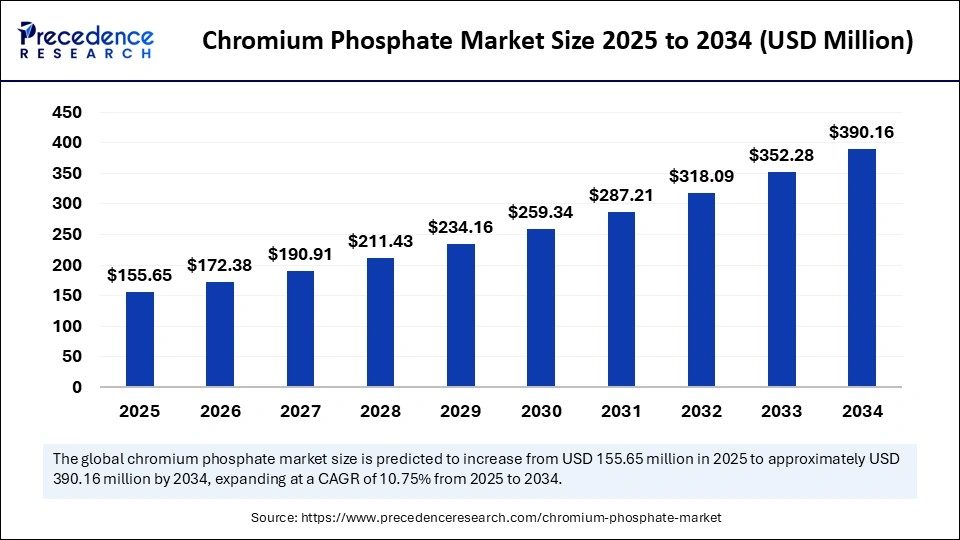

The global chromium phosphate market, valued at USD 140.54 million in 2024, is projected to reach an impressive USD 390.16 million by 2034, growing at a robust CAGR of 10.75% from 2025 to 2034. This dynamic growth is catalyzed by escalating demand for corrosion-resistant coatings and the expanding use of chromium phosphate across aerospace, automotive, and construction industries. As these sectors prioritize durability and sustainability, chromium phosphate’s role as a key ingredient in protective coatings and metal pretreatments continues to intensify.

What’s Driving This Growth?

The chromium phosphate market is primarily propelled by its exceptional anti-corrosion properties, making it indispensable in multiple high-growth industries. The rise in infrastructure development, automotive production, and aerospace manufacturing are major drivers, all requiring materials that can withstand harsh environments. Additionally, increased environmental regulations are steering manufacturers towards chromium phosphate as a safer alternative to hexavalent chromium, further boosting its adoption.

Chromium Phosphate Market Key Highlights

-

The market size was USD 140.54 million in 2024 and is forecasted to grow to USD 390.16 million by 2034.

-

Asia Pacific dominates the market, representing USD 70.04 million in 2025 with a forecast to nearly triple by 2034 at USD 177.52 million.

-

China and India are key growth engines within Asia Pacific, driven by strong automotive and construction sectors.

-

The coatings & paints segment held the largest share in 2024, fueled by rising demand for corrosion-resistant architectural coatings.

-

Key market players include Bayer AG, Brenntag, Nippon Chemical Industrial, Merck KGaA, and Oxkem Limited.

-

Artificial intelligence adoption is enhancing production efficiency and quality control in chromium phosphate manufacturing.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6652

Chromium Phosphate Market Revenue Breakdown and Segments

| Parameter | Details |

|---|---|

| Market Size in 2024 | USD 140.54 Million |

| Market Size in 2025 | USD 155.65 Million |

| Projected Market by 2034 | USD 390.16 Million |

| CAGR (2025-2034) | 10.75% |

| Dominant Region | Asia Pacific |

| Segmentation Focus | Product Type, Application, End-Use, Region |

How Is AI Revolutionizing the Chromium Phosphate Market?

Artificial intelligence (AI) technologies are increasingly integrated into chromium phosphate production, significantly optimizing operational workflows. AI facilitates predictive maintenance, reducing downtime and cutting operational costs while improving supply chain responsiveness. Quality control gains precision through AI-powered vision systems that detect defects faster and with greater accuracy than traditional methods. Moreover, AI-driven demand forecasting enables manufacturers to align production closely with market needs, minimizing waste and enhancing timely deliveries.

