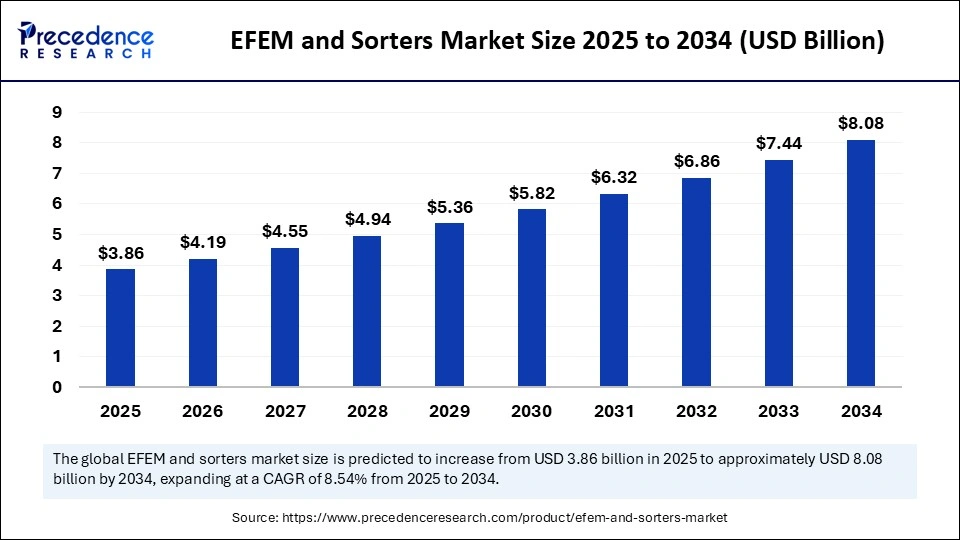

The global EFEM and sorters market, valued at USD 3.56 billion in 2024, is anticipated to surge to approximately USD 8.08 billion by 2034, expanding at a robust CAGR of 8.54% between 2025 and 2034. This growth is propelled by escalating automation demands and the rapid expansion of the semiconductor and logistics sectors.

EFEM and Sorters Market Drivers and Growth Forecast

The EFEM (Equipment Front-End Module) and sorters market is pivotal in semiconductor manufacturing, enabling precise, contamination-free wafer handling and sorting. With the semiconductor industry shifting from 300mm to larger 450mm wafers, advanced EFEM and sorter systems are increasingly essential.

Industry 4.0 technologies—including IoT, AI-powered analytics, and automated decision-making—are revolutionizing semiconductor fabrication, boosting efficiency and throughput. The market’s CAGR of 8.54% reflects these trends, driven by electronics miniaturization, 5G proliferation, and increased demand for semiconductor devices across industries.

EFEM and Sorters Market Key Insights

-

The market size was USD 3.56 billion in 2024 and is projected to grow to USD 8.08 billion by 2034.

-

Asia Pacific holds the dominant regional market share, led by semiconductor powerhouses such as Taiwan, South Korea, and China.

-

North America is the fastest-growing region, spurred by government initiatives including the U.S. CHIPS Act.

-

EFEM equipment type accounted for the largest revenue share in 2024, underscoring its critical role in wafer processing.

-

300mm wafer size compatibility dominates current revenue, while 450mm wafers represent a high-growth opportunity.

-

Fully automated systems led market revenues, driven by contamination reduction and enhanced operational efficiency.

-

Leading market players include TSMC, Samsung, and key equipment manufacturers focused on innovation in automation technology.

EFEM and Sorters Market Revenue and Market Breakdown

| Aspect | Detail |

|---|---|

| Market Size (2024) | USD 3.56 Billion |

| Market Size (2025) | USD 3.86 Billion |

| Forecast Market Size (2034) | USD 8.08 Billion |

| CAGR (2025–2034) | 8.54% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Segments | Equipment Type, Wafer Size, Automation Level, Application, End-User, Region |

Artificial intelligence is pivotal in automating wafer handling and sorting with machine learning and computer vision technologies enhancing wafer alignment, defect detection, and sorting accuracy. AI integration reduces human error and processing time, thus improving throughput and yield.

