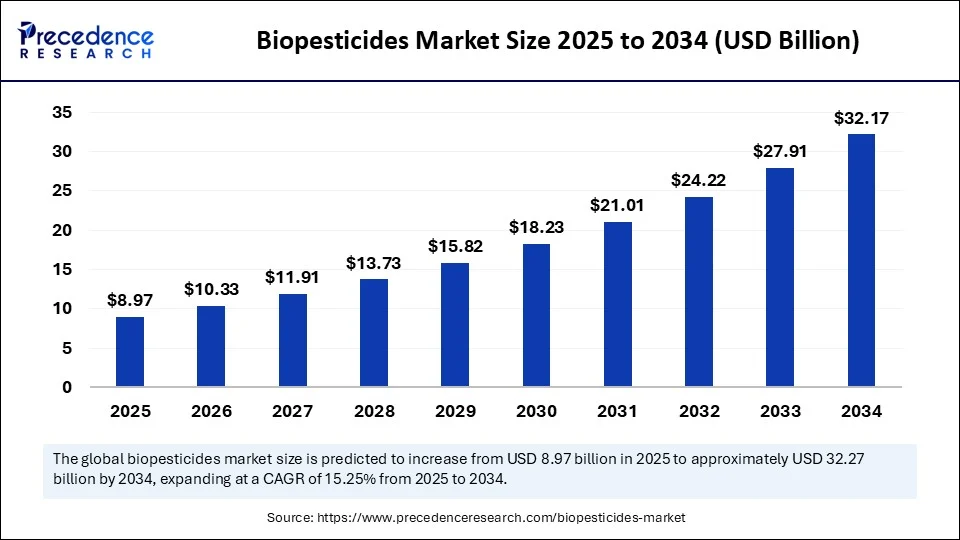

Sustainable farming practices are fueling rapid growth in the global biopesticides market, projected to expand from USD 8.97 billion in 2025 to USD 32.17 billion by 2034. With an impressive compound annual growth rate (CAGR) of 15.25%, biopesticides are becoming essential in integrated pest management and eco-friendly agriculture, addressing increasing regulatory pressures and consumer demand for residue-free food.

What Is Driving the Impressive Growth in Biopesticides?

The increasing shift toward sustainable agriculture is the top catalyst behind this market’s rapid expansion. Governments worldwide are restricting synthetic pesticides, incentivizing natural, biodegradable alternatives. Additionally, rising consumer demand for organic produce and the rising awareness about the environmental impact of chemical pesticides are pushing farmers to adopt biopesticides.

North America currently leads the market, with Asia Pacific emerging as the fastest-growing region due to its vast agricultural base and growing regulatory support.

Biopesticides Market Quick Insights

-

The global biopesticides market size stood at USD 7.78 billion in 2024.

-

Forecasted to grow to USD 32.17 billion by 2034 at a CAGR of 15.25%.

-

North America is the dominant region, supported by advanced agricultural practices.

-

Asia Pacific is the fastest growing, driven by food security concerns in India, China, and Japan.

-

Bioinsecticides dominate the product segment due to their efficacy in managing crop pests.

-

Leading market players include IndiaMart and Justdial, enabling broad distribution.

Biopesticides Market Revenue and Market Breakdown

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 7.78 |

| 2025 | 8.97 |

| 2034 | 32.17 |

Artificial Intelligence (AI) is revolutionizing biopesticide development and application. AI-driven platforms analyze real-time data on crop health and pest patterns, allowing for precise application of biopesticides, reducing waste and improving yields. Additionally, AI accelerates R&D by simulating microbial strain efficacy, drastically shortening product development cycles.

Moreover, AI optimizes supply chains by ensuring ideal storage and transport conditions for biopesticides, extending shelf life. AI-powered advisory services further equip farmers with personalized guidance on biopesticide usage, enhancing adoption rates globally.

What Are the Key Growth Factors for Biopesticides?

The global sustainability mandate is the strongest driver, with governments enforcing tighter regulations on chemical pesticides. Farmers’ focus on lowering input costs through integrated pest management and consumer preference for chemical residue-free food also propels growth. Innovations in microbial and fungal biopesticides improve efficacy and shelf life, expanding their use across multiple crops and climates.

What Emerging Opportunities and Trends Can Shape the Market?

