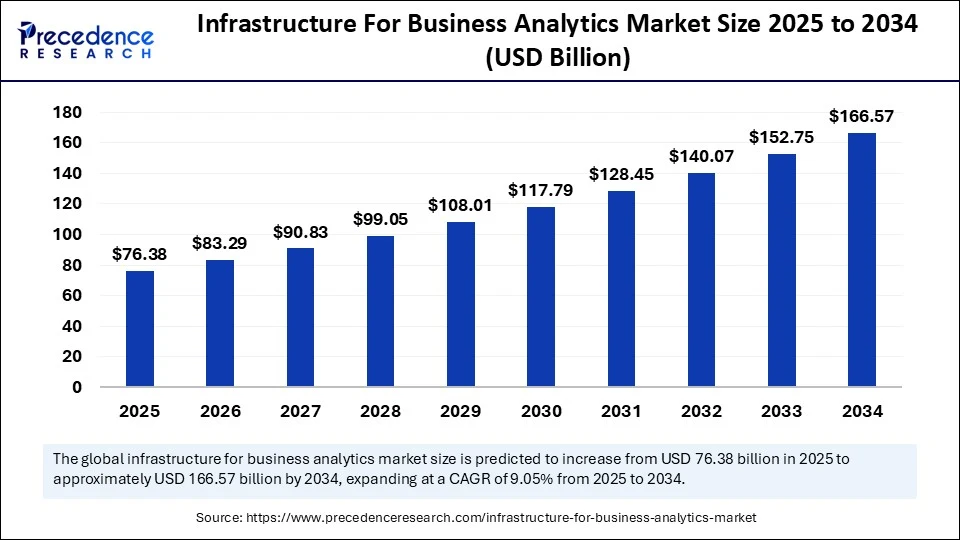

The global infrastructure for business analytics market recorded a valuation of USD 70.04 billion in 2024 and is projected to escalate to approximately USD 166.57 billion by 2034. Expanding at a steady CAGR of 9.05% from 2025 to 2034, the market is propelled by the growing adoption of cloud technologies, mounting demand for real-time analytics, and emerging data lakehouse architectures. The convergence of advanced analytics with stringent compliance regulations across sectors is further catalyzing investments in data infrastructure globally.

Infrastructure for Business Analytics Market Key Insights

-

The global market value stood at USD 70.04 billion in 2024 and is forecast to surpass USD 166.57 billion by 2034.

-

North America led the market in 2024, driven by digital economy expansion and large-scale cloud adoption.

-

Asia Pacific emerged as the fastest-growing region, buoyed by government digitalization policies and SME adoption.

-

The storage & data platforms segment dominated market share in 2024, supported by the explosion of big data and real-time intelligence needs.

-

Financial services represent the largest industry vertical, heavily investing in AI-driven analytics for risk management and customer personalization.

-

Top players actively driving the market include Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, and Oracle.

How Does AI Accelerate Infrastructure for Business Analytics Market Growth?

Artificial Intelligence is fundamentally reshaping the infrastructure for business analytics by enabling the rapid processing of vast, complex datasets. AI integration empowers organizations with accurate, predictive insights and advanced automation capabilities, improving forecasting and personalized analytics delivery. The rise of cloud-based AI tools enhances scalability and accessibility, making sophisticated analytics infrastructure more attainable for enterprises and SMEs alike. With AI-driven automation and real-time inference, businesses gain actionable intelligence at unprecedented speed and depth, fueling market expansion.

Infrastructure for Business Analytics Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 166.57 Billion |

| Market Size in 2025 | USD 76.38 Billion |

| Market Size in 2024 | USD 70.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Infrastructure Component, Services / Commercial Model, Industry Vertical, Organization Size / Buyer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Are the Key Growth Drivers of This Market?

The increasing need for real-time insights across industries such as BFSI, healthcare, manufacturing, and public utilities is a primary growth catalyst. This demand helps businesses optimize processes, manage risks, and enhance decision-making. Additionally, the accelerating shift to cloud-based platforms offers cost efficiency, scalability, and flexibility critical for handling fluctuating data volumes. Furthermore, widespread digital transformation and regulatory compliance requirements compel enterprises to invest heavily in robust analytics infrastructure.

