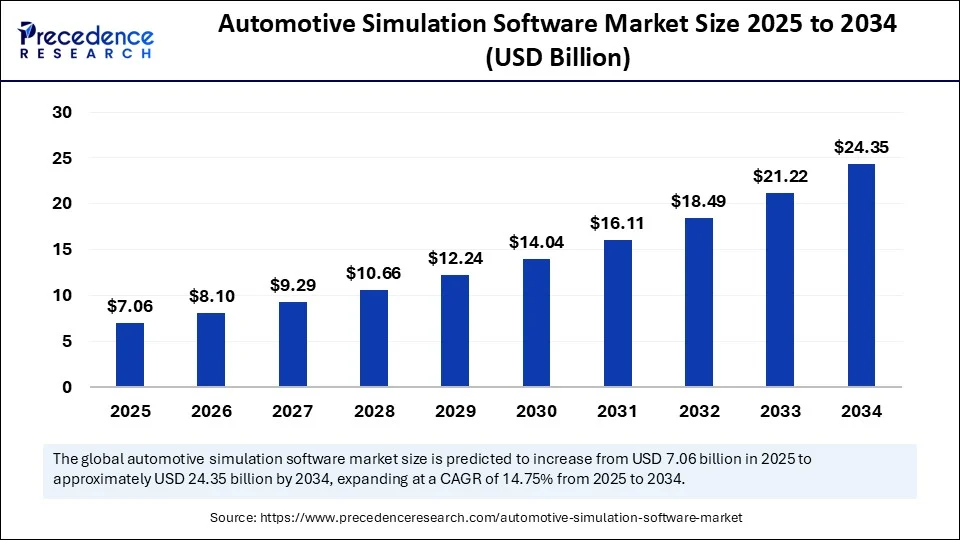

The global automotive simulation software market, valued at USD 6.15 billion in 2024, is projected to surge to approximately USD 24.35 billion by 2034, expanding at a robust CAGR of 14.75% from 2025 to 2034.

This growth is primarily driven by the rising complexity of automotive systems, enhanced adoption of cloud-based simulation platforms, and rapid technological advancements in electric and autonomous vehicles, heralding a new era in automotive development and safety innovation.

Automotive Simulation Software Market Key Insights

-

The market size in 2024 stood at USD 6.15 billion and is expected to escalate to USD 24.35 billion by 2034.

-

North America dominated the market with a 34% share in 2024, driven by stringent safety regulations and technological innovation.

-

Asia Pacific is the fastest-growing region, projected to grow at a CAGR of 15.80%.

-

The U.S. market alone was valued at USD 1.46 billion in 2024 and is forecast to reach USD 5.92 billion by 2034.

-

Structural simulation holds the largest segment share of 24% for 2024.

-

Cloud-based simulation mode is anticipated to grow at 18.40%, the fastest among deployment modes.

-

Electric vehicles simulation expected to record the highest CAGR of 19.60% through 2034.

-

Leading companies innovating in this space include Ansys, Siemens, Dassault Systèmes, Altair Engineering, and AVL List GmbH.

How Is Artificial Intelligence Shaping Automotive Simulation Software?

Artificial intelligence (AI) is dramatically transforming automotive simulation by providing sophisticated tools to generate realistic 3D environments, automate the creation of test scenarios, and develop accurate surrogate models. These AI-driven advancements not only lighten the engineering workload but also boost simulation realism and precision, critical for validating complex vehicle systems.

Moreover, AI extends beyond simulation engines, analyzing driver behaviors and providing real-time feedback, enhancing road safety. It also optimizes production workflows and supply chains in automotive manufacturing, leading to reduced costs and improved operational efficiency. AI-enabled applications such as digital twins and autonomous driving simulations further enhance vehicle development capabilities.

What Factors Are Driving Market Growth?

The growth of automotive simulation software is propelled by several key factors:

-

Increasing complexity of automotive electronics and systems, including ECUs and ADAS.

-

Adoption of cloud-based simulation platforms offering flexible and scalable computing resources.

-

Rising investments in electric and autonomous vehicles demanding advanced simulation for design and validation.

-

Stringent global safety and environmental regulations necessitating thorough testing.

-

Digital transformation in the automotive sector improving design accuracy and reducing development time and costs.

What Are the Emerging Opportunities and Trends?

Could cloud-based platforms and AI integration become the new standard in automotive simulation?

The growing adoption of cloud-based simulation platforms, providing on-demand computing resources and easier deployment, offers vast opportunities for faster innovation cycles. Simultaneously, integrating AI and machine learning into simulation enables the generation of extensive scenario datasets and automatic design optimization, setting new performance benchmarks.

Is the electric vehicle segment poised for revolutionary simulation advancements?

