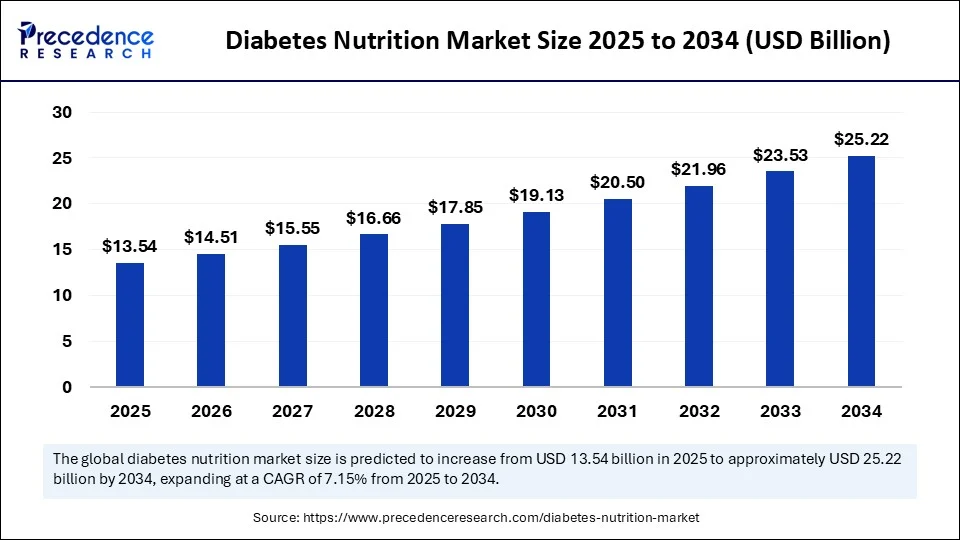

The global diabetes nutrition market is projected to experience significant growth, expanding from USD 13.54 billion in 2025 to an estimated USD 25.22 billion by 2034, with a strong CAGR of 7.15%. This growth is primarily driven by the increasing prevalence of diabetes worldwide, an aging population, changes in urban lifestyles, and a growing preference for nutrition products tailored to specific health conditions.

Diabetes Nutrition Market Key Highlights

-

The market is expected to nearly double, from USD 13.54 billion in 2025 to USD 25.22 billion in 2034, at a CAGR of 7.15%.

-

North America leads the market share, with the U.S. accounting for USD 3.31 billion in 2024 and projected to reach USD 6.74 billion by 2034.

-

Asia-Pacific is the fastest-growing region, driven by high diabetes rates and shifting lifestyle patterns.

-

Major players include Nestlé, Danone, Omada Health, and innovative AI-focused startups.

-

The powdered form segment dominates due to its formulation flexibility, while capsules and tablets are the fastest-growing product forms.

-

Adults aged 18 to 64 form the largest consumer base, while seniors (65 years and above) represent the fastest-growing demographic.

-

Type 2 diabetes patients are the largest end-users, with the prediabetic population rapidly increasing.

-

Supermarkets and hypermarkets remain the primary distribution channels, though online and e-commerce channels are expanding swiftly.

AI’s Transformational Role in Diabetes Nutrition

Artificial Intelligence (AI) is revolutionizing diabetes nutrition by enabling highly personalized dietary management. Advanced systems such as MealMeter integrate real-time biometric data—including glucose levels, heart rate, and physical activity—to provide tailored macronutrient guidance. Innovations that combine continuous glucose monitoring, AI-assisted photo-based meal tracking, and microbiome analysis are delivering a level of precision in calorie and nutrient assessment far beyond traditional methods.

Apps like Omada Health’s OmadaSpark utilize AI to provide customized education, adaptive meal logging, and nutrition advice that addresses both diabetes and obesity. This represents a shift toward more patient-centered “anti-diet” coaching that resonates with today’s users.

What’s Driving the Growth of the Diabetes Nutrition Market?

Key factors propelling market growth include:

-

Increasing Diabetes Prevalence: Over 589 million adults were living with diabetes in 2025, with projections estimating 853 million by 2050—a rise of 46%.

-

Aging Population: Age-related metabolic disorders contribute to growing demand for specialized nutrition.

-

Lifestyle Changes: Urbanization, unhealthy eating habits, and rising obesity rates are expanding the market for tailored nutrition solutions.

-

Focus on Preventive Healthcare: Greater emphasis on early intervention enhances demand for nutrition products that support prevention and management.

Diabetes Nutrition Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.22 Billion |

| Market Size in 2025 | USD 13.54 Billion |

| Market Size in 2024 | USD 12.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Age Group, Form, End User, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Could the “Food as Medicine” Movement and Personalized Nutrition Bring New Possibilities?

The movement to consider “food as medicine” is reshaping diabetes nutrition. Significant investments support programs that integrate nutrition as a fundamental part of disease management. U.S.-based initiatives such as EatSF and Vouchers 4 Veggies provide produce prescriptions for underserved communities, often linked with Medicaid and Medicare support. Companies like Nourish have committed over USD 100 million to develop AI-driven personalized dietary platforms staffed with large teams of expert dietitians.