These AI advancements not only boost efficiency but also help companies maintain high industry standards amid growing global demand and environmental sustainability pressures. As AI continues to evolve, its role in supporting smarter manufacturing and logistics will likely elevate the chromium phosphate market’s competitiveness and innovation.

What Are the Key Growth Factors?

The chromium phosphate market benefits from:

-

Rising industrialization, especially in Asia Pacific automotive and construction sectors.

-

Growing demand for corrosion-resistant, eco-friendly coatings due to stricter environmental laws.

-

Expansion of high-performance applications in aerospace, electronics, and medical device coatings.

-

Increasing use as a pigment and flame retardant in architectural and automotive coatings.

-

The shift towards sustainable and antimicrobial coatings boosting new product development.

What Opportunities and Trends Will Shape the Market’s Future?

Is the surging demand for sustainable and eco-friendly coatings shaping chromium phosphate innovations? Absolutely. The development of water-based, low-VOC coatings enriched with chromium phosphate’s antimicrobial benefits presents an exciting pathway in medical and architectural applications. Could emerging regions like India and China unlock fresh avenues for growth? Yes, these markets show strong potential driven by infrastructure projects and expanding automotive manufacturing.

Moreover, advances in medical applications—such as antimicrobial coatings for medical devices and uses in chemotherapy—highlight chromium phosphate’s expanding functional landscape. The growing prominence of electric vehicles also drives demand for durable coatings, reflecting broader mobility shifts.

How Does Regional and Segment Analysis Look?

Asia Pacific leads in market size and CAGR, with China and India spearheading industrial growth supported by infrastructure investments and automotive expansions. North America and Europe follow, focusing on advanced coatings and medical applications. The coatings & paints segment is the largest end-user, leveraged heavily in construction and automotive sectors. Meanwhile, the chromium phosphate pigments segment leads product types, credited for anti-corrosive durability and versatility in architectural coatings. Rapid growth is anticipated in the ceramics and automotive segments thanks to their increasing reliance on chromium phosphate’s protective qualities.

Chromium Phosphate Market Companies

- Lanxess AG

- Solvay SA

- Arkema Group

- Gujarat Fluorochemicals Ltd.

- Mitsubishi Materials Corporation

- Chromo Chemicals Pvt. Ltd.

- Shandong Xingyuan Chemical Co., Ltd.

- Alfa Aesar (Thermo Fisher)

- Huntsman Corporation

- Cabot Corporation

- Elementis PLC

- Ferro Corporation

- BASF SE

- Chemours Company

- Eka Chemicals

- Yixing Jinfeng Chemical Co., Ltd.

- Zhejiang Zhongxin Chemical Co., Ltd.

- Jiangsu Wuzhou New Material Co., Ltd.

- India Glycols Ltd.

- Shanghai Chemex Corporation

What Challenges and Cost Pressures Affect This Market?

Stringent environmental regulations pose significant challenges for chromium phosphate production due to toxicity concerns and compliance costs. These pressures increase manufacturing expenses and limit application scopes in certain industries. Additionally, poor water solubility and dissolution rates in pharmaceutical applications present formulation hurdles that may elevate costs or require innovative delivery methods. Ongoing research aims to overcome these challenges through nanoparticle technology and alternative processes.

Case Study Highlight: Chromium Phosphate in Automotive Coatings

In Asia Pacific, a leading automotive manufacturer adopted chromium phosphate-based coatings infused with AI-monitored production lines. This integration reduced coating defects by 25%, improved corrosion resistance by 30%, and shortened production cycle times by 15%. The result was a considerable enhancement in vehicle durability against harsh environmental conditions, boosting customer satisfaction and warranty outcomes.

Read Also: Copper Hydroxide Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Simulator Windows and Simulator Skylight Market Size to Surpass USD 7.65 Billion by 2034 - September 1, 2025

- Chromium Phosphate Market Size to Cross USD 390.16 Million by 2034 - September 1, 2025

- Copper Hydroxide Market Size to Hit USD 822.39 Million by 2034 - September 1, 2025