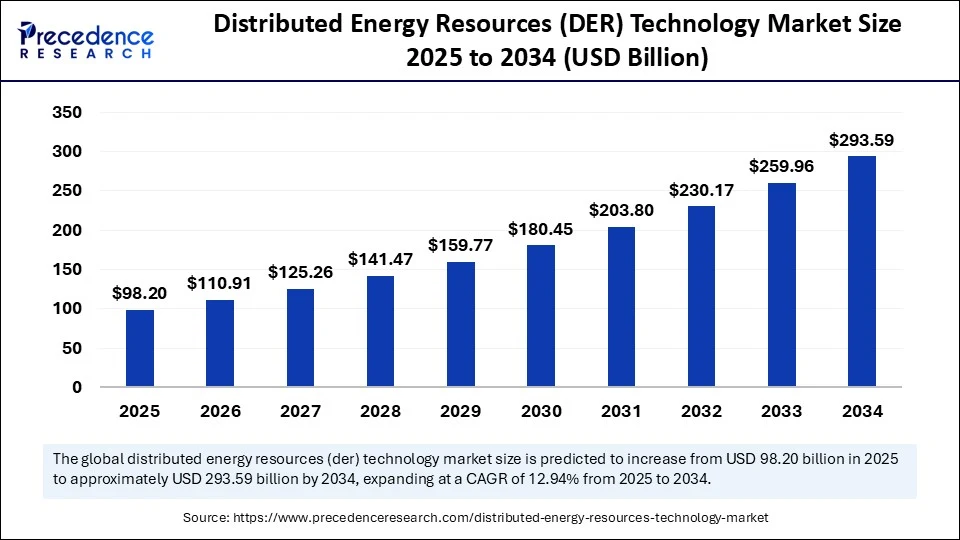

The global distributed energy resources (DER) technology market is on a remarkable growth trajectory, poised to expand from USD 98.20 billion in 2025 to an astounding USD 293.59 billion by 2034, reflecting a vigorous CAGR of 12.94% over the forecast period.

This surge is driven by advancements in energy storage, smart grid technologies, the imperative for grid flexibility and resilience, and progressive governmental policies worldwide. Increasing deployment of DER solutions such as solar PV, battery storage, and hybrid systems at or near the point of consumption is transforming traditional energy landscapes into dynamic, sustainable, and efficient ecosystems.

Distributed Energy Resources Technology Market Key Insights

-

The DER technology market was valued at USD 86.95 billion in 2024 and is expected to reach USD 293.59 billion by 2034.

-

Asia Pacific led the market with a 42% share in 2024, valued at USD 36.52 billion, and is projected to grow swiftly.

-

North America is forecasted to grow at the fastest rate during the forecast period.

-

Solar PV (distributed rooftop and small ground-mount) captured the largest technology segment share, 38% in 2024.

-

The battery energy storage systems segment is anticipated to be the fastest growing in the coming years.

-

Leading players driving innovation include ABB, Siemens, Schneider Electric, Tesla, and General Electric.

-

The grid-tied DER systems held the largest share with 60%, while hybrid systems are the fastest growing segment.

-

Residential applications dominated with 46% market share in 2024.

-

Data centers and cloud edge facilities are emerging high-growth verticals due to increasing energy demands.

How Does AI Shape the Distributed Energy Resources Market?

Artificial intelligence is playing an increasingly pivotal role in the evolution of DER technologies. AI-powered grid management systems optimize energy distribution by dynamically adapting to fluctuating demand and integrating diverse energy sources, including renewables, without added complexity. This intelligent management enhances grid reliability and reduces costs by directing investments strategically and leveraging consumer participation in energy programs for infrastructure cost offsets.

However, the extensive deployment of AI models carries environmental considerations. The high electricity consumption of these AI systems, often powered by fossil fuels, significantly contributes to greenhouse gas emissions. Moreover, energy-intensive cooling requirements of AI data centers can exacerbate water scarcity challenges in vulnerable regions. Thus, balancing AI benefits with sustainable operational practices remains critical for market stakeholders.

What Are the Key Growth Drivers for DER Technology?

Several factors propel the DER market upward. Technological innovations in energy storage, smart grid integration, and advanced control software enable more efficient, flexible, and resilient power systems. Supportive government policies, subsidies, and regulatory frameworks, especially in Asia Pacific nations like China, India, Japan, and South Korea, accelerate DER adoption by encouraging renewable-based distributed systems in rural and underserved areas. Rising electricity costs and mounting environmental concerns further incentivize the shift toward decentralized energy production, enhancing energy independence and sustainability.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6698

Distributed Energy Resources Technology Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 293.59 Billion |

| Market Size in 2025 | USD 98.20 Billion |

| Market Size in 2024 | USD 86.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.94% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product/Hardware, System Architecture / Integration Mode, End-use / Application Vertical, Power/Capacity Range, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Which Emerging Opportunities and Trends Are Shaping the DER Landscape?

-

How are hybrid DER systems redefining energy flexibility and resilience?

-

In what ways are virtual power plants (VPPs) enhancing grid stability and economic efficiency?

-

Can residential and small capacity DER segments unlock widespread consumer energy empowerment?

-

How will the integration of DER technologies in data centers innovate energy use amid growing digital demands?

