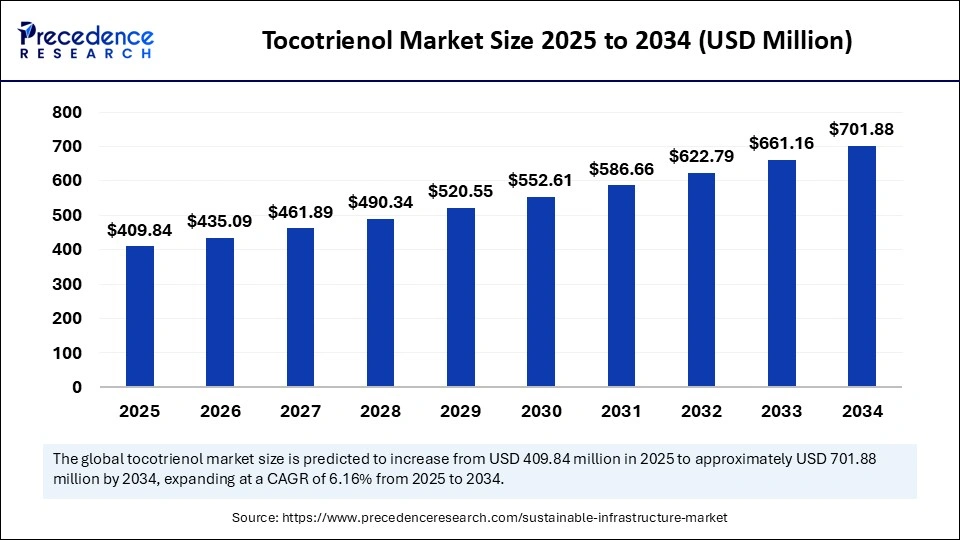

The global tocotrienol market is set to reach approximately USD 701.88 million by 2034, growing at a strong CAGR of 6.16% from 2025 to 2034, driven by health-conscious consumers seeking natural antioxidants and innovative nutraceutical and cosmetic products.

The tocotrienol market posts robust expansion, projected to rise from USD 409.84 million in 2025 to USD 701.88 million by 2034. As part of the Vitamin E family, tocotrienols are renowned for their potent antioxidant, anti-inflammatory, and neuroprotective benefits. Industry growth rests on increasing clinical awareness, consumer demand for plant-based antioxidants, and growing adoption in nutraceuticals, pharmaceuticals, cosmetics, and fortified foods.

Tocotrienol Market Key Insights

-

The Asia Pacific region dominates, valued at USD 163.94 million in 2025, due to upstream palm oil production, integrated supply chains, and mature nutraceutical manufacturing.

-

North America is the fastest-growing region, propelled by aging demographics, strong supplement uptake, and advanced clinical research.

-

Palm oil is the leading source, lending cost efficiency and supply reliability, especially in Malaysia and Indonesia.

-

Gamma tocotrienol holds the largest product share, valued for cardiovascular and neuroprotective therapeutics.

-

The capsules and softgels segment remains dominant, favored for convenience and consumer trust.

-

Dietary supplements are the top application, with cosmetics and personal care growing fastest.

-

Offline retail continues to lead distribution, while online channels show rapid growth, driven by digital health campaigns.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6750

Tocotrienol Market Revenue Table

| Measure | Value (USD Million) |

|---|---|

| Market Size, 2024 | 386.06 |

| Market Size, 2025 | 409.84 |

| Forecast, 2034 | 701.88 |

| Asia Pacific, 2025 | 163.94 |

| Asia Pacific, 2034 | 284.26 |

| Growth Rate (2025-2034, % CAGR) | 6.16 |

Artificial intelligence is revolutionizing the tocotrienol industry by streamlining supply chain efficiency and demand forecasting. AI enables ingredient processors and nutraceutical brands to optimize raw material sourcing, monitor global weather risk on palm production, and enhance clinical trial analysis for new tocotrienol-based formulations. These predictive tools provide faster pathways to market, delivering evidence-backed claims and clear documentation for regulatory approvals.

AI-powered consumer analytics also help brands target specific demographic segments—such as aging populations or wellness-focused millennials—driving personalized product recommendations for tocotrienol supplements. Through machine learning, companies refine product messaging and digital marketing, ensuring that the therapeutic benefits of tocotrienols reach broader audiences with greater impact.

What Drives the Tocotrienol Market Forward?

Market expansion is fueled by:

-

Rising preventive healthcare awareness, especially for cardiovascular, metabolic, and neurodegenerative conditions.

-

Broadening clinical studies showing reduced oxidative stress and improved lipid metabolism, reflected in recent publications such as Frontiers in Nutrition, 2024.

-

Growing nutricosmetic demand, as tocotrienols are increasingly included in skin rejuvenation and anti-aging formulas, appealing to holistic beauty and wellness trends.

Are Production Costs Holding the Market Back?

High costs in tocotrienol production—especially for extraction from palm oil, rice bran, and annatto—pose challenges. Complex technologies, agricultural supply volatility, and sustainability compliance (including RSPO certification) keep prices elevated. Such constraints limit mainstream adoption and restrict tocotrienols to premium nutrition and specialist healthcare niches.

Is Nutricosmetics the Market’s Biggest Opportunity?

Indeed, nutricosmetics are an emerging disruption. As nutrition and beauty merge, tocotrienols offer plant-derived, antioