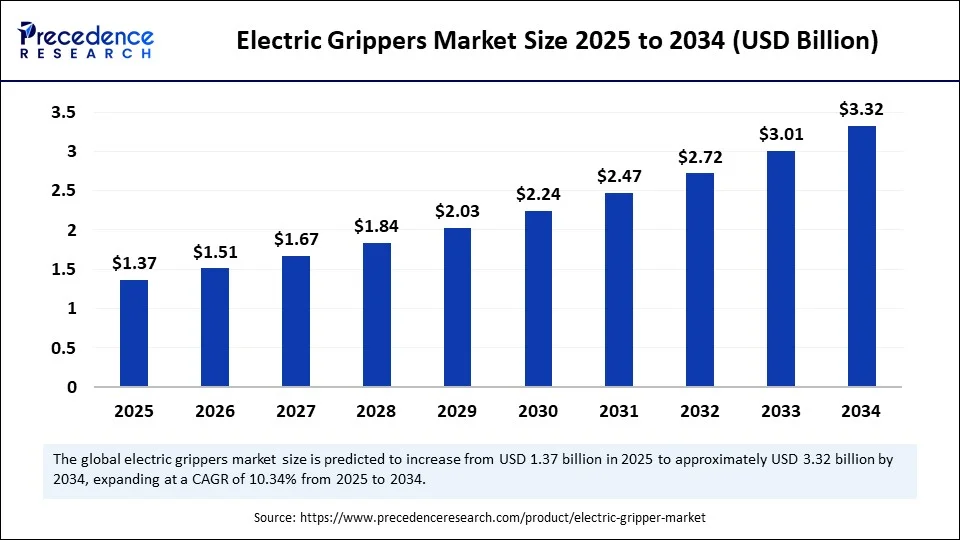

The global electric grippers market is on a robust growth trajectory, projected to expand from USD 1.37 billion in 2025 to approximately USD 3.32 billion by 2034, reflecting a healthy CAGR of 10.34%. This upward path is propelled by accelerating adoption of industrial automation, increasing deployment of collaborative robots, and rising innovation in intelligent, energy-efficient gripping solutions across smart manufacturing environments.

What Is Driving the Growth of the Electric Grippers Market?

The electric grippers market is thriving due to the rapid integration of automation technologies across industries. The global industrial robot stock exceeded 4.28 million units in 2023, creating a demand for advanced end-effectors like electric grippers that offer precise control, compact electric motors, and real-time telemetry via multi-axis sensors.

These grippers are pivotal in delicate assembly, machine tending, and e-commerce packaging, where repeatability and force control significantly improve operational throughput and quality.

Electric Grippers Market Key Insights

-

The market size was USD 1.24 billion in 2024 and is forecasted to reach USD 3.32 billion by 2034.

-

Asia Pacific leads the market with a 40% share and is expected to continue dominating due to significant investments in automation and smart factory deployments.

-

The automotive sector holds the largest share of 28% as it extensively integrates electric grippers in assembly and inspection processes.

-

Servo-electric actuation technology commands a 45% market share, favored for its high torque density and precise control.

-

Two-finger parallel grippers dominate the mechanism segment with 35% share due to their quick cycle times and repeatability.

-

IO-Link is the leading communication interface, holding a 35% market share, appreciated for its simplicity and machine integration benefits.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6840

Electric Grippers Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.24 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size by 2034 | USD 3.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.34% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gripper Mechanism, Actuation Technology, Payload Capacity, Precision, Communication Interface, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial Intelligence (AI) is revolutionizing electric grippers by imbuing them with greater intelligence and flexibility. AI-powered vision systems and machine learning models enable electric grippers to perform complex industrial tasks with improved accuracy and adaptability. Additionally, AI enhances reliability by analyzing sensor data for predictive maintenance, reducing downtime, and optimizing operational costs.

The integration of AI also allows electric grippers to communicate performance metrics like energy consumption and force application in real time, enabling factory teams to adjust processes dynamically and maintain high production efficiency. The ongoing fusion of AI with gripping technologies is poised to accelerate smart factory adoption worldwide.

What Factors Are Fueling Market Expansion?

The surging demand for collaborative robots is a significant growth catalyst. With global robot density hitting 162 units per 10,000 workers and increasing demand from the food and consumer goods sectors, manufacturers are scaling gripping solutions adapted for high-volume production lines. Automation vendors like ABB are prioritizing robotics and AI strategies, embedding in-built sensing and programmable force controls in grippers to support mixed-model production lines.

Smart factory adoption accelerates innovation in gripping technologies, with devices transmitting data to digital twins, PLCs, and Industry 4.0 ecosystems, facilitating real-time decision-making and predictive maintenance. These developments reduce commissioning times and operational inefficiencies, bolstering market growth.

What Opportunities and Trends Are Shaping the Market?

Why Are Two-Finger Parallel Grippers So Popular?

Two-finger parallel grippers dominate due to their simple kinematics, repeatability, and fast cycle times, ideal for automotive and electronics assembly. Their standard tooling compatibility simplifies integration with robotic arms and reduces commissioning times.

