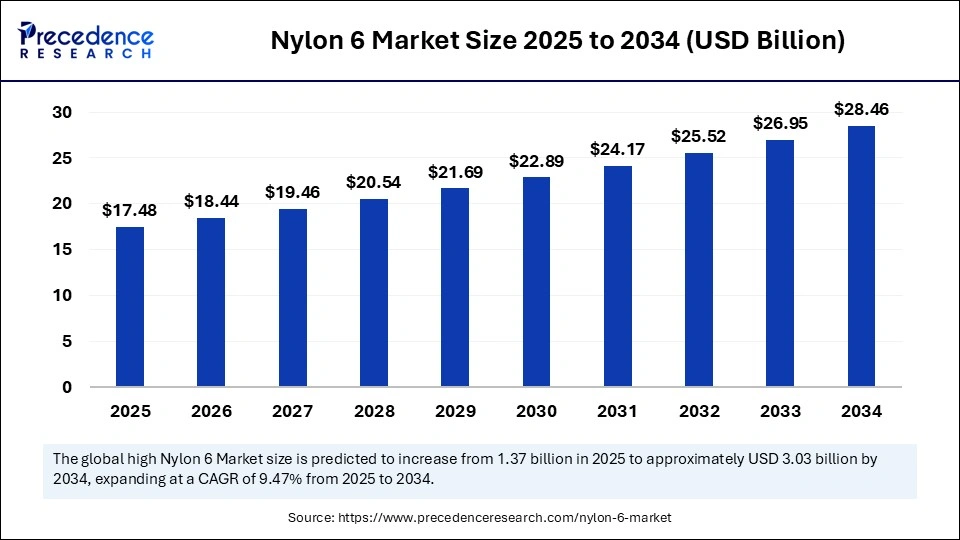

The global nylon 6 market was valued at USD 16.56 billion in 2024 and is projected to rise to approximately USD 28.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.57% from 2025 to 2034. This growth is fueled by expanding demand for lightweight, durable engineering plastics and high-performance fibers across multiple sectors such as automotive, textiles, packaging, electrical & electronics, and consumer goods.

Nylon 6 Market Key Insights

-

The market size is expected to grow from USD 17.48 billion in 2025 to USD 28.46 billion by 2034.

-

Asia Pacific dominates the market with the largest consumption and production base.

-

North America is the fastest-growing region, driven by innovation and sustainability initiatives.

-

Leading industry players focus heavily on recycling technologies and bio-based Nylon 6 variants.

-

Fibers remain the largest product segment, followed by rapidly expanding Nylon 6 films for packaging.

-

Standard grade Nylon 6 leads in market share due to its cost-efficiency and versatile applications.

Nylon 6 Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 16.56 Billion |

| Market Size in 2025 | USD 17.48 Billion |

| Market Size by 2034 | USD 28.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Form, Grade, Feedstock / Source, Processing Method, Application, End User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI’s Transformative Role in the Nylon 6 Market

Artificial Intelligence is emerging as a critical driver of efficiency and innovation in the Nylon 6 industry. By leveraging AI-enabled predictive analytics, manufacturers can optimize demand forecasting and reduce waste and overproduction. Intelligent automation in production processes ensures consistent quality in polymerization and fiber spinning, raising manufacturing standards.

Furthermore, AI accelerates R&D efforts by simulating new Nylon 6 formulations and enhancing recyclability, substantially reducing prototyping costs and development timelines. These technological advances collectively foster a smarter, more sustainable Nylon 6 ecosystem.

Key Market Growth Factors

Nylon 6’s growth is propelled by its excellent mechanical properties including tensile strength, elasticity, and chemical resistance, which make it ideal for replacing metals in lightweight engineering applications. The automotive sector’s push for fuel efficiency through weight reduction is a prime growth driver, with Nylon 6 increasingly used in engine parts, air intake manifolds, and interior components.