-

What role will policy reforms and subsidies play in accelerating DER adoption in developing markets?

Market expert from Precedence Research, Principal Consultant Dr. Ananya Kumar, remarks, “The DER technology market is at a transformative juncture, fueled by convergence of AI, storage innovations, and regulatory momentum. Companies that harness these dynamics to deliver scalable, customizable, and consumer-centric solutions will lead the next wave of energy democratization globally.”

Distributed Energy Resources Technology Market Regional Overview

Asia Pacific Market Leadership

The Asia Pacific region dominated the DER technology market in 2024, capturing over 42% market share with a valuation of approximately USD 36.52 billion. This significant market presence stems from strong governmental incentives, regulatory reforms, and rising energy demand in major economies such as China, India, Japan, and South Korea.

These countries have implemented favorable policies including subsidies, net metering programs, and renewed focus on rural electrification, which collectively propel DER adoption. The surge in electricity prices, technological advancements, and the push for energy independence further strengthen Asia Pacific’s leading position in the DER market.

North America’s Fastest Growth Rate

North America is poised to exhibit the fastest CAGR in the DER market during the forecast period. The region is witnessing a paradigm shift towards decentralized, localized energy production aimed at reducing transmission and distribution losses and enhancing grid resilience.

This regional growth is also driven by strong support for transitioning to renewable energy and growing consumer empowerment through residential DER adoption. The presence of advanced grid infrastructure and regulatory frameworks supporting solar PV, battery storage, and microgrid technologies underpin this expansion.

Distributed Energy Resources Technology Market Segmental Overview

Technology Segmentation

Solar photovoltaic (PV) systems lead the technology segment, accounting for about 38% of the DER market share in 2024. Distributed rooftop and small ground-mount solar PV installations dominate this space, benefiting from decreasing costs and policy support. Battery energy storage systems and inverters/converters follow closely in market share, with the inverter/converter segment notably holding around 30% and projected as the fastest-growing segment due to its essential role in enabling grid integration and energy efficiency.

Architectural Segmentation: Grid-Tied vs. Hybrid Systems

Grid-tied DER systems command a dominant 60% share of the market in 2024, favored for their seamless integration with existing power grids, ability for net metering, environmental benefits, and cost-effectiveness. However, hybrid systems—featuring a combination of DER technologies along with energy storage to balance supply and demand even during outages—are experiencing the highest growth rate. Hybrid systems provide greater flexibility by allowing customization and expansion tailored to local energy needs.

Application Segmentation

Residential applications constitute nearly half (46%) of the DER market share in 2024, highlighting the increasing importance of consumer-level energy management solutions, including rooftop solar and home energy storage systems. DER technologies in residential sectors are enabling users to become energy producers and improve resilience against outages.

Emerging Verticals: Data Centers and Cloud Edge Facilities

Data centers and cloud edge facilities represent one of the fastest-growing verticals in the DER market due to their escalating and variable energy needs. Driven by the proliferation of AI, cloud computing, and digital services, data center power consumption is projected to increase dramatically through the end of this decade. Distributed energy solutions including microgrids and DERs offer reliable, clean, and cost-effective energy tailored to these facilities, helping mitigate risks posed by grid congestion and energy demand spikes.

This comprehensive segmental and regional overview illustrates the dynamic growth landscape of the DER technology market, shaped by robust government incentives, technological innovation, diverse applications, and evolving energy consumption patterns.

Distributed Energy Resources Technology Market Companies

- Siemens Energy

- ABB

- Schneider Electric

- General Electric (GE Renewable Energy / GE Grid Solutions)

- Hitachi Energy (Hitachi + ABB Power Grids combined portfolio)

- Eaton

- Caterpillar

- Cummins

- Tesla (Energy)

- BYD

- LG Energy Solution/ LG Chem (energy storage)

- Samsung SDI

- Panasonic Energy

- Sungrow

- Huawei Digital Power

- SolarEdge Technologies

- Enphase Energy

- SMA Solar Technology

- FIMER

- CATL (Contemporary Amperex Technology Co., Ltd.)

Challenges and Cost Pressures in DER Adoption

Despite promising growth, the DER market faces challenges including cybersecurity risks like data breaches and ransomware, the complexity and costs of integrating advanced AI and smart grid systems, and environmental concerns linked to AI infrastructure. Cost pressures arise from the need for continuous innovation, infrastructure upgrades, and balancing sustainability with affordability in technology deployment.

Case Study Highlight: Virtual Power Plant Transforming Energy Management

A virtual power plant (VPP) integrating gas turbines, wind, solar, and battery storage systems was deployed by a utility in North America to balance supply-demand seamlessly, enhancing grid reliability and reducing dispatch costs. This VPP improved renewable energy integration and demonstrated rapid response capabilities to electricity price fluctuations, underscoring DER potential in modern energy ecosystems.

Read Also: Wireless Occupancy Sensors Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Distributed Energy Resources Technology Market Size to Gain USD 293.59 Billion by 2034 - September 4, 2025

- Advanced Antenna Systems Market Size to Cross USD 21.00 Billion by 2034 - September 4, 2025

- Military 3D Printing Market Size to Surpass USD 4.24 Billion by 2034 - September 4, 2025