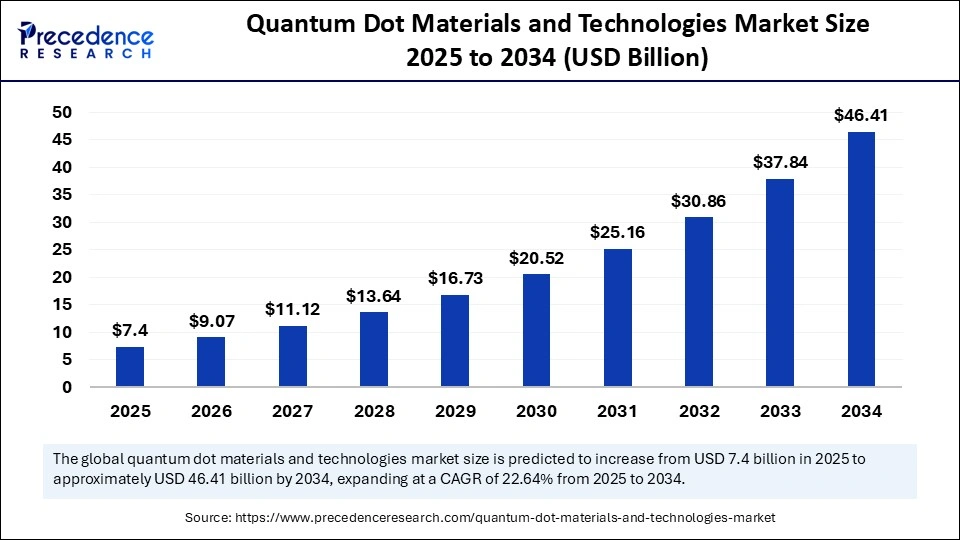

According to Precedence Research, the global quantum dot materials and technologies market size was valued at USD 6.03 billion in 2024 and is projected to grow from USD 7.40 billion in 2025 to nearly USD 46.41 billion by 2034, registering a robust CAGR of 22.64% during the forecast period (2025–2034). The surge is fueled by advancements in semiconductor nanocrystals (quantum dots) that offer superior color performance, energy efficiency, and biomedical applications.

Quantum dots are transforming industries ranging from consumer electronics to healthcare, supported by AI-driven material innovation, flexible device integration, and eco-friendly cadmium-free formulations. Government investments in quantum ecosystems across Asia-Pacific, North America, and Europe are further setting the stage for mass commercialization.

Quick Insights

-

Market Size (2024): USD 6.03 Billion

-

Market Forecast (2034): USD 46.41 Billion

-

CAGR (2025–2034): 22.64%

-

Leading Region (2024): Asia-Pacific (44% market share)

-

Fastest-Growing Region: North America

-

Top Material Type (2024): Cadmium-Free Quantum Dots (32% share)

-

Fastest-Growing Material Type: Perovskite Quantum Dots

-

Top Device Application (2024): Displays–TVs (40% share)

-

Fastest-Growing Application: Biomedical Imaging & Diagnostics

-

Dominant Manufacturing Technique: Colloidal Synthesis (36% share)

-

Top End-Use Industry (2024): Consumer Electronics (45% share)

-

Fastest-Growing End-Use: Healthcare & Life Sciences

-

Leading Companies: Samsung Electronics, LG Display, Nanosys Inc., Quantum Materials Corp., Nanoco Group Plc\

Get a Sample: https://www.precedenceresearch.com/sample/6726

What Opportunities Are Driving the Quantum Dot Market?

-

High-Resolution Displays: Premium TVs, monitors, and smartphones are rapidly integrating QD displays for vibrant color purity, sharper contrasts, and energy efficiency.

-

Biomedical Imaging & Diagnostics: Quantum dots’ photostability and tunable emissions make them ideal for early cancer detection, biosensors, and drug delivery.

-

AI-Enhanced Material Discovery: Machine learning models are optimizing synthesis and scalability, ensuring high consistency and cost efficiency.

-

Eco-Friendly Materials: With cadmium bans in place across Europe and North America, cadmium-free and perovskite QDs are gaining momentum.

-

Emerging Applications: Integration into quantum computing, defense optics, solar photovoltaics, and flexible electronics unlocks long-term growth.

Expert Insight

“Quantum dots are no longer just about sharper TVs — they’re about redefining biomedical imaging, solar efficiency, and even the foundations of quantum computing. The next decade will be about moving from premium electronics into cross-industry adoption. Companies that master both sustainable synthesis and AI-enhanced design will dominate this fast-growing landscape.”

