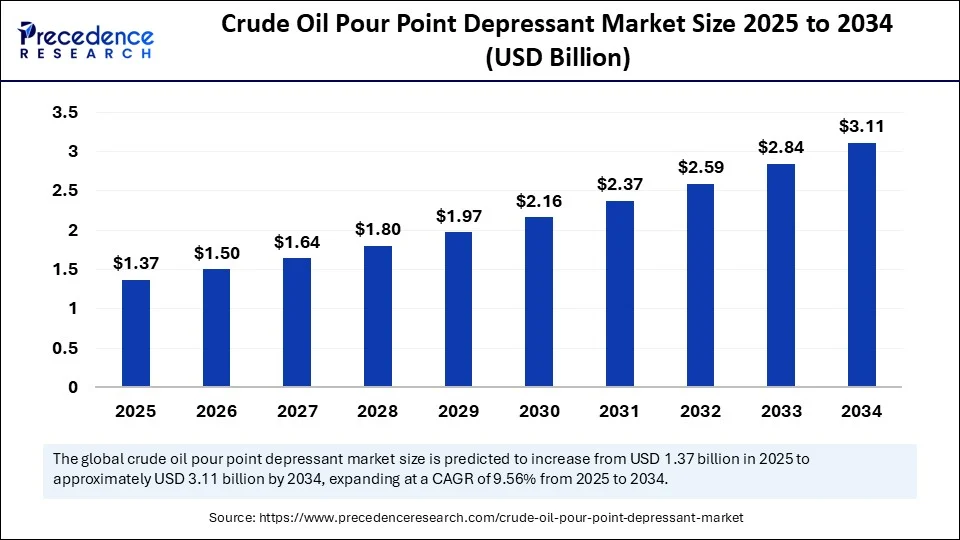

The global crude oil pour point depressant market is set to skyrocket, leaping from $1.37 billion in 2025 to an estimated $3.11 billion by 2034, according to a recent Precedence Research report. Driven by the booming oil & gas industry, harsh climate logistics, and rapid advances in both chemistry and artificial intelligence, the market enjoys a robust compound annual growth rate (CAGR) of 9.56% through 2034. North America currently leads the global market, but Asia Pacific is rapidly catching up as the fastest-growing region, thanks to industrialization and a surging automotive sector.

What Is Driving Such Explosive Growth?

The ever-increasing need to keep crude oil flowing—especially in colder climates and from newly discovered heavy oil reserves—fuels demand for efficient pour point depressants (PPDs). These chemical additives are now indispensable for pipeline transport, storage, and refining, ensuring cost savings, operational safety, and reduced environmental risk as the oil sector ventures into new territories and more extreme conditions.

Crude Oil Pour Point Depressant Market Quick Insights

-

The market value is set at $1.37 billion for 2025, soaring to $3.11 billion by 2034.

-

CAGR: A robust 9.56% for the forecast period 2025–2034.

-

Top region: North America, driven by the U.S.—which alone is forecasted to reach $800.28 million by 2034.

-

Fastest-growing region: Asia Pacific, powered by China and India’s industrial and automotive booms.

-

Dominant end user: Oilfield service companies, as PPDs become crucial to extraction, processing, and shipping.

-

Direct sales led the segment in 2024, a trend expected to continue, while the online sales channel is set for rapid growth.

-

Major companies: Schlumberger Limited, Baker Hughes, Halliburton Company, Afton Chemical, Clariant, The Lubrizol Corporation, BASF SE, Sanyo Chemical Industries, Akzonobel, Evonik Industries, Croda International, Chevron Corporation, Innospec Inc., Messina Chemicals, Infineum International Ltd.

Global Revenue Table

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 1.25 |

| 2025 | 1.37 |

| 2034 | 3.11 |

AI is turbocharging market innovation:

Artificial intelligence enables researchers to optimize PPD design and performance by analyzing complex relationships between oil composition and chemical structure. Advanced AI algorithms sift through data on wax content, API gravity, and asphaltene presence, quickly pinpointing the most effective molecular tweaks for superior cold-flow performance. This not only speeds up R&D but makes next-generation PPDs far more adaptable to changing oilfield conditions.

Operational efficiency through predictive analytics:

Smart optimization tools predict how pour point depressants will interact with different crude oil types in real-world situations. AI-driven simulation accelerates the rollout of new products and allows producers to customize formulations for Arctic operations or specific refineries. The result: Improved flow properties, reduced viscosity, and lower overall costs for oil producers on a global scale.

Market Growth Factors: Why Now?

-

Expansion of oil and gas extraction in Arctic and remote regions with heavy and high-wax crude oils.

-

Focus on flow assurance: Pipeline operators and refiners depend on PPDs to prevent blockages and pump failures.

-

Rising global energy demand: As upstream investments rebound, more crude moves through vulnerable, cold-climate pipelines.

-

Technological advancements: Especially in polymer chemistry and nano-additives that deliver tailored solutions.

Where Are the Biggest Opportunities—And the Next Wave of Trends?

Are New Eco-Friendly Additives About to Go Mainstream?

The industry is rapidly pivoting toward sustainable, biodegradable depressants to comply with increasingly strict global environmental regulations—especially in Europe and certain U.S. states. Top innovators are racing to create formulations that combine performance with a smaller ecological footprint.

What Will Shape the Next Frontier in Pour Point Depressant Technology?

-

Breakthroughs in nano-pour point depressants, biogenic oil-based solutions, and “smart” adaptive polymers are emerging from both industry and academic labs.

-

Integration of digital twin testing and AR/VR simulation for optimized field deployment and lower R&D risk.

Crude Oil Pour Point Depressant Market Regional Analysis: Who’s Leading, Who’s Catching Up?

-

North America: Still dominates, thanks to vast oil resources, advanced pipeline systems, and high adoption rates of modern flow assurance solutions.

-

Asia Pacific: Fastest-growing zone—China and India lead, supported by rapid industrialization, robust downstream investments, and policy support.

-

Europe: Stands out for regulatory rigor and green innovation—Germany and the UK, in particular, push for eco-friendly PPDs.

-

Latin America & Middle East/Africa: Demand is growing for offshore and heavy oil solutions, especially in Brazil, Venezuela, and key African regions, though lighter crude predominates in many areas.

Crude Oil Pour Point Depressant Market Market Segmentation

-

By Chemistry: Polymer-based, nano-composite, silicone, and other specialty chemistries.

-

By Crude Oil Type: Heavy, light, ultra-heavy, synthetic blends.

-

By Application: Extraction, transportation, storage, refinery processes.

-

By End Use: Oilfield service companies, pipeline operators, downstream refiners.

-

By Distribution: Direct sales (dominant), rising e-commerce/online platforms.

Latest Breakthroughs & Key Players

Breakthroughs:

-

Advanced polymer formulations and nanocomposite depressants engineered for ultra-cold climates.

-

Use of waste-derived or biogenic oils as efficient, greener alternatives to legacy products.

Key companies mentioned:

-

Schlumberger Limited

-

Baker Hughes

-

Halliburton Company

-

Afton Chemical

-

Clariant

-

The Lubrizol Corporation

-

BASF SE

-

Sanyo Chemical Industries

-

Akzonobel

-

Evonik Industries

-

Croda International

-

Chevron Corporation

-

Innospec Inc.

-

Messina Chemicals

-

Infineum International Ltd.

What Are the Market’s Toughest Challenges?

-

Rising cost pressures: Price volatility for specialty chemicals and raw materials impacts profitability.

-

Compliance with environmental regulations: Adds complexity to product development and marketing.

-

Transport and operational risks: Unpredictable climates mean constant adaptation and R&D prioritization.

-

Regional access: Remote oilfields are hard to supply with custom chemical solutions—logistics challenges remain.

Case Study Highlight

In Alaska’s North Slope, an oilfield service company recently implemented a novel AI-designed nanocomposite PPD. This move cut maintenance shutdowns by 30% during peak winter, while keeping pipeline capacity at a record high. Similar projects are being trialed across Russia and Canada, further validating AI’s role in next-level crude oil flow assurance.

Read Also: Container Closure Integrity Testing Service Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 934

- Exosome Therapeutics Market Size to Attain USD 4.02 Billion by 2034, Driven by Innovations in Chronic Disease Treatment and AI-Enabled Drug Development - October 7, 2025

- Petroleum Refining Hydrogen Market Size to Reach USD 459.13 Billion by 2034 - October 6, 2025

- Quantum-Safe Cloud Storage Market Size to Reach USD 19.28 Billion by 2034 with a CAGR of 28.92% - October 6, 2025