With diabetes rates soaring, there is an urgent demand for culturally sensitive, evidence-based nutritional products designed for both disease prevention and management. Leading FMCG companies like Nestlé and Danone have introduced targeted product lines, while interest in functional foods and supplements continues to accelerate.

Diabetes Nutrition Market Regional Overview

-

North America: The region commands the largest share of the market, accounting for 43% of global diabetes expenditures. The U.S. alone reported USD 3.31 billion in 2024, with expected doubling by 2034, supported by high rates of undiagnosed diabetes and strong government-private healthcare investment.

-

Asia-Pacific: This is the fastest-growing region, fueled by 77 million diabetic adults in India, rapidly increasing obesity rates, and expanding urban middle classes. E-commerce and mobile health technologies are further strengthening growth.

-

Europe, Latin America, Middle East & Africa: These regions show steady adoption driven by improving awareness and retail infrastructure, though challenges remain around product availability and affordability.

Diabetes Nutrition Market Segmentation Insights

Product Type

-

Medical Nutrition: This category holds the largest share in the diabetes nutrition market. Medical nutrition products are specially designed to aid individuals with diabetes both in healthcare settings and for home use. They help regulate blood sugar levels, prevent complications, and support overall health in diabetic patients.

-

Dietary Supplements: This segment is experiencing rapid growth due to rising demand for convenient, on-the-go nutritional options. Plant-based supplements are especially popular, reflecting a shift toward natural and holistic wellness. Growing awareness around preventive care and the role of micronutrients in managing diabetes also fuels this segment’s expansion.

Age Group

-

Adults (18-64 years): Adults represent the biggest group consuming diabetes nutrition products, driven by the high prevalence of type 2 diabetes within this demographic. Many in this group seek nutritional solutions to effectively manage their condition.

-

Seniors (65+ years): Though smaller in size, the senior segment is growing the fastest. This is due to increased risk of diabetes-related complications such as neuropathy and cardiovascular issues among older adults, which elevates the need for specialized nutrition supporting both diabetes and age-related health challenges.

Form

-

Powders: Powders lead the market because they offer flexibility and can be customized easily. They are commonly mixed into drinks or foods based on personal preference and provide precise nutrient dosing. Their longer shelf life also makes them a preferred choice.

-

Capsules and Tablets: This segment is rapidly gaining popularity due to convenience and ease of use. Capsules and tablets are ideal for busy individuals and seniors who prefer simple, portable supplement forms without the mess of powders.

End User

-

Type 2 Diabetes Patients: This group forms the largest portion of the market, fueled by the global rise in type 2 diabetes caused by lifestyle factors. Products aimed at this segment focus on controlling blood sugar, managing weight, and reducing cardiovascular risks.

-

Prediabetics: This segment is expanding quickly as more people recognize the importance of early intervention in preventing type 2 diabetes. Nutrition products for prediabetics emphasize low glycemic foods, fiber intake, and weight management to help prevent disease progression.

Sales Channel

-

Supermarkets and Hypermarkets: These remain the primary sales channels due to their wide availability and variety of diabetes nutrition products. They cater to a broad customer base looking for easy access to specialized nutrition.

-

E-commerce: Online sales are growing the fastest, driven by convenience, extensive product options, and access to niche brands. The increase in digital health awareness and mobile shopping has significantly boosted online purchases in this category.

Leading Market Players and Innovations

-

Nestlé and Danone: Developing specialized foods for GLP-1 injection users and advanced low-glycemic index (GI) functional foods.

-

Omada Health: Offering AI-based nutrition coaching platforms.

-

Nourish: Delivering AI-driven personalized dietary management at scale with extensive dietitian support.

-

MealMeter: Providing real-time, multimodal macronutrient measurement for precision nutrition.

Challenges and Cost Pressures

-

Limited Access Globally: Over 81% of people with diabetes reside in low- and middle-income countries where access to specialized nutrition products and expert guidance is limited.

-

Cultural & Educational Barriers: Lack of awareness about diabetes-specific nutrition constrains adoption, particularly outside of North America and Europe.

-

Cost Issues: High prices and partial insurance coverage restrict affordability for many patients.

Impactful Innovation in Action (Case Study)

In India, a major urban health center recently implemented an AI-powered nutrition intervention using continuous glucose monitoring and photo-based meal logging among 500 participants in a diabetes prevention program. Over 12 weeks, patients achieved an average HbA1c decrease of 0.6% and notable BMI reduction, highlighting the effectiveness of technology-enabled personalized nutrition in high-burden, resource-limited settings.

Read Also: HT Supplement (50X) Market

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Exosome Therapeutics Market Size to Attain USD 4.02 Billion by 2034, Driven by Innovations in Chronic Disease Treatment and AI-Enabled Drug Development - October 7, 2025

- Petroleum Refining Hydrogen Market Size to Reach USD 459.13 Billion by 2034 - October 6, 2025

- Quantum-Safe Cloud Storage Market Size to Reach USD 19.28 Billion by 2034 with a CAGR of 28.92% - October 6, 2025