How Is Servo-Electric Actuation Leading?

Servo-electric actuation is preferred for its torque density, precision, and compatibility with existing robot controllers, holding 45% revenue share. Improvements in servo electronics, including closed-loop force control and faster commutation, have made delicate assemblies more manageable.

What Trends Are Emerging in Payload and Precision?

The 5–20 kg payload range dominates, particularly in consumer electronics and automotive sectors, balancing gripping power and energy efficiency. Standard precision grippers, delivering repeatability within ±0.1 mm, hold the largest share, while high-precision grippers for semiconductor and aerospace sectors are growing fastest due to demands for ultra-fine tolerances.

Which Communication Interfaces Are Driving Industry Adoption?

IO-Link’s simplicity and affordability make it the preferred communication interface, favored for plug-and-play installations in packaging and automotive industries. Industrial Ethernet is poised for rapid growth, enabling high-bandwidth, low-latency communication required for future smart factories.

Regional and Segmentation Analysis

Asia Pacific commands the largest regional market share due to strong governmental support, capital investments, and the concentration of semiconductor fabs in countries like Taiwan, South Korea, and China. South Korea leads robot density with over 1,000 robots per 10,000 workers, fueling gripper adoption in advanced manufacturing.

The automotive sector leads end-use industries, with growing robot installations across Europe and North America. Electronics and semiconductor industries exhibit the fastest growing demand, fueled by wafer fab expansions and the need for delicate handling of micro-components.

Segmentation by Actuation Technology

-

Servo-Electric Actuation: Holds the largest market share of 45%. Valued for its high torque density, precise control, and compatibility with existing robot controllers, making it ideal for delicate assemblies and automation applications.

-

Pneumatic Actuation: Utilized for applications requiring faster response times and lower cost but limited by less precision compared to servo-electric.

-

Other Actuation Types: Include hydraulic and other specialized actuation mechanisms, serving niche applications but with relatively smaller market shares.

Segmentation by Mechanism Type

-

Two-Finger Parallel Grippers: Dominates the mechanism segment with around 35% market share due to simplicity, fast cycle times, quick repeatability, and compatibility with a wide range of automated systems.

-

Three-Finger Grippers: Preferred for applications requiring a more stable grip and versatility.

-

Magnetic, Vacuum, and Specialized Grippers: Serve specific roles in electronics, packaging, and delicate manufacturing sectors.

Segmentation by Payload Capacity

-

5 to 20 kg Payload: Largest share, largely driven by automotive, consumer electronics, and general manufacturing sectors where mid-range payload balancing power and efficiency is critical.

-

Below 5 kg and Above 20 kg: Smaller shares, with smaller payloads typical in precision electronics and above 20 kg in heavier industrial applications.

Segmentation by Precision Level

-

Standard Precision: Holds the largest share, delivering repeatability within ±0.1 mm, suitable for most automotive and general assembly tasks.

-

High Precision: Fastest growing segment, especially relevant for semiconductor, electronics, and aerospace sectors requiring ultra-fine tolerances.

Segmentation by Communication Interface

-

IO-Link: Leads with approximately 35% share, favored for its cost-efficiency, ease of installation, and integration with existing automation systems.

-

Industrial Ethernet: Experiencing rapid growth due to its ability to provide high bandwidth and low latency communication, essential for future Industry 4.0 and smart factory applications.

-

Other Interfaces: Include traditional fieldbus systems used in legacy installations.

Segmentation by Industry Vertical

-

Automotive: Largest end-user industry, accounting for about 28% share, due to extensive use of robotic assembly and inspection requiring electric grippers.

-

Electronics and Semiconductor: Fastest growing sector driven by delicate handling needs in wafer fabs and microelectronics production.

-

Food & Consumer Goods: Increasing automation demand is boosting adoption.

-

Others: Include pharmaceuticals, packaging, and heavy industries with niche usages.

Electric Grippers Market Companies

- ABB Robotics

- ATI Industrial Automation

- Camozzi Automation

- Comau

- Destaco

- FANUC

- Festo

- Gimatic

- J. Schmalz GmbH

- Kawasaki Robotics

- OnRobot

- Parker Hannifin

- PIAB

- Robotiq

- SCHUNK

- SMC Corporation

- Soft Robotics Inc.

- Weiss Robotics

- Yaskawa Motoman

- Zimmer Group

What Challenges Does the Market Face?

Limited payload capacity restricts electric gripper use in heavy-duty manufacturing, where pneumatic or hydraulic grippers prevail. Additionally, high initial investment costs pose adoption barriers for small to medium enterprises. Manufacturers must balance precision and versatility while controlling costs to expand market reach.

Case Study: Enhancing Automotive Assembly Efficiency

A leading automotive manufacturer integrated servo-electric grippers with AI-enabled vision systems on their assembly lines. The result was a 15% increase in throughput and a 10% reduction in scrap rates, demonstrating improved efficiency and consistent quality. Real-time telemetry enabled predictive maintenance, minimizing downtime and optimizing resource allocation.

Read Also: Cooling Fan Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025