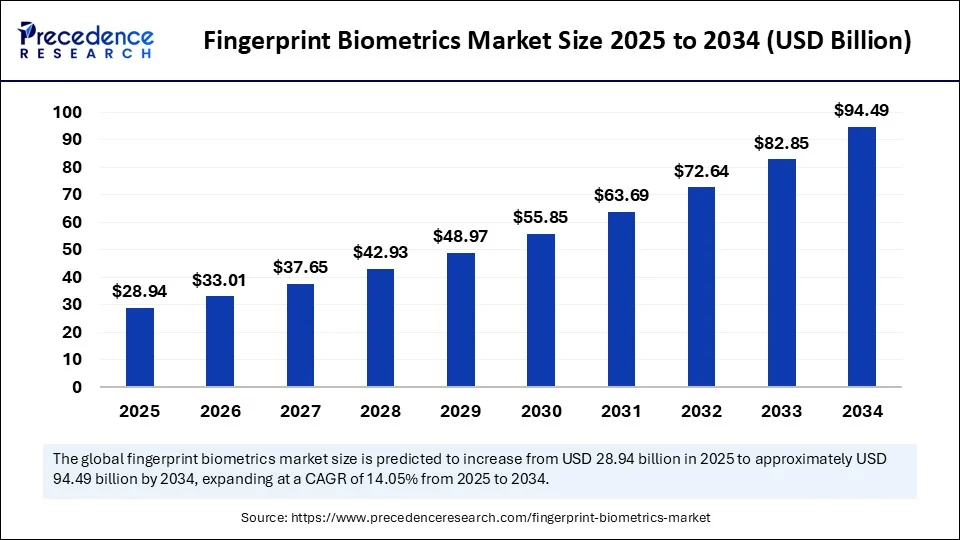

The global fingerprint biometrics market is poised for explosive growth, driven by rising demand for secure digital verification across industries and regions. According to Precedence Research, the market will soar from USD 28.94 billion in 2025 to USD 94.49 billion by 2034, expanding at a robust CAGR of 14.05% .

Security in an Age of Smart Access

The fingerprint biometrics market, foundational to modern identity verification, thrives amid escalating cyber risks, regulatory pressures, and consumer demand for convenience. Pioneering advances in artificial intelligence and sensor technology propel both speed and reliability, making fingerprint authentication indispensable from smartphones to border control. The forecasted CAGR of 14.05% from 2025 to 2034 highlights its transition from a niche tool to a ubiquitous cornerstone of digital trust .

Fingerprint Biometrics Market Key Insights

-

The global market value will reach USD 94.49 Billion by 2034 .

-

Asia Pacific currently dominates, fueled by widespread government-backed biometric identification initiatives .

-

North America is the fastest-growing region, leveraged by advanced infrastructure and R&D investments.

-

Top drivers include national ID programs, smartphone integration, fintech expansion, and healthcare digitization .

-

Leading segments: Hardware (dominant), Optical sensors (largest share), Mobile single-finger capture (most integrated form factor), and Verification mode (core authentication) .

Fingerprint Biometrics Market Revenue Breakdown

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 25.38 |

| 2025 | 28.94 |

| 2034 | 94.49 |

| Region | 2025 Market Size (USD Billion) | 2034 Market Size (USD Billion) | CAGR (2025-2034) |

|---|---|---|---|

| Asia Pacific | 11.00 | 36.38 | 14.20% |

| North America | Fastest Growing | – | – |

Artificial intelligence is revolutionizing fingerprint biometrics, enabling real-time matching even under difficult conditions (e.g., partial or degraded prints). Deep learning models dramatically enhance resilience against spoofing and fraud, lowering false acceptance and rejection rates.

Additionally, AI-powered systems adapt to user behaviors and environmental changes, expanding applications from device unlocking to multimodal recognition combining fingerprints with facial or iris data. As AI integrates with machine vision and cloud platforms, it drives new industry standards for both performance and security, prompting widespread adoption .

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6693

Security at Your Fingertips: Growth Factors and Market Drivers

Unmatched security and ease-of-use make fingerprint biometrics the authentication method of choice. The surge in cyberattacks and identity theft compels governments and enterprises to adopt robust biometric solutions.

Miniaturized sensors and embedded biometric chips have made the technology accessible across consumer electronics, while critical sectors like healthcare benefit from improved patient safety and data integrity. National ID projects, passport programs, and cashless payments further fuel global momentum for the market .

