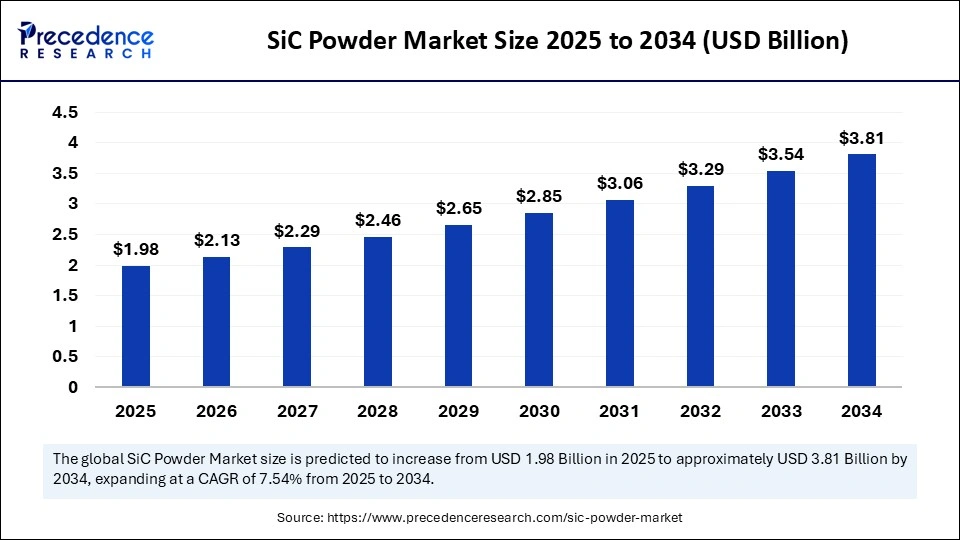

The global silicon carbide (SiC) powder market is set to expand significantly, reaching a valuation of approximately USD 3.81 billion by 2034, growing at a strong CAGR of 7.54% from 2025 to 2034. This growth is primarily driven by rising electric vehicle (EV) adoption, expanding renewable energy infrastructure, and increasing demand from 5G high-frequency applications, reflecting a transformative shift in power electronics and semiconductor sectors.

What is Driving the SiC Powder Market Growth? CAGR and Key Factors

The SiC powder market is flourishing as industries pivot toward energy-efficient and high-performance materials. SiC’s properties, including wide bandgap, high thermal conductivity, and excellent breakdown field strength—enable power modules to operate at higher voltages and temperatures with faster switching speeds and less cooling. These advantages power innovative solutions like traction inverters and onboard chargers in electric vehicles, boosting the market.

Supply chain stabilization through long-term contracts and investments is overcoming production constraints. Likewise, renewable energy developments demand high-efficiency inverters and converters, further accelerating SiC powder consumption globally. Emerging 5G infrastructure needs also contribute, requiring SiC components in high-frequency applications.

SiC Powder Market Key Highlights

-

The market valuation was USD 1.84 billion in 2024 and is expected to hit USD 3.81 billion by 2034.

-

Asia Pacific leads the market, capturing nearly 60% of revenue share in 2024.

-

Major market segments by type include black SiC powder dominating with 55% share, and green SiC powder growing rapidly due to electron-grade applications.

-

The micro-sized SiC powder constitutes 60% of the market due to consistent hardness and thermal stability.

-

The abrasives application segment holds the largest revenue share at approximately 35%.

-

Industrial manufacturing is the largest end-use segment, contributing 40% of the market share.

-

Leading players include companies specializing in SiC wafer production and power electronics materials.

Revenue and Market Size Breakdown

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 1.84 |

| 2025 | 1.98 |

| 2034 | 3.81 |

How Is AI Shaping the SiC Powder Market?

Artificial intelligence (AI) is playing a vital role in optimizing the SiC powder supply chain. AI-driven modeling enhances crystal growth processes that produce silicon carbide powders with higher purity and superior characteristics, suitable for high-performance electronics and EV applications.

