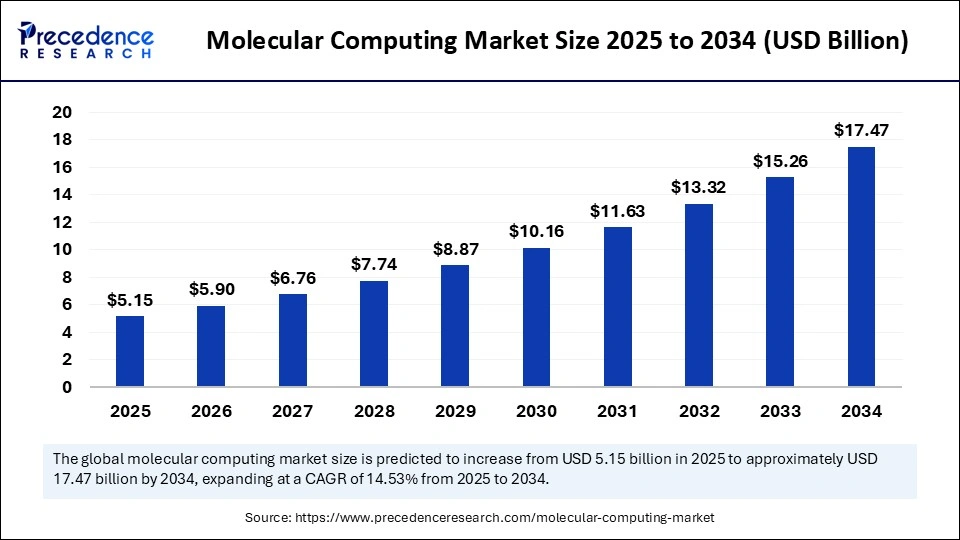

The molecular computing market, valued at $4.50 billion in 2024, is predicted to surge to $17.47 billion by 2034, fueled by a staggering 14.53% CAGR. The fundamental driver is the industry’s quest for alternatives to silicon-based computing, with molecular devices unlocking unprecedented computational speed and efficiency. Core applications include drug discovery, cryptography, diagnostics, and emerging fields in personalized medicine and advanced materials, with AI and nanotechnology opening new commercialization pathways.

Molecular Computing Market Key Points

-

Global market value: $5.15 billion in 2025, rising to $17.47 billion by 2034.

-

Top region: North America (42% market share in 2024), powered by leading universities and biotech innovation.

-

Fastest growth: Asia Pacific, driven by policy pushes in China, Japan, South Korea, and India.

-

Leading segment: DNA computing (45% share in 2024) due to high parallelism and energy efficiency.

-

Largest application: Drug discovery & molecular modeling (35% share in 2024), supporting pharma and biotech breakthroughs.

-

Key player segment: Academic & research institutes (38% share), as innovation hubs for next-gen computing technologies.

-

U.S. market: $1.46 billion in 2024, expected to hit $5.75 billion by 2034.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6945

Market Value Table

| Year | Global Market Size | North America Share | U.S. Market Size |

|---|---|---|---|

| 2024 | $4.50 Billion | 42% | $1.46 Billion |

| 2025 | $5.15 Billion | – | – |

| 2034 | $17.47 Billion | – | $5.75 Billion |

Artificial intelligence is playing a pivotal role in molecular computing’s rise. Machine learning algorithms now help researchers predict molecular structures, optimize chemical reaction pathways, and model circuits with greater accuracy than ever before. This fusion of AI and molecular techniques speeds innovation while reducing costly trial-and-error cycles.

AI-powered analysis is particularly transformative for genomics, drug discovery, and advanced materials — where molecular computing enables massive data throughput and unprecedented parallelism. Startups and research labs now deploy scalable, AI-driven molecular hardware and platforms for high-resolution simulation and rapid product development, accelerating commercialization timelines and reducing R&D risk.

What is Driving Market Growth?

Rising energy demands and the limitations of silicon chips (especially for miniaturization and efficiency) are motivating industries to seek alternatives. Nanotechnology and synthetic biology breakthroughs have made it possible to precisely engineer molecules for computation, enabling ultra-dense parallel processing and pushing the frontiers of healthcare, security, and materials sciences.