— Dr. Ananya Mehra, Principal Consultant, Precedence Research

Regional Insights

Asia-Pacific: The Global Leader

Asia-Pacific held 44% of the global share in 2024, valued at USD 3.26 billion in 2025, and is projected to reach USD 20.65 billion by 2034. Growth is driven by:

-

Strong semiconductor and display manufacturing ecosystems (China, South Korea, Japan, Taiwan).

-

Consumer electronics boom with middle-class adoption of 4K/8K televisions and premium smartphones.

-

Government subsidies and quantum technology roadmaps supporting scalable QD synthesis.

-

Aggressive integration by Samsung and LG into QLED and OLED products.

North America: Fastest-Growing Hub

Expected to record the fastest CAGR from 2025–2034, North America’s growth is supported by:

-

Significant government funding in nanotechnology and quantum computing.

-

Biomedical innovations applying QDs in real-time imaging and drug discovery.

-

Rising adoption in virtual/augmented reality, automotive displays, and defense applications.

-

Academic and industry collaborations accelerating commercialization.

Segmentation Analysis

-

By Material Type:

-

Cadmium-Free Quantum Dots lead with 32% share in 2024, aligned with sustainability and regulatory trends.

-

Perovskite QDs expected to grow fastest due to high efficiency in optoelectronics.

-

-

By Device/Application:

-

Displays (TVs) dominate with 40% share; QLED technology is rapidly replacing LCDs.

-

Biomedical Applications to expand at the fastest CAGR, offering breakthroughs in biomarker detection and drug delivery.

-

-

By Manufacturing Technique:

-

Colloidal Synthesis dominates (36%) for its scalability and control over particle size.

-

Self-Assembly to expand fastest, offering low-cost, high-stability QDs for sensors and photonics.

-

-

By End-Use Industry:

-

Consumer Electronics remains the largest segment (45% share).

-

Healthcare & Life Sciences emerging fastest, leveraging QDs in diagnostics and therapeutics.

-

-

By Distribution Channel:

-

Direct Sales dominate with 42% share, ensuring technical support and customization.

-

Online Platforms grow fastest, enabling global accessibility for research labs and niche buyers.

-

Latest Breakthroughs

-

LG Electronics (Jan 2025): Launched the world’s first wireless OLED evo M5 with QD-enhanced display technology, offering unmatched clarity.

-

University of Innsbruck (Aug 2025): Pioneered a method to produce quantum dots generating controlled photon streams without expensive electronics — a potential game-changer for quantum communication.

Challenges & Cost Pressures

While the market outlook is promising, challenges remain:

-

High Manufacturing Costs: Complex synthesis methods and expensive precursors hinder scalability.

-

Toxicity Concerns: Cadmium-based QDs face regulatory bans, creating compliance and recycling issues.

-

Supply Chain Constraints: Dependence on specialized chemicals could limit production if disruptions occur.

-

Market Entry Barriers: High R&D intensity makes it difficult for small players to compete against giants like Samsung and LG.

Case Example: Samsung’s Quantum Leap

Samsung’s aggressive integration of QDs in its QLED TV series demonstrates the commercial viability of this technology. By focusing on cadmium-free formulations, Samsung not only complies with EU regulations but also differentiates in a crowded premium display market. This has positioned the company as a front-runner in consumer electronics, inspiring other manufacturers to follow suit.

Call to Action

Precedence Research offers an in-depth market report with forecasts, segmentation, competitive landscape, and technology insights for businesses, investors, and innovators.

📥 Download a sample report here: Quantum Dot Materials and Technologies Market Report

Or, schedule a consultation with our analysts to understand how quantum dot materials can transform your industry applications.

About Precedence Research

Precedence Research is a global market intelligence firm, delivering data-driven insights and strategic recommendations across healthcare, technology, chemicals, and energy sectors. Our team combines domain expertise with advanced analytics to help businesses navigate market transitions, identify growth opportunities, and build competitive advantage.

🌐 Website: www.precedenceresearch.com

📧 Email: sales@precedenceresearch.com

📞 Phone: +1 9197 992 333

- Quantum Dot Materials and Technologies Market to Surpass USD 46.4 Billion by 2034, Expanding at a CAGR of 22.64% - September 9, 2025

- Infrastructure For Business Analytics Market Size to Surpass USD 166.57 Bn by 2034, Growing at 9.05% CAGR - September 8, 2025

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024