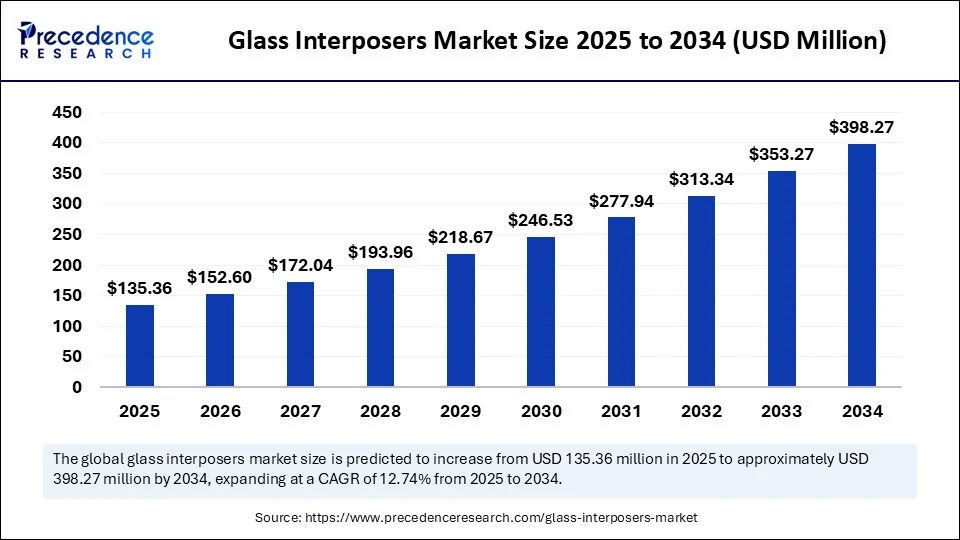

The global glass interposers market is entering a period of dynamic expansion, pegged at $135.36 million in 2025 and forecast to reach $398.27 million by 2034, charting a robust CAGR of 12.74%.

This growth is fundamentally driven by rapid technological advancement most notably, the shift from traditional lighting systems to high-efficiency LEDs, and the global wave of semiconductor packaging innovation. The market’s lifeblood flows from increasing demand for high-performance microelectronics, miniaturization trends, and higher signal integration requirements.

Glass Interposers Market Quick Insights

- The global glass interposers market will grow from $135.36 million in 2025 to $398.27 million by 2034, reflecting a CAGR of 12.74%.

- Asia Pacific remains the leading, fastest-growing region, with a projected market size of $249.40 million by 2034.

- India is an innovation hub, driven by advanced research and niche photonics applications.

- Top players include Corning Incorporated, Plan Optik AG, and SCHOTT.

- Dominant segment: 2D glass interposers, valued for cost efficiency and scalability.

- 300mm wafer size holds the lead for manufacturing volume and cost reduction.

- Through-glass vias (TGVs) are the backbone of high-frequency and high-performance packaging.

- Fan-out and panel-level glass packaging are the quick-rising stars, offering next-gen cost and performance advantages.

Glass Interposers Market Revenue Table

| Metric | Value |

| Market Size (2025) | $135.36 Million |

| Forecast (2034) | $398.27 Million |

| CAGR (2025-2034) | 12.74% |

| Asia Pacific Market (2024/2034) | $84.09M / $249.40M |

| Dominant Segment | 2D Glass Interposers |

| Leading Wafer Size | 300mm |

| Segmentation | Product/Type, Wafer Size, Substrate Technology, Packaging Architecture, Region |

How Is AI Transforming the Glass Interposers Market?

Artificial Intelligence is reshaping every part of the glass interposers value chain. On the design side, AI-powered simulation can rapidly optimize interposer layouts, predict thermal/electrical behaviors, and flag design improvements streamlining development cycles and ensuring higher consistency. In manufacturing, deep learning algorithms are enhancing TGV drilling precision and automating defect detection with machine vision, which minimizes yield losses and keeps quality standards high.

Moreover, predictive maintenance powered by AI is keeping fabrication equipment running at peak efficiency, reducing unscheduled downtimes and improving throughput. By integrating AI at multiple points design, manufacture, and inspection manufacturers are scaling production and capability with calibrated accuracy.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6599

What Market Growth Factors Are Accelerating Adoption?

- Unmatched electrical and thermal stability of glass compared to silicon alternatives.

- Demand for advanced semiconductor packaging (2.5D/3D stacking) and high-bandwidth memory.

- Miniaturization and lightweight trends in consumer electronics.

- Expansion of 5G, AI accelerators, and high-speed networks.

- Easy integration with high-density interconnects and redistribution layers.

Glass Interposers Market Opportunities and Trends:

How Are Data Centers, Devices and Automotive Sectors Reinventing the Market for Glass Interposers?

Join the chiplet revolution! Glass interposers are powering next-generation AI data centers, 5G infrastructure, and ultra-thin consumer electronics. Their superior signal integrity and minimal warpage make them the substrate of choice as data workloads and device density scale. Automotive electronics—and especially ADAS and EV power systems—are emerging as untapped applications for glass-based interposers, offering new frontiers for market growth.

Regional Analysis: Why Asia Pacific Is the Hub

Asia Pacific dominates with its advanced chip manufacturing ecosystem especially hubs in Japan, South Korea, Taiwan, and China. Local supply chains are strengthened by the presence of leading glass substrate suppliers and precision fabricators. Government-backed R&D, collaborative industry-academia partnerships, and large-scale production capabilities keep Asia Pacific at the cutting edge.