Robust support from governments, venture investors, and corporate R&D is further propelling molecular computing out of the lab and into real-world, data-intensive applications.

Key Trends and Opportunities

Why Is DNA Computing Leading the Charge?

DNA computing, with a dominant 45% market share, is prized for its unmatched density, energy efficiency, and reliability. Thanks to investments in sequencing and error correction, DNA-based systems tackle complex challenges in cryptography, bioinformatics, and combinatorial optimization far beyond the reach of conventional hardware.

Which Applications Will Transform Healthcare?

Drug discovery and molecular modeling account for the largest market share (35%), as molecular computing enables ultra-fast simulation of chemical interactions. This speeds up screening and design cycles, cuts research costs, and brings precision medicine closer to widespread reality.

Where Are the Biggest Regional Growth Opportunities?

North America leads due to its sheer scale of academic research, federal investments, and established technology infrastructure. However, Asia Pacific’s pro-innovation climate — especially in China and India — is catalyzing rapid regional expansion, with government funding pushing the limits of DNA and polymer computing into commercial domains.

How Will Synthetic Polymers Shape the Future?

Synthetic polymer/supramolecular computing is set for rapid growth amid advances in chemistry and nanomanufacturing. These systems offer modularity and specialized performance, enhancing fields like targeted drug delivery, smart materials, and nanorobotics with custom-designed molecular properties.

Regional and Segment Analysis

-

North America: Dominates the market with 42% share. Home to world-leading universities and national labs, the region benefits from robust government funding (NSF, NIH) and a fertile innovation environment. Silicon Valley startups and pharma companies are pushing commercialization, supported by strong IP protections and federal grants.

-

Asia Pacific: Fastest growth region, with China, Japan, South Korea, and India investing heavily in molecular and DNA computing infrastructure. Attractive regulatory climates and escalating demand for high-performance systems are bringing both local and global companies into the fray.

-

Europe, Latin America, Middle East & Africa: Active R&D efforts, rising adoption for healthcare and cybersecurity applications, and support from academic institutions and EU programs are expanding the market’s geographic footprint.

Segmentation Overview

-

By Technology/Type: DNA computing is the current leader; synthetic polymer/supramolecular systems are rising fast.

-

By Application: Drug discovery, molecular modeling, and cryptography drive the highest demand.

-

By Component: Molecular hardware (DNA strands, nanostructures) forms the foundational layer; integrated platforms and software systems are pivotal for future scalability.

-

By End-User: Academic/research institutions (38%) remain critical innovation engines; pharmaceutical & biotech firms will see the fastest adoption rates as industry partnerships accelerate technology transfer.

Molecular Computing Market Companies

- Molecular Assemblies, Inc.

- Catalog DNA Computing Inc.

- Cambricon Technologies

- Roswell Biotechnologies

- Helixworks Technologies

- Oxford Nanopore Technologies

- DNA Script

- NTT Basic Research Laboratories

- Evonetix Ltd.

- Synthomics Inc.

Pressing Challenges and Cost Pressures

Molecular computing faces formidable barriers high technical complexity, costly lab infrastructure, and the difficulty of scaling prototypes into commercially viable products. Error rates in molecular reactions and integration hurdles with legacy silicon systems introduce reliability concerns. Capital requirements and extended commercialization timelines are further impediments, making cross-sector collaboration and sustained investment essential for market maturation.

Case Study: DNA Computing in Drug Discovery

A recent proof-of-concept at a leading academic research institute utilized DNA computing to simulate drug-target binding in seconds, slashing research costs and accelerating drug optimization cycles. The integration of AI modeling cut trial-and-error inefficiencies and surfaced viable compounds sooner — demonstrating molecular computing’s potential to revolutionize pharmaceutical R&D.

Read Also: Quantum-Safe Cloud Storage Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Molecular Computing Market Size to Surpass USD 17.47 Billion by 2034 - October 8, 2025

- Bioinformatics-as-a-Service Market Size to Worth USD 14.56 Billion by 2034 - October 8, 2025

- Personalized Skin Care Products Market Size to Reach USD 66.59 Billion by 2034 - October 8, 2025