHL heavily invest in AI-based automation to raise service standards and operational agility. This technology enables data processing at an unprecedented scale over 45 billion logistics data points yearly, fueling smarter decision-making and proactive maintenance strategies.

Air Freight Forwarding System Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.30 Billion |

| Market Size in 2026 | USD 9.70 Billion |

| Market Size by 2034 | USD 13.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution Type, Deployment, Service Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends Are Shaping the Market?

How is the rise of e-commerce impacting freight forwarding?

E-commerce’s explosive growth boosts demand for fast, transparent, and reliable air cargo services, catalyzing innovation in freight management software and cloud-based solutions.

What role does technology innovation play in market evolution?

The integration of IoT sensors, AI analytics, and cloud platforms is enhancing shipment monitoring, operational adaptability, and cost management.

Are there new emerging markets creating growth avenues?

Asia Pacific’s rapid e-commerce expansion and infrastructure upgrades present significant opportunities, especially in China, Southeast Asia, and key cargo hubs like Hong Kong and Incheon airports.

Air Freight Forwarding System Market Regional and Segmental Insights

North America held the largest revenue share in 2024 due to its robust manufacturing base, critical air cargo hubs like Memphis and Miami, and rapid adoption of AI route optimization. The Asia Pacific region saw the fastest growth, with an 11% annual increase in air cargo demand in mid-2025, propelled by e-commerce and cross-border shipments rising over 14%.

By solution type, freight management software remains the dominant segment due to the complexity of global supply chains requiring real-time shipment visibility. Cloud-based deployment leads the market for offering flexible, scalable logistics solutions, while on-premises systems are growing due to increased concerns over data security.

Transportation management holds approximately 40% of the service type segment, addressing the critical need for accurate shipment tracking and timely delivery. The customs clearance and regulatory compliance segment is growing rapidly as automated solutions ease cross-border delays and improve trade efficiency.

Top Vendors in the Air Freight Forwarding System Market & Their Offerings

- Kuehne + Nagel (Switzerland): Leading the global air freight sector with 1.89 million metric tons shipped in 2025, Kuehne + Nagel offers end-to-end logistics solutions, including air, sea, and overland transport, catering to industries such as automotive, pharmaceuticals, and electronics.

- DHL Supply Chain & Global Forwarding (Germany): A major player in the logistics industry, DHL provides comprehensive air freight services, leveraging its extensive global network to offer time-sensitive and temperature-controlled solutions across various sectors.

- DSV (Denmark): Ranked third globally, DSV specialises in air freight forwarding, offering tailored solutions to meet the diverse needs of industries such as automotive, healthcare, and technology.

- DB Schenker (Germany): With a strong presence in the air freight market, DB Schenker offers integrated logistics services, including air cargo, warehousing, and supply chain management, with a focus on industries such as automotive and pharmaceuticals.

- Sinotrans (China): A leading Chinese logistics provider, Sinotrans offers comprehensive air freight services, catering to industries such as electronics, automotive, and retail, with a focus on efficiency and cost-effectiveness.

- Nippon Express (Japan): A prominent Japanese logistics company, Nippon Express provides air freight forwarding services, specializing in sectors such as automotive, electronics, and healthcare, with a commitment to reliability and customer satisfaction.

- Expeditors International (USA): Recognized for its global reach, Expeditors provides air freight forwarding services, with a focus on industries such as technology, retail, and healthcare, emphasizing compliance and efficiency.

Air Freight Forwarding System Market Companies

- Panalpina (DHL)

- C.H. Robinson

- UPS Supply Chain Solutions

- FedEx Logistics

- Agility Logistics

- CEVA Logistics

- Geodis

- Hellmann Worldwide Logistics

- Bolloré Logistics

- Yusen Logistics

- Kerry Logistics

- Rhenus Logistics

- Toll Group

- Damco

What Challenges Does the Industry Face?

High operational costs, especially volatile fuel prices and rising airport charges, pose significant challenges to profitability. Geopolitical tensions and trade disruptions introduce market instability. Moreover, cybersecurity threats elevate the need for secure logistics IT infrastructure, impacting system deployments and investment strategies.

Market Segmentation

By Solution Type

- Freight Management Software

- Cargo Tracking & Visibility Systems

- Warehouse & Inventory Management Solutions

- Documentation & Customs Compliance Tools

- Analytics & Reporting Platforms

- Others

By Deployment

- On-Premises

- Cloud-Based / SaaS

By Service Type

- Transportation Management

- Route Planning & Optimization

- Shipment Consolidation & Documentation

- Freight Cost Management

- Customs Clearance & Regulatory Compliance

- Others

By End User

- Airlines & Cargo Carriers

- Freight Forwarding Companies

- Logistics Service Providers

- Exporters / Importers

- E-commerce Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Bioinformatics-as-a-Service (BaaS) Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Robotic Arm Market Size to Touch USD 555.44 Billion by 2034 - October 13, 2025

- In Vivo Cell Reprogramming Market to Reach Significant Valuation by 2034 with Rapid Growth Driven by Regenerative Medicine Innovations - October 13, 2025

- Air Freight Forwarding System Market Size to Soar to USD 13.61 Billion by 2034 with 4.33% CAGR Growth Forecast - October 13, 2025