Simulation of electric vehicle components, especially batteries and thermal systems, is gaining momentum with the fastest growth rates projected. Innovations like integrated thermal management systems and multiphysics simulations aid in cost reduction and enhancing vehicle reliability, presenting lucrative opportunities for software providers and OEMs.

How Does Regional and Segment Analysis Shape Market Dynamics?

North America: Market Leadership and Drivers

North America leads the automotive simulation software market with a significant share of around 34% in 2024. This dominance is driven by the region’s established automotive ecosystem, including major automakers and advanced R&D facilities. Stringent safety and environmental regulations in the U.S. and Canada compel automakers to adopt sophisticated simulation tools for design validation and regulatory compliance. The growing complexity of vehicle systems—such as electronic control units (ECUs), advanced driver-assistance systems (ADAS), and infotainment—requires robust simulation solutions. Additionally, the early adoption of cloud-based simulation platforms and high investments in electric and autonomous vehicle technologies further propel growth in this region, with the U.S. market alone expected to grow at a CAGR of about 15% through 2034.

Asia Pacific: Fastest Growing Region

Asia Pacific is the fastest-growing market segment with a CAGR of about 15.8% to 16.8%, driven by rapid urbanization, expanding automotive manufacturing, and heavy investments in electric and autonomous vehicles. Countries like China, Japan, India, and South Korea lead the region, characterized by strong government support for innovation and sustainability in mobility. The increasing demand for advanced safety features and fuel-efficient vehicles in the region is boosting automotive simulation adoption. China notably dominates with the largest revenue share, leveraging simulation extensively for electric vehicle and autonomous driving development. The region’s growth is also fueled by digital transformation within the automotive industry and efforts to develop sustainable transport solutions.

Europe: Regulatory Focus and Innovation Hub

Europe remains a key market with significant growth potential, fueled primarily by stringent emission and safety regulations such as the Euro 7 standards. The automotive industry in countries like Germany and France is a major player in simulation adoption. Germany, known for engineering excellence and sustainability initiatives, is rapidly adopting simulation software for electric powertrain optimization, crash testing, and regulatory compliance. European manufacturers are leveraging simulation to meet tough environmental standards and innovate quickly with electric and autonomous vehicles. Government initiatives supporting digital transformation and emission reduction contribute to market expansion.

Segment Analysis: Dominance of Structural Simulation

Among application segments, structural simulation commands the largest share of approximately 24%. This segment focuses on vehicle body strength, crashworthiness, and compliance with safety standards. Structural simulation is crucial for risk reduction, helping manufacturers design vehicles that can withstand impacts while meeting regulatory requirements. This segment’s prominence reflects the automotive industry’s emphasis on safety and durability.

ADAS and autonomous system simulations are the fastest-growing segments due to increasing demand for advanced safety features and autonomous driving capabilities. These simulations enable virtual testing and validation of complex sensor and control systems essential for autonomous vehicle development, supporting safer and more efficient transportation technologies.

Deployment: On-Premises vs. Cloud

The on-premises deployment model currently holds the majority market share, estimated at about 64%, favored for its control, security, and integration with existing corporate IT infrastructure. Automotive manufacturers often choose this deployment to protect sensitive data related to vehicle designs and intellectual property. On-premises solutions also provide high computing performance and low latency needed for complex simulations.

However, cloud-based deployment is the fastest-growing mode, with a CAGR close to 18%. Cloud platforms offer flexibility, scalability, and accessibility, enabling remote collaboration across global development teams. They eliminate substantial upfront infrastructure costs and allow faster scaling of simulation resources. The shift toward cloud deployment reflects the industry’s increasing demand for agility, cost efficiency, and collaborative innovation across multiple geographies.

Automotive Simulation Software Market Companies

- Gamma Technologies

- ESI Group

- dSPACE

- Design Simulation Technologies

- Dassault

- AVL List

- Autodesk

- Anthony Best Dynamics

- Ansys

- Altair Engineering

What Challenges and Cost Pressures Does the Market Face?

Despite strong growth, the market confronts challenges such as high costs of simulation models and the complexity in running multiple simulations. Accurate real-world representation in virtual environments remains a technical hurdle. Additionally, infrastructure maintenance and scalability pose cost pressures, particularly for on-premises solutions.

Are There Any Notable Case Studies?

Simulation has enabled leading automotive OEMs to reduce prototype iterations and accelerate product launches significantly. For example, using integrated thermal management system simulations, a major EV manufacturer optimized battery performance, reduced overheating risks, and shortened development timelines.

Read Also: Advanced Antenna Systems Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6714

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Powder Bonding 3D Printing Construction Market Build complex formwork with precision, customization, and sustainable design - September 9, 2025

- Protein Characterization and Identification Market Set to Reach USD 8.04 Billion by 2034 Fueled by 5.29% CAGR and AI-Driven Innovations - September 9, 2025

- Automotive Simulation Software Market Size to Cross USD 24.35 Billion by 2034 - September 8, 2025