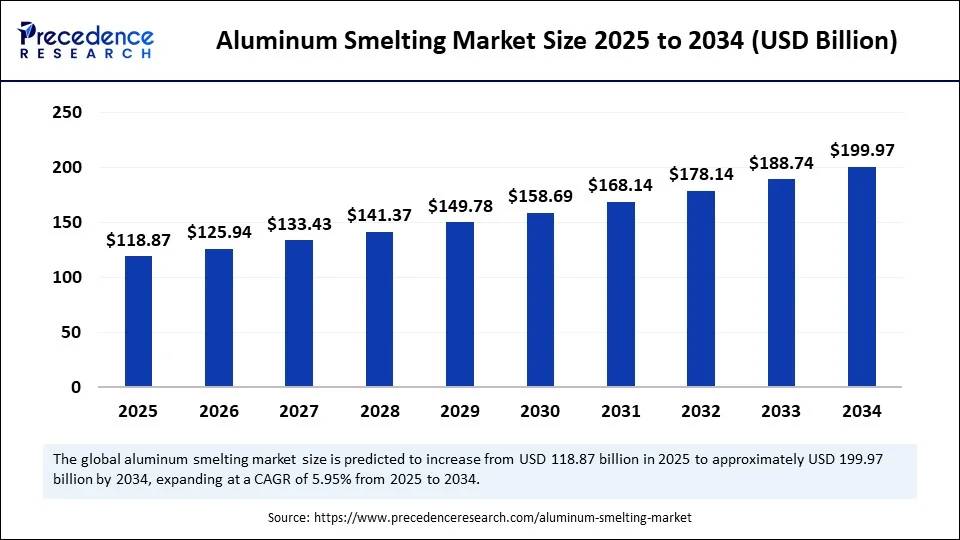

The global aluminum smelting market is poised for robust growth, expanding from USD 118.87 billion in 2025 to nearly USD 200 billion by 2034, driven by rapid industrialization, technological advancements, and surging demand in key applications across automotive, construction, and aerospace sectors. The market’s CAGR of 5.95% underscores its steady expansion, with Asia Pacific leading growth and North America following as the fastest-growing region.

Aluminum Smelting Market Key Highlights

-

The market size was USD 112.19 billion in 2024 and is forecasted to reach USD 199.97 billion by 2034.

-

Asia Pacific dominates with a 65% market share in 2024, led by China and India.

-

The leading aluminum production process is the Hall–Héroult method.

-

Automotive and transportation segments constitute the largest application share.

-

Coal-based smelters currently dominate power sourcing, with hydroelectric sources growing rapidly.

-

Major companies include Adani Group, Vedanta, Hindalco, and key Chinese smelters.

-

AI integration has reduced energy consumption by 17% and improved operational efficiency.

-

North America is the fastest-growing regional market due to electric vehicle adoption and clean energy incentives.

Market Growth Driven by Lightweight Demand and Technology

The aluminum smelting market is set to witness significant growth due to increasing demand for lightweight materials in vehicles and aircraft, improving fuel efficiency and reducing emissions. Aluminum’s properties—lightweight, strong, corrosion-resistant, and recyclable make it indispensable in automotive manufacturing, aerospace, construction, packaging, and electronics.

The rise of electric vehicles further amplifies demand for aluminum components, fostering growth during the forecast period. Technological advancements, including the development of inert anode and carbothermic reduction techniques and a shift toward renewable energy-powered smelters, are enhancing production efficiency and sustainability, which fuel market expansion.

AI Role in the Aluminum Smelting Market

Artificial Intelligence is transforming aluminum smelting by optimizing energy-intensive processes and streamlining production. AI-driven process control has notably decreased energy consumption by 17%, enhancing output quality while reducing costs.

Through continuous monitoring and adjustment of process parameters, AI enables data-driven decision-making that boosts operational efficiency. This integration is essential for meeting sustainability goals and lowering the carbon footprint in such an energy-demanding industry.

Market Growth Factors

Several factors are accelerating the aluminum smelting market growth:

-

Rising demand for lighter vehicles and aircraft to achieve better fuel economy and emissions reduction.

-

Increasing electric vehicle adoption relying heavily on aluminum to improve vehicle range and efficiency.

-

Governmental investments and supportive policies boosting infrastructure projects require extensive aluminum use.

-

Technological advancements in smelting processes that reduce emissions and operational costs.

-

Asia Pacific’s industrialization and leading aluminum production capacity fuel global supply and consumption.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 112.19 Billion |

| Market Size in 2025 | USD 118.87 Billion |

| Market Size by 2034 | USD 199.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.95% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Power Source, Product Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Opportunities and Trends: What Are the Emerging Growth Drivers?

How is infrastructure investment shaping market growth?

Rapid infrastructure projects globally are driving aluminum demand for building materials, roofing, windows, and cladding, supported by aluminum’s strength, corrosion resistance, and aesthetic appeal. Government and private sector spending on construction is expected to provide lasting growth opportunities.

What innovations in smelting technology are improving sustainability?

Emerging inert anode technology offers carbon-neutral aluminum production by eliminating CO2 emissions, while adopting renewable energy sources like hydroelectric power is reducing the industry’s environmental impact substantially.

Which product forms are witnessing high demand?

Aluminum ingots dominate, especially in automotive and aerospace sectors, with billets growing due to demand for castings and extrusions in construction and transportation.

Regional and Segmentation Overview

Asia Pacific leads with a 65% market share, driven by China’s overwhelming 60% share of global smelter capacity and India’s expanding investments. The region’s robust automotive, construction, and electronics industries dominate aluminum consumption.

North America is the fastest growing, buoyed by incentives for green energy and electric vehicles.

Segmentation Highlights

Process: The Hall–Héroult electrolytic reduction method remains dominant, though inert anode technology is rapidly gaining.

Power Source: Coal-based smelters hold the majority market, but hydroelectric-powered smelters are expanding due to sustainability efforts.

Product Form: Ingots lead, with growing applications for billets and slabs.

Application: Automotive & transportation segments retain dominance due to lightweighting demands; electrical and electronics applications are growing.

Latest Breakthroughs and Leading Companies

In December 2024, the Adani Group announced a $5 billion investment plan into aluminum, steel, and copper to boost India’s infrastructure and energy competitiveness. This move aims to challenge incumbent market players such as Vedanta and Hindalco by leveraging synergies with established logistics and energy businesses.

Aluminum Smelting Market Companies

- Nel Hydrogen

- ITM Power

- thyssenkrupp nucera

- Siemens Energy

- McPhy Energy

- Cummins (Hydrogenics)

- Plug Power

- Enapter

- AFC Energy

- Giner ELX (Giner Inc.)

- H2B2 Electrolysis Technologies

- Ohmium International

- Toshiba Energy Systems & Solutions (Toshiba ESS)

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries (MHI)

- Bloom Energy

- Sunfire

Challenges and Cost Pressures

The aluminum smelting industry faces significant cost pressures from high electricity consumption and fluctuating energy prices, which can impact operational margins. The high capital investment required to adopt newer, cleaner technologies often limits entry or expansion for smaller players. Additionally, meeting stringent environmental regulations while maintaining cost competitiveness remains a persistent industry challenge.

Case Study: Efficiency Gains Through AI

A major smelting plant integrated AI for predictive process control, cutting energy use by 17% and improving product output quality. This implementation cut operational costs and supported the plant’s carbon reduction targets, setting a benchmark for sustainable smelting in the industry.

Read Also: Precision Reduction Gears Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025