India in particular leads innovation for photonics and specialty electronics, supported by high-value applications in aerospace, medical devices, and defense.

Glass Interposers Market Segmentation Overview

By Product / Type:

- 2D Glass Interposers dominate the market due to their simpler design and mature manufacturing processes. They are cost-efficient and offer reliable electrical performance with low signal loss. Their compatibility with existing semiconductor packaging lines and scalability for high-volume applications in consumer electronics, networking devices, and optical modules make them the preferred choice.

- 3D Glass Interposers are the fastest-growing segment, driven by rising demand from AI, high-performance computing (HPC), and advanced data processing systems. They enable multi-layer stacking of logic and memory chips, reducing latency and improving energy efficiency. Despite higher complexity and costs, their superior electrical and thermal properties suit premium, compact, high-performance electronics like AR/VR, 5G, and autonomous systems.

By Wafer Size:

- 300 mm wafers hold dominance due to their ability to support high-volume manufacturing with better yield efficiency and lower cost per unit. They align well with modern semiconductor fabs and advanced packaging technology, widely used in consumer electronics, high-performance computing, and networking. The mature supply chain ensures consistent quality and cost control, making 300 mm the preferred size for large-scale production and advanced IC packaging.

- 200 mm wafers are gaining traction, particularly in niche and specialty semiconductor applications, such as aerospace, defense, and medical electronics. They are favored in mid-volume and prototype fabs with lower setup costs, ideal for smaller production runs. The flexibility of 200 mm wafers allows emerging economies and fab-lite models to enter semiconductor packaging, making this size key for customized and emerging market applications.

By Substrate Technology:

- Through-Glass Vias (TGV) dominate due to exceptional electrical performance, ultra-low signal loss, and high-density interconnection capability. TGV supports high-frequency, high-speed applications like RF devices, optical communication, and HPC modules. Continuous process improvements have enhanced yield and reduced defects, making TGV cost-competitive while ensuring mechanical integrity and reliability. Its capability for fine-pitch routing and vertical integration aligns with miniaturization trends.

By Packaging Architecture:

- 2.5D Packaging is the mainstream choice because it balances high performance with manageable manufacturing complexity. It supports integration of multiple dies on a single interposer, enhancing bandwidth and lowering latency. Widely used in graphics processors, network processors, and high-bandwidth memory modules, 2.5D packaging enables heterogeneous integration without full 3D thermal challenges, making it a favored and proven commercial solution.

- Fan-Out Packaging is the fastest-growing packaging segment, prized for ultra-thin form factors without requiring an interposer substrate. This makes it suitable for smartphones, wearables, and other space-constrained devices. Advances in glass-based fan-out enhance warpage control and electrical performance, supporting high-density routing and cost-effective mass production.

- Glass Panel-Level Packaging is rapidly growing due to large-area processing advantages, offering cost reductions and higher throughput compared to wafer-based methods. It supports large-scale production without compromising precision, ideal for future semiconductor packaging generations and flexible electronics.

Latest Company Breakthroughs

- Corning Incorporated:Pioneering high-purity glass substrates and advancements in panel-level processing.

- Plan Optik AG: Leading optical and microfluidic compatibility in wafer fabrication.

- SCHOTT: Driving innovations in specialty glass for advanced IC packaging.

Glass Interposers Market Companies

- Corning Incorporated

- AGC Inc. (Asahi Glass)

- SCHOTT AG

- Plan Optik AG

- Kiso Micro Co., Ltd.

- Ushio Inc.

- 3D Glass Solutions, Inc.

- Triton Microtechnologies, Inc.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Murata Manufacturing Co., Ltd.

- Dai Nippon Printing Co., Ltd.

- RENA (Glass interposer provider)

- Samtec Inc.

- Workshop of Photonics

- TECNISCO, LTD.

- Ohara Corporation

- Nippon Electric Glass (NEG)

- Entegris

Challenges and Cost Pressures

The greatest barriers to adoption:

- TGV fabrication at scale demands high precision, adding cost and complexity.

- Lower manufacturing yields compared to silicon/organic alternatives.

- High capital investment required for transitioning facilities.

- Industry expertise and process standardization still limited.

- Supply chain vulnerabilities in specialty glass materials.

- Hesitancy among device makers to shift from silicon due to reliability and interoperability concerns.

Case Study: India’s Rise in Innovation-Led, Niche Microelectronics

India’s research institutions and startups—collaborating with global design houses—are setting benchmarks with thermal and electrical performance breakthroughs for aerospace and defense. Innovations include laser-assisted patterning and hybrid bonding for next-gen photonic applications, showing how smaller, specialized markets can drive global value with focused expertise.

Read Also: Diabetes Nutrition Market

Read Also: HT Supplement (50X) Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Exosome Therapeutics Market Size to Attain USD 4.02 Billion by 2034, Driven by Innovations in Chronic Disease Treatment and AI-Enabled Drug Development - October 7, 2025

- Petroleum Refining Hydrogen Market Size to Reach USD 459.13 Billion by 2034 - October 6, 2025

- Quantum-Safe Cloud Storage Market Size to Reach USD 19.28 Billion by 2034 with a CAGR of 28.92% - October 6, 2025