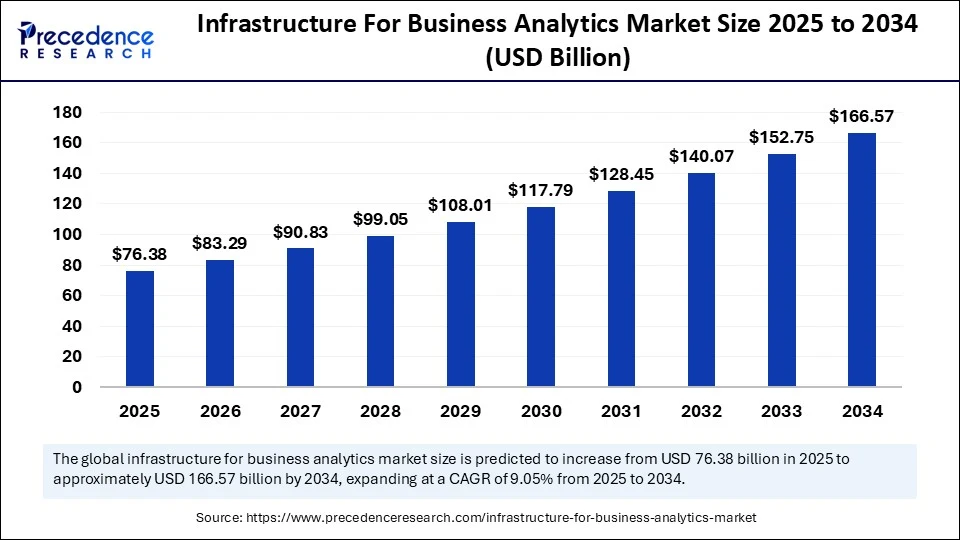

According to a recent study by Precedence Research, the global infrastructure for business analytics market is projected to rise from USD 76.38 billion in 2025 to nearly USD 166.57 billion by 2034, registering a strong CAGR of 9.05% during the forecast period. The growth is fueled by accelerating cloud migration, increasing need for real-time analytics, rapid adoption of data lakehouse architectures, and stricter regulatory compliance requirements.

Enterprises across industries are investing heavily in scalable infrastructure that can handle massive volumes of structured and unstructured data. This includes cloud platforms, accelerated compute, advanced storage, orchestration tools, and professional services, all working together to enable predictive insights and decision-making.

Quick Insights

-

Market Size (2024): USD 70.04 billion

-

Forecast (2034): USD 166.57 billion

-

CAGR (2025–2034): 9.05%

-

Top Region: North America – 40% market share in 2024

-

Fastest-Growing Region: Asia Pacific

-

Leading Segment (Infrastructure Component): Storage & Data Platforms (30% share in 2024)

-

Top Services Segment: Implementation & Integration Services (38% share in 2024)

-

Industry Leader (Vertical): Financial Services (18% share in 2024)

-

Largest Buyer Type: Large Enterprises (62% share in 2024)

-

Notable Fast-Growth Segments: Accelerated Compute, Managed Services, Healthcare & Life Sciences, and Mid-Market Enterprises

Get a Sample: https://www.precedenceresearch.com/sample/6717

What’s Driving the Market?

How is AI reshaping infrastructure for business analytics?

Artificial Intelligence has become a cornerstone of next-generation analytics infrastructure. Its ability to handle complex computational demands and generate predictive insights in real time makes it indispensable for enterprises. AI-powered tools are automating ETL processes, enhancing model management, enabling conversational analytics, and delivering personalized intelligence. Combined with the shift to cloud-based platforms, AI is fueling faster, cost-efficient, and more scalable adoption of advanced analytics infrastructure.

Expert Commentary

“As enterprises scale their digital operations, the ability to process, secure, and analyze data in real time has become a competitive necessity. The convergence of cloud, AI, and accelerated computing is reshaping the infrastructure landscape, moving organizations from reactive reporting to predictive and prescriptive intelligence. Businesses that invest in flexible, AI-ready infrastructure will not only gain operational efficiency but also unlock new revenue opportunities across verticals,” said Dr. Ananya Mehra, Principal Consultant at Precedence Research.

Regional Analysis

North America: Market Leader

North America dominated the market in 2024, accounting for 40% share. The region’s leadership is attributed to its digital-first economy, early adoption of cloud and AI platforms, and significant investments in data-driven operations across healthcare, BFSI, retail, and manufacturing. With governments and enterprises in the U.S. and Canada investing in smart infrastructure and cloud-native data platforms, the region is expected to maintain its edge through 2034.

Asia Pacific: Fastest-Growing Region

Asia Pacific is expected to record the highest CAGR over the forecast period. The growth is driven by government-backed digitalization initiatives, expansion of smart infrastructure, and increased adoption of cloud-based analytics among SMEs. Recent developments, such as Reliance Industries Ltd.’s launch of Reliance Intelligence in India to build AI-ready, green-powered data centers, highlight the region’s momentum toward becoming a global AI and analytics hub.