What Opportunities and Trends Are Emerging in This Market?

Rising investments in smart infrastructure are fueling regional market growth by modernizing IT systems and enabling advanced data generation, especially in urban areas. These initiatives, prominent in North America, Europe, and Asia Pacific, create increased demand for sophisticated analytics platforms to manage the vast real-time data from smart cities and digital projects.

Mid-sized enterprises play a key role in accelerating cloud analytics adoption by seeking scalable, cost-effective solutions that fit their growth ambitions. Their agility in embracing cloud-native and AI-driven analytics drives demand for tailored infrastructure, helping expand the market beyond large enterprises.

Advances in accelerated computing with GPUs and TPUs are transforming infrastructure performance by enabling faster, parallel processing of complex analytics workloads. This boosts real-time insights, reduces latency, and lowers operational costs, establishing new standards for speed and efficiency in analytics platforms.

Integration and managed services are evolving to support complex, multi-cloud analytics environments. They are increasingly providing seamless data integration, automated operations, enhanced security, and customized industry support, allowing organizations to focus on extracting value from analytics rather than managing infrastructure complexities.

Infrastructure for Business Analytics Market Regional and Segmentation Analysis Highlights

North America held a dominant market position in 2024, supported by robust IT infrastructure investments and a thriving digital economy. The U.S. market alone is expected to grow from USD 19.61 billion in 2024 to approximately USD 47.56 billion by 2034 at a CAGR of 9.26%. Asia Pacific is the fastest-growing region, buoyed by government support and rapid SME adoption of cloud and AI technologies. Storage & data platforms remain the largest segment by infrastructure component, handling data warehouses, lakes, and lakehouses critical for big data operations. Implementation & integration services lead the service segment, reflecting high demand for expert deployment and management solutions. Large enterprises dominate adoption, but mid-market companies demonstrate rapid growth, particularly in cloud analytics.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6717

Latest Breakthroughs from Top Companies

Market leaders such as Microsoft, AWS, Google Cloud, IBM, and Oracle continue to innovate by expanding AI-powered analytics offerings and enhancing data platform scalability. Developments in accelerated computing hardware like GPUs and TPUs enable high-performance analytics for AI and machine learning workloads. Enhanced managed and security services address growing concerns about data governance and compliance, enabling broader cloud adoption.

Infrastructure for Business Analytics Market Companies

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Snowflake Inc.

- Databricks

- IBM (Cloud & Data Platforms)

- Oracle Corporation

- SAP SE

- Teradata

- Cloudera

- SAS Institute

- Hewlett Packard Enterprise (HPE)

- Dell Technologies (PowerScale, ECS)

- VMware

- Cisco Systems

- Informatica

- Tableau (Salesforce)

- Palantir Technologies

- Accenture

Challenges and Cost Pressures

High initial costs for on-premises hardware and software remain a barrier, particularly for smaller firms. Data security concerns and talent shortages in analytics expertise also constrain growth. Enterprises require ongoing investment in skilled personnel and security infrastructure to manage increasingly complex data environments.

Case Study: Accelerating Analytics in Financial Services

A leading financial services firm leveraged cloud-based AI analytics infrastructure to improve fraud detection and risk management. This implementation led to a 30% reduction in fraud losses and accelerated compliance reporting by 25%, demonstrating the powerful ROI potential of advanced analytics infrastructure.

Read Also: Microbiome Manufacturing Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Powder Bonding 3D Printing Construction Market Build complex formwork with precision, customization, and sustainable design - September 9, 2025

- Protein Characterization and Identification Market Set to Reach USD 8.04 Billion by 2034 Fueled by 5.29% CAGR and AI-Driven Innovations - September 9, 2025

- Automotive Simulation Software Market Size to Cross USD 24.35 Billion by 2034 - September 8, 2025