Additionally, AI-based quality control systems implemented in manufacturing plants detect defects in real-time, reducing waste and lowering production costs. This integration ensures better efficiency and consistency in SiC powder production, empowering manufacturers to meet the rising demand more effectively.

What Factors Are Fueling Market Growth?

Several core factors support the SiC powder market’s expansion:

-

Growing electric vehicle adoption boosts demand for power electronics using SiC components to increase efficiency, range, and charging speed.

-

Accelerated investments in renewable energy infrastructure deploy SiC-based high-efficiency converters managing variable power generation in solar and wind systems.

-

The expanding 5G network rollout increases the need for high-frequency semiconductors made from SiC powder.

-

Technological advancements in power semiconductors and advanced ceramics underline the shift from traditional silicon to SiC-based solutions.

What Opportunities and Trends Are Emerging in the SiC Powder Market?

Why is the green SiC powder segment expected to grow faster than black SiC?

Green SiC powder, being electronics grade, offers higher purity and better edges crucial for wafer slicing, semiconductor substrates, and thermal management in power devices. Increased demand from EV, 5G, and renewable sectors propels this growth.

How does the market segment by purity level affect industry adoption?

Powders with 97–99% purity dominate due to applications in heavy industry abrasives, while ≥99% purity powders are rapidly gaining ground in semiconductor and power electronics due to stringent quality needs.

Why do micro-sized powders lead the market?

Micro powders provide consistent properties such as hardness and wear resistance, essential for grinding wheels and polishing media, supporting steady industrial demand.

Regional and Segmentation Analysis

Asia Pacific is the strongest regional market, supported by manufacturing hubs in China, India, Japan, and Southeast Asia with proximity to raw material sources and large industrial base. North America and Europe follow with growing renewable energy projects and semiconductor investments. Market segmentation covers:

-

Type: Black SiC powder leads, especially in abrasives and refractory applications; green SiC expanding in electronics.

-

Purity Level: Heavy industry favors 97–99%; semiconductor uses pull ≥99% powders.

-

Particle Size: Micro powders dominate due to versatility; nano powders grow fast for next-gen electronics.

-

Application: Abrasives largest revenue share; electronics & semiconductors fast-growing.

-

End-Use Industry: Industrial manufacturing largest, automotive growing fastest due to EVs.

-

Regions: Asia Pacific leads, with notable growth in North America and Europe.

SiC Powder Market Companies

- Saint-Gobain S.A.

- Washington Mills Electro Minerals Ltd.

- ESD-SIC b.v.

- Navitas Advanced Materials

- AGSCO Corporation

- Carborundum Universal Ltd. (CUMI)

- Grindwell Norton Ltd. (Saint-Gobain subsidiary)

- Entegris, Inc.

- SK Siltron Co., Ltd.

- Dow Corning (DuPont spin-off involvement in SiC)

- Fiven ASA

- Xiamen Powerway Advanced Material Co., Ltd.

- Pacific Rundum Co., Ltd.

- TankeBlue Semiconductor Co., Ltd.

- Snam Abrasives Pvt. Ltd.

What Challenges and Cost Pressures Exist?

High production costs due to energy-intensive carbothermal reduction and purification processes restrict broader adoption. Small players face entry barriers, and traditional silicon solutions still hold industry inertia despite SiC advantages. Additionally, raw material supply constraints with limited wafer production capacity hamper rapid scaling.

Case Study: SiC in Electric Vehicle Power Electronics

A leading automotive tier-one has integrated SiC powder-derived components into traction inverters and onboard chargers, achieving higher efficiency and thermal management, which extended EV driving range and reduced charging times. The accelerated validation of powder purity and particle control shortened supplier approval, enabling quicker production scale-up, reflecting broader industry trends.

Read Also: Consumer Metaverse Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Aluminum Smelting Market Size to Surpass USD 199.97 Billion by 2034 - September 25, 2025

- Spinosad Active Ingredient Market Size to Reach USD 1,364.27 Million by 2034 - September 25, 2025

- Liquid-Applied Sound-Damping Coating Market Size to Cross USD 376.12 Million by 2034 - September 25, 2025