Segment Analysis

The infrastructure component segment of the market is dominated by storage and data platforms, which captured the largest share of revenue in 2024 at nearly 30%. This dominance is attributed to the exponential rise of big data across industries and the need for advanced solutions such as data warehouses, lakes, and lakehouse architectures that can handle both structured and unstructured information efficiently. These platforms form the foundation for real-time analytics and business intelligence. Meanwhile, the accelerated compute segment—which includes GPUs, TPUs, and FPGAs—is emerging as the fastest-growing category. Its growth is being driven by increasing enterprise demand for AI workloads, deep learning, and high-performance computing, making it an essential component for future-ready analytics infrastructure.

From the services and commercial model perspective, the market is led by implementation and integration services, which accounted for 38% of total revenue in 2024. These services remain crucial as organizations transition to complex cloud and hybrid infrastructures, requiring expert deployment and seamless integration of analytics ecosystems. However, the managed services segment is rapidly expanding as more enterprises look to outsource monitoring, compliance, and governance functions. Managed service providers (MSPs) offer not just cost savings, but also specialized expertise in managing multi-cloud and hybrid environments, making them increasingly valuable to enterprises of all sizes.

By organization size, large enterprises dominated the market with 62% share in 2024. These companies generate massive datasets across multiple business functions, requiring scalable, secure, and sophisticated infrastructure solutions. Their preference for hybrid models that balance the flexibility of cloud with the control of on-premises systems continues to shape demand. At the same time, mid-market enterprises represent the fastest-growing buyer group. This is largely due to their shift toward cloud-based analytics platforms, which offer cost-efficient scalability and democratize access to advanced data visualization, integration, and predictive analytics.

In terms of industry verticals, the financial services sector led the market with an 18% share in 2024. Banks, insurers, and investment firms are investing heavily in analytics infrastructure to strengthen risk management, fraud detection, compliance, and customer personalization. Their adoption of cloud-native and AI-powered platforms makes BFSI one of the most mature end-users of analytics infrastructure. On the other hand, the healthcare and life sciences industry is projected to witness significant growth in the coming years. With the rise of real-time patient monitoring, remote care solutions, and data-intensive clinical trials, healthcare organizations are rapidly embracing cloud and AI-driven platforms. Many are also turning to external partners for analytics capabilities to overcome the high costs of in-house infrastructure development, further boosting demand in this sector.

Read Also: Urban Air Mobility Market Size to Reach USD 92.60 Billion by 2034

Market Challenges

Despite strong growth potential, the market faces hurdles:

-

High Initial Investment: On-premise deployments often demand significant capital expenditure in hardware, software, and integration.

-

Data Security Concerns: Rising cyberattacks and regulatory requirements make data governance a critical challenge.

-

Skill Shortages: A global talent gap in AI, data engineering, and cloud orchestration could slow enterprise adoption.

Industry Developments

-

Amazon (June 2025): Announced a USD 20 billion investment in Pennsylvania to expand AI-ready data centers, creating over 1,200 jobs.

-

Jabil Inc. (June 2025): Committed USD 500 million to expand U.S.-based cloud and AI data center infrastructure.

-

Hitachi Digital Services (May 2025): Signed a five-year agreement with Envista Holdings to deliver end-to-end managed services across 60 countries.

-

NTT DATA (Nov 2024): Expanded partnership with Google Cloud to accelerate adoption of cloud-based data analytics and generative AI in Asia Pacific.

Case Example: BFSI Sector Transformation

Banks and financial institutions are among the earliest adopters of analytics infrastructure. With real-time fraud detection, AI-powered credit scoring, and regulatory compliance systems, BFSI organizations are driving large-scale adoption of cloud-native, AI-ready infrastructure. For example, multinational banks are leveraging data lakehouse platforms combined with GPU-based compute to process petabytes of customer and transaction data daily.

Key Players

Major market participants include:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

Databricks

-

Snowflake Inc.

-

IBM

-

Oracle Corporation

-

SAP SE

-

Teradata

-

Palantir Technologies

-

Accenture

-

Dell Technologies

-

Cisco Systems

Opportunities Ahead

How does cloud adoption unlock future opportunities?

The shift to cloud computing represents the most transformative opportunity for the infrastructure for business analytics market. Cloud platforms enable scalability, cost efficiency, and flexibility for organizations of all sizes. By reducing upfront hardware investment, cloud-based analytics empower SMEs to compete with larger enterprises while allowing Fortune 500 companies to scale their predictive analytics globally.

- Quantum Dot Materials and Technologies Market to Surpass USD 46.4 Billion by 2034, Expanding at a CAGR of 22.64% - September 9, 2025

- Infrastructure For Business Analytics Market Size to Surpass USD 166.57 Bn by 2034, Growing at 9.05% CAGR - September 8, 2025

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024