Similarly, the expansive textile industry relies on Nylon 6 fibers for durable, high-performance fabrics. Packaging industries also adopt Nylon 6 films for their superior barrier properties that extend shelf life and improve food safety. Rising urbanization and industrialization in emerging economies further augment demand, while sustainability efforts open doors for bio-based and recycled Nylon 6 formulations.

What Opportunities and Trends Are Shaping the Nylon 6 Market?

Why are Nylon 6 fibers dominating the market?

Nylon 6 fibers are extensively utilized in textiles, apparel, and industrial fabrics due to their remarkable strength, wear resistance, and elasticity. The rise in fast fashion and technical textiles, coupled with innovations in recycling, reinforce their market position, offering sustainable and versatile solutions.

How are Nylon 6 films expanding market reach?

Nylon 6 films are the fastest-growing product segment, driven by packaging needs for barrier protection, lightweight durability, and flexibility. Their applications now extend beyond packaging to automotive and electronics industries, supported by advancements in recyclable and multilayer composite materials.

What feedstock trends influence market dynamics?

While caprolactam-based Nylon 6 remains the dominant feedstock due to mature production infrastructure, recycled Nylon 6 is rapidly gaining traction. Growing environmental mandates and technological advances in recycling elevate its market share, aligning with global sustainability goals.

Which processing methods predominate and why?

Injection molding retains dominance owing to its precision, scalability, and cost-effectiveness for producing complex components in automotive and electronics sectors. However, extrusion is the fastest-growing method, favored for films, sheets, and profiles, reflecting demand from packaging and industrial applications.

Regional and Segmentation Analysis

Asia Pacific commands the largest market share with robust production capabilities and high demand in automotive, packaging, and textiles, led by China, India, and Japan. North America is the fastest-growing market, powered by regulatory focus on sustainability, innovation in electric vehicles, and high R&D investment. Europe and emerging regions also contribute through advanced markets and expanding industrial bases.

Segment-wise, fibers occupy the lion’s share, followed by rapidly growing films. Standard grade Nylon 6 dominates by volume, while reinforced grades are expanding fastest due to their superior mechanical properties suited for automotive and electronics. Caprolactam feedstock leads, although recycled Nylon 6 surges. Injection molding dominates processing, with extrusion on the rise. Textiles and apparel hold the largest application share but automotive is the fastest growing due to lightweighting trends. Direct sales dominate distribution, though online B2B platforms are growing fast in adoption.

Nylon 6 Market Companies

- BASF SE

- DuPont de Nemours, Inc.

- DSM Engineering Materials

- UBE Corporation

- Toray Industries, Inc.

- RadiciGroup

- Lanxess AG

- Domo Chemicals

- Invista (Koch Industries)

- Asahi Kasei Corporation

- Kolon Industries, Inc.

- Arkema S.A.

- Shenma Industrial Co., Ltd.

- Hyosung Corporation

- Aquafil S.p.A.

- Ascend Performance Materials

- EMS-Chemie Holding AG

- SABIC

- Toyobo Co., Ltd.

- AdvanSix Inc.

Challenges and Cost Pressures

The Nylon 6 market faces challenges such as volatility in raw material prices affecting production costs and margins. Environmental concerns led by plastic waste and carbon emission mandates impose regulatory pressures, particularly in developed regions. Competition from alternative polymers like Nylon 66 and polyesters, as well as high energy consumption in Nylon 6 production, add to the hurdles. Additionally, fragmented market dynamics and aggressive pricing make profitability challenging for smaller players.

Case Study: Sustainable Fiber Production in Asia

A major Asian textile manufacturer partnered with chemical producers to implement AI-driven quality control and adopt recycled Nylon 6 feedstock, reducing raw material costs by 15% while boosting production efficiency. This collaboration enhanced product sustainability credentials and opened access to eco-conscious international markets, exemplifying the synergy between technology adoption and circular economy principles.

Read Also: SiC Powder Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025