Opportunity and Trend: Is the Market Unlocking New Frontiers?

Will emerging economies, cloud biometrics, and smart devices be the next blockbuster trends in fingerprint authentication?

-

Rapid adoption in fintech, e-governance, and healthcare signals expanding market boundaries.

-

Sensor miniaturization and AI integration foster novel applications from wearables to IoT devices.

-

Governments increasingly deploy biometrics for border management and digital identity programs, creating vast new opportunities.

Fingerprint Biometrics Market Regional Analysis: Where Is the Growth?

Asia Pacific: Why Does It Lead the Market?

The Asia Pacific region dominates the global fingerprint biometrics market due to several powerful factors. The large population base combined with rapid digital transformation programs are crucial drivers. Countries like India, China, and Indonesia have implemented expansive government-backed biometric identification initiatives aimed at national ID systems, banking access, and e-governance solutions.

The widespread availability and affordability of smartphones embedded with fingerprint sensors have made biometric authentication accessible to millions. Furthermore, a booming fintech sector in Asia-Pacific intensifies demand for secure digital transactions using fingerprint biometrics. In addition, industries such as healthcare and education across the region are integrating fingerprint biometrics for improved operational efficiency and accountability.

Investments in artificial intelligence and contactless biometric technologies further solidify Asia Pacific’s position as the market leader, with expected growth from USD 11.00 billion in 2025 to USD 36.38 billion by 2034 at a CAGR of 14.20%.

North America: The Fastest-Growing Region

North America is experiencing the fastest growth in the fingerprint biometrics market. This expansion is primarily driven by a robust technological infrastructure and a supportive regulatory environment. The U.S. government’s focus on security applications like biometric passports, border security, and national databases strengthens adoption.

Leading technology companies headquartered in this region invest heavily in research and development, accelerating innovation in biometric solutions. Early adoption in critical sectors such as healthcare and financial services continues to protect sensitive data and meet compliance requirements. Moreover, consumer demand for advanced security features in smartphones and smart devices fuels the market growth.

Overall, the combination of regulatory support, strong cybersecurity concerns, and technological infrastructure positions North America as a vital growth engine in the global fingerprint biometrics landscape .

Europe: Steady and Compliance-Focused Growth

Europe shows steady fingerprint biometrics market growth with a focus on regulatory compliance and cross-border security. Governments and enterprises prioritize data protection and privacy norms, ensuring biometric solutions align with GDPR and other regulations.

The region’s investments in secure border management, immigration control, and government ID systems foster progress. Growth is moderate but consistent as biometric technology becomes integral in multiple sectors, driven by security needs and digital identity initiatives .

Latin America & Middle East/Africa: Emerging Adoption

Latin America and the Middle East & Africa regions are witnessing rising adoption of fingerprint biometrics in government and law enforcement applications including national ID programs and secure transaction frameworks. These regions leverage biometric systems for voter registration, border control, and citizen identity verification, which drives market penetration.

Though still emerging compared to Asia-Pacific and North America, these markets provide significant growth opportunities due to ongoing public sector digitization and demand for secure and efficient identification methods.

Fingerprint Biometrics Market Segmentation

Component: Hardware vs. Software

Hardware is the dominant segment of the fingerprint biometrics market. It includes physical devices such as fingerprint scanners, sensors, and biometric modules that are essential for capturing fingerprint data. The widespread use of smartphones, laptops, and access control systems fuels demand for reliable and durable hardware. Manufacturers continue to innovate in miniaturization, durability, and energy efficiency, vital for consumer convenience and enterprise deployment.

The software segment, conversely, is the fastest-growing due to expanding applications in AI-powered biometric recognition, real-time data analysis, anti-spoofing, and cloud integration. Cloud-based biometric software provides scalability, ease of updates, and remote accessibility, making it popular across sectors embracing digital transformation .

Sensor Type: Optical vs. Ultrasonic

Optical sensors hold the largest share of the market as they are widely used in smartphones and access control systems due to their cost-effectiveness and reliability. They capture detailed fingerprint images by using light-based technology.

Ultrasonic sensors are the fastest-growing segment, distinguished by their ability to capture three-dimensional fingerprint data through skin penetration. They offer superior accuracy, work well in challenging conditions such as wet or dirty fingers, and provide robust anti-spoofing features. Ultrasonic sensors are increasingly integrated into premium smartphones and high-security applications in healthcare and finance .

