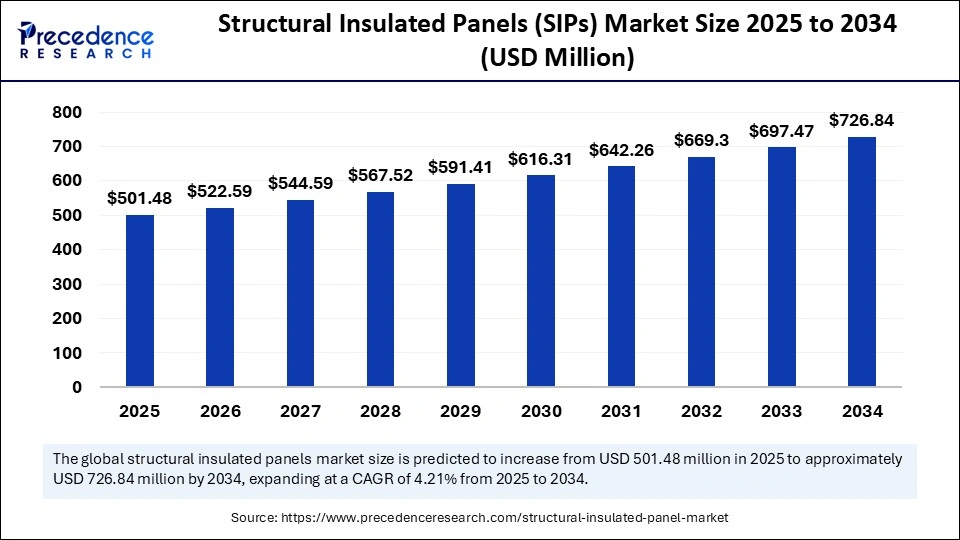

The global structural insulated panels (SIPs) market, valued at USD 481.22 million in 2024, is forecasted to grow to approximately USD 726.84 million by 2034, expanding at a steady CAGR of 4.21% from 2025 to 2034. This growth is driven by urbanization, the rise of smart city projects, and the growing emphasis on sustainability and energy efficiency in construction worldwide.

Structural Insulated Panels Market Overview and Key Drivers

Structural insulated panels, composed of an insulating foam core bonded between two structural facings such as oriented strand boards (OSB), are becoming a preferred choice in residential, commercial, and industrial construction. Their superior thermal insulation, energy efficiency, and rapid installation capabilities align well with global green building initiatives aimed at reducing greenhouse gas emissions. Technological advancements and increased adoption of prefabricated construction methods further propel market growth.

Structural Insulated Panels Market Key Insights

-

The global SIPs market was valued at USD 481.22 million in 2024 and is expected to reach USD 726.84 million by 2034.

-

North America held the largest market share in 2024, driven by green building regulations and active manufacturers.

-

Asia Pacific is projected to be the fastest-growing region due to rising sustainability awareness and urbanization.

-

The EPS (expanded polystyrene) panels segment led the market in 2024 due to cost efficiency and good thermal performance.

-

OSB is the leading facing material, favored for its affordability and structural strength.

-

Walls accounted for the largest application share in 2024, with roofs poised to grow quickly.

-

Direct sales dominated distribution, while indirect sales channels are gaining momentum.

-

Key companies include Kingspan Group, Aditya Birla Group, Shandong Qigong Environmental Protection Technology, and others.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6738

Structural Insulated Panels Market Revenue Table (USD Million)

| Year | Market Size (USD Million) |

|---|---|

| 2024 | 481.22 |

| 2025 | 501.48 |

| 2034 | 726.84 |

Artificial Intelligence (AI) is revolutionizing the SIPs market by optimizing manufacturing, design, and deployment processes. AI leverages automated design protocols and predictive maintenance to enhance safety, cost-effectiveness, and compliance with building regulations. By analyzing environmental factors such as seismic activity, wind loads, and temperature fluctuations, AI enables the selection of optimal panel configurations, reducing waste and cost at early design stages.

Furthermore, AI-driven automation supports precise material usage and quality control, minimizing human error in fabrication. This technology not only accelerates production but also ensures consistency and durability, which are critical in modern construction practices.

What Are the Key Growth Factors for the Structural Insulated Panels Market?

The SIPs market growth is primarily fueled by:

-

The increasing demand for energy-efficient buildings that minimize heating and cooling energy consumption.

-

Government initiatives promoting green construction and sustainable building materials to reduce carbon footprints globally.

-

The rise of prefabricated and modular construction techniques, allowing for faster assembly and reduced labor costs.

-

Technological advancements enhancing thermal resistance and fire safety, particularly in PUR/PIR foam panels.

-

Expansion of urbanization and smart city projects, especially in Asia Pacific and North America.

What Opportunities and Trends Are Shaping the Future of the SIPs Market?

How does automation influence SIPs production?

Automation offers opportunities for increased production speed, higher quality, and reduced costs through the use of CAD/CAM software and AI monitoring systems. This trend could transform traditional manufacturing into high-efficiency, flexible operations with enhanced safety.

Why is EPS preferred among insulation materials?

EPS panels are cost-effective, lightweight, and have a low water absorption rate, making them attractive for builders aiming to reduce construction time and expenses while maintaining thermal performance.

How does sustainability awareness impact regional growth?

In Asia Pacific, growing environmental awareness and government mandates for resource-efficient construction foster the increased adoption of SIPs, driving fast market expansion in the region.

Structural Insulated Panels Market Regional and Segment Analysis

North America leads the market due to stringent green building codes, mature construction sectors, and strong manufacturer presence. Asia Pacific is the fastest growing, driven by urbanization and smart city developments. Europe, Latin America, and the Middle East & Africa follow in growth potential aligned with sustainable construction adoption.

Structural Insulated Panels Market Segmental Analysis

-

By Product Type: EPS panels dominate, while PUR/PIR panels grow fastest due to superior thermal and fire resistance.

-

By Facing Material: OSB is dominant, with cement boards gaining rapid traction because of UV, moisture resistance, and durability.

-

By Application: Walls are the largest segment, with roofs expected to see rapid growth due to energy-efficient roofing technologies.

-

By Distribution Channel: Direct sales lead, providing customization and higher margins; indirect sales are expanding as manufacturers rely on broader networks.

Structural Insulated Panels Market Innovations and Key Players

The market is witnessing breakthroughs in panel materials and integration of building-integrated photovoltaics in roofs, enhancing energy savings. Leading companies driving these advances include Kingspan Group, Aditya Birla Group, Shandong Qigong Environmental Protection Technology, Formance, DSS Industries, Diligent Enterprises, Nohara Holdings, and Bondor.

Challenges and Cost Pressures

Despite many benefits, SIPs face challenges such as sensitivity to moisture which requires careful sealing, limited lifespan of certain materials, and high initial capital investments. The balance between raw material costs, manufacturing automation, and market pricing remains critical to wider adoption.

Case Study Highlight: Automation Enhances Panel Quality at Kingspan

Kingspan Group implemented an AI-driven automated manufacturing line for SIPs, reducing production errors by 30% and cutting turnaround time by 25%. This technological adoption improved panel consistency and customer satisfaction, setting a benchmark in SIP manufacturing efficiency.

Read Also: Distributed Energy Resources (DER) Technology Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Managed DNS Services Market Size to Hit USD 2,288.60 Million by 2035 - March 5, 2026

- Power EPC Market Size to Hit USD 1,376.29 Billion by 2035 - March 5, 2026

- Ursolic Acid Market Size to Hit USD 68.77 Billion by 2035 - March 5, 2026