Real-time data analytics enable fabs to respond dynamically to equipment changes and process variations, fostering predictive maintenance and operational excellence. Consequently, AI drives smarter, more sustainable wafer manufacturing environments, championing Industry 4.0 transition and market growth.

What Factors Are Driving Market Growth?

The EFEM and sorters market growth is primarily driven by the burgeoning semiconductor industry’s need for higher wafer throughput and precision. Miniaturization trends in electronics and growing adoption of electric and hybrid vehicles demand sophisticated chips, increasing wafer production volumes.

Technological advances like EUV lithography impose stringent contamination and accuracy requirements that EFEM and sorters fulfill. Furthermore, automation adoption across fabs for seamless wafer transfer and inspection bolsters productivity and reduces operational overhead.

What Opportunities and Trends Are Shaping This Market?

What is fueling the demand for larger wafer sizes?

The shift from 300mm to 450mm wafers enables fabs to substantially enhance throughput and reduce per-chip manufacturing costs. This technological progression creates opportunities for new EFEM and sorter devices tailored to handle larger wafers with high precision and minimal contamination.

How are Industry 4.0 and smart fabs influencing market prospects?

The integration of IoT, AI, and big data analytics enables real-time process monitoring, defect prediction, and autonomous decision-making, ushering smarter wafer handling systems. These technologies optimize fab operations, improve yield, and promote data-driven manufacturing, representing a significant market opportunity.

What challenges could potentially impede market expansion?

A prominent challenge is the lack of industry-wide standardization, affecting system integration and operational consistency. Additionally, high costs associated with advanced automation technologies and maintenance pose barriers, especially for smaller fabs.

Regional and Market Segmentation Analysis

Asia Pacific dominates with a significant share, bolstered by semiconductor giants like TSMC, Samsung, and important fabs in Taiwan, South Korea, Japan, and China. China’s government-driven semiconductor initiatives heavily fuel regional demand.

North America shows fastest growth due to substantial governmental support from programs such as the CHIPS Act, focusing on domestic production and advanced technology development. Europe, Latin America, and MEA contribute modestly but are gradually expanding fab capacities.

Equipment type segmentation highlights EFEM as the largest revenue contributor, essential for clean, precise wafer transfer. Integration of EFEM and sorter systems grows due to fab preferences for optimized workflows.

In wafer size splits, 300mm wafers lead current revenues, while 450mm wafer compatibility offers high future growth potential. Fully automated systems lead the automation level segment, with smart Industry 4.0-enabled systems gaining rapid adoption.

Applications are dominated by front-end wafer fabrication, with wafer testing and inspection growing due to complexity in semiconductor designs. The foundries segment leads end-users, supported by large-volume wafer production needs; OSAT segment is growing quickly driven by back-end automation demands.

EFEM and Sorters Market Companies

- Brooks Automation

- Daifuku Co., Ltd.

- Hirata Corporation

- Kawasaki Robotics

- Konbu Systems

- MEKICS Co. Ltd.

- Rorze Corporation

- Ryoyo Electro Corporation

- Shibaura Mechatronics Corporation

- Shinko Electric Industries Co., Ltd.

- Sinfonia Technology Co., Ltd.

- TDK Corporation (Wafer Handling Subsidiaries)

- TEL (Tokyo Electron Limited)

- ULVAC, Inc.

- Yaskawa Electric Corporation

Challenges and Cost Pressures

The absence of standardized protocols complicates system interoperability, affecting scalability. High capital expenditure and operational costs limit adoption among smaller fabs. Additionally, ongoing innovation requires continuous investment in R&D and maintenance to sustain technology edge.

Case Study: Scaling Fab Productivity with Integrated EFEM + Sorter Systems

A leading semiconductor foundry modernized its production line by deploying integrated EFEM and sorter systems powered by AI algorithms. This upgrade enhanced wafer transfer precision by 30%, reduced contamination incidents by 25%, and boosted fab throughput by 15%, illustrating how next-gen automation directly drives yield improvements and cost efficiencies.

Read Also: Fluorinated Compounds Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025