Capture Mode: Mobile Single-Finger Capture

Mobile single-finger capture is the predominant fingerprint capture mode, standard in smartphones, tablets, and laptops. It offers fast, secure, and convenient biometric verification embedded in compact devices with low power consumption. Government and enterprise adoption extends to ID cards and access badges using this capture mode, cementing its large market share .

Authentication Mode: Verification vs. Identification

Verification (one-to-one matching) holds the largest market share, widely used for secure access control by matching a fingerprint to a stored template. It’s prevalent in smartphones, ATMs, laptops, and workplace security, favored for its cost-effectiveness and reliability.

Identification (one-to-many matching) is the fastest-growing authentication mode, critical for law enforcement, border management, and national ID programs. It matches fingerprints against large databases to establish identity, supporting public safety, voter registration, and civil identity systems.

Both authentication modes are expanding due to increasing security needs and digital governance projects globally.

Deployment: On-Premise and Cloud-Based Biometrics

On-premise deployment dominates because government, defense, and financial sectors prefer keeping biometric data and infrastructure in-house for security and regulatory compliance. Customizable on-premise systems support strict data protection mandates and reduce risks of external breaches.

Cloud-based biometric solutions are the fastest-growing deployment model, favored for scalability, remote access, and cost efficiency. These solutions enable real-time verification across networks, crucial for digital banking, eKYC compliance, and online services. Cloud deployment also accelerates software updates and AI-driven analytics, aligning with trends toward digital ecosystems and remote work.

End-User/Industry: Key Sectors

Consumer electronics lead with devices like smartphones, tablets, laptops, and wearables, embedding fingerprint biometric features for enhanced security and user convenience. Mobile payments and app services further entrench biometrics in consumer devices globally.

The government and public sector is the fastest-growing industry vertical, driven by national biometric projects including biometric passports, voter ID systems, and border security. Public safety, law enforcement, and smart city initiatives also rely heavily on biometric authentication.

Other important sectors include fintech, healthcare (for patient ID and data protection), and enterprise access management .

Applications: Security and Convenience

Fingerprint biometrics find their largest application in mobile device unlocking and smartphone authentication, a ubiquitous security feature globally. This segment dominates due to consumer demand for quick, reliable access.

eKYC (Electronic Know Your Customer) is the fastest-growing application, especially in financial services and digital banking. Biometric verification reduces fraud and enhances compliance during customer onboarding processes.

Other applications include access control (physical and logical), financial onboarding, border control, and e-governance, where secure and user-friendly authentication is paramount.

Recent Breakthroughs & Top Companies

Latest advancements include:

-

Next-generation optical and ultrasonic sensors for high-accuracy, in-display capture.

-

Deep learning-powered anti-spoofing and real-time cloud-based authentication solutions.

-

Integration of fingerprint biometrics in wearables, smart cards, and IoT systems.

Fingerprint Biometrics Market Companies

- IDEMIA

- Fingerprint Cards (FPC)

- HID Global

- NEC Corporation

- Suprema Inc.

- ZKTeco

- Synaptics

- Goodix Technology

- Thales Group

- Crossmatch

- Idex Biometrics

- SecuGen

- Dermalog Identification Systems

- Neurotechnology

- Aware, Inc.

- Fujitsu Limited

- BioEnable Technologies

- Anviz Global

- M2SYS Technology

- Daon

Challenges and Cost Pressures: What’s Holding Back Adoption?

Despite rapid expansion, barriers remain: privacy concerns over data handling, risk of biometric spoofing, varying regulatory frameworks, and high upfront costs restrain some market segments. Technical issues such as false negatives (from injury or aging skin) and cultural skepticism also present obstacles. Global harmonization of standards and investment in anti-spoofing technology will be necessary for further growth .

Case Study: Biometric Transformation in Government Identity Programs

India’s Aadhaar program, alongside similar initiatives in Indonesia and China, showcases the transformative potential of fingerprint biometrics in streamlining citizen services from banking access to e-governance. These programs serve over a billion individuals with robust digital identity verification, propelling market growth.

Read Also: Wearable Biometric Monitor Market

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Distributed Energy Resources Technology Market Size to Gain USD 293.59 Billion by 2034 - September 4, 2025

- Advanced Antenna Systems Market Size to Cross USD 21.00 Billion by 2034 - September 4, 2025

- Military 3D Printing Market Size to Surpass USD 4.24 Billion by 2034 - September 4, 2025