Emerging opportunities and trends are poised to significantly shape the biopesticides market trajectory in the coming years. One of the most promising avenues is the untapped potential in emerging economies. Countries in Asia, Africa, and Latin America, with expansive agricultural lands and growing populations, offer vast opportunities for biopesticide adoption. As these regions strengthen their regulatory frameworks and increase awareness about sustainable farming practices, the demand for eco-friendly pest control solutions is expected to surge, unlocking new market segments and driving growth beyond the traditional strongholds.

Advances in bio-fungicides are also set to have a profound impact on high-value crop protection. Innovations in microbial and natural fungal agents are enhancing the efficacy and spectrum of bio-fungicides, making them more reliable alternatives to chemical fungicides. This development is particularly crucial for high-value crops such as fruits, vegetables, and specialty crops, where disease management is vital and chemical residues pose significant concerns. Enhanced bio-fungicides not only improve yield quality but also support organic and sustainable farming certifications, offering growers greater market opportunities.

Regarding formulations, liquid biopesticides currently dominate due to their ease of application and superior coverage. However, as precision farming technologies gain traction, including drones and sensor-based application systems, the question arises whether liquid formulations will maintain their dominance. Emerging dry and encapsulated formulations designed for targeted delivery and long-lasting effects are gaining attention. These new formats may complement or even challenge liquid formulations by providing improved stability, reduced wastage, and compatibility with advanced application machinery.

Finally, AI-driven technologies hold transformative potential to accelerate market adoption of biopesticides. AI enables real-time pest monitoring and predictive analytics, allowing precise and timely application of biopesticides, which can enhance their effectiveness and cost-efficiency. Additionally, AI contributes to faster development of new microbial strains and optimization of formulations through simulation and data analysis. AI-powered advisory platforms also empower farmers with personalized usage guidelines, boosting confidence and adoption rates of biopesticides worldwide. Together, these technological advances could drive a more accelerated and widespread integration of biopesticides into modern agricultural practices.

Biopesticides Market Regional and Segment Analysis

North America dominates the biopesticides market thanks to its well-established agricultural infrastructure, stringent regulatory frameworks favoring eco-friendly pest control, and early adoption of sustainable farming practices. These factors collectively create an enabling environment that supports market growth and innovation.

The Asia Pacific region is experiencing rapid market expansion, primarily driven by its large and growing population coupled with urgent food security concerns. Increasing awareness and governmental initiatives towards sustainable agriculture further accelerate biopesticide usage in this region.

Within the product segments, bioinsecticides hold the largest market share due to their effectiveness in controlling crop-damaging insects while being environmentally safe. Microbial biopesticides are the leading source category, utilizing naturally occurring microorganisms to manage pests, which aligns with growing demand for natural crop protection.

Foliar sprays are the most preferred mode of application, favored for their ease of use and ability to provide thorough coverage on crop leaves, enhancing pest control efficiency. Moreover, fruits and vegetables are the primary crops where biopesticides are extensively applied, driven by a heightened consumer demand for organic produce and residue-free food products in these categories. This segmental and regional analysis reflects clear market trends toward sustainable agriculture and organic food production supported by biopesticide technologies.

Biopesticides Market Companies

- Bayer CropScience

- BASF SE

- Syngenta

- UPL Limited

- FMC Corporation

- Corteva Agriscience

- Marrone Bio Innovations

- Valent BioSciences (Sumitomo Chemical)

- Certis Biologicals

- Novozymes A/S

- Andermatt Biocontrol AG

- Koppert Biological Systems

- BioWorks Inc.

- Stockton Bio-Ag (STK)

- Vegalab S.A.

- Lallemand Plant Care

- Bionema Ltd.

- Gowan Company

- GreenLight Biosciences

- Biotech International

Challenges and Cost Pressures

Shelf-life limitations and logistical barriers constrain widespread adoption, particularly in remote areas. The complexity of global regulatory frameworks also poses commercialization challenges. Nonetheless, education and formulation advances promise to alleviate these pressures.

Case Study: AI-Enhanced Microbial Formulations

A collaborative project leveraged AI and supercomputing to screen millions of microbial candidates, accelerating the development of a new biopesticide formula that improved crop yield by 20% while reducing chemical pesticide application by 35%.

Read Also: Infrastructure For Business Analytics Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6716

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Powder Bonding 3D Printing Construction Market Build complex formwork with precision, customization, and sustainable design - September 9, 2025

- Protein Characterization and Identification Market Set to Reach USD 8.04 Billion by 2034 Fueled by 5.29% CAGR and AI-Driven Innovations - September 9, 2025

- Automotive Simulation Software Market Size to Cross USD 24.35 Billion by 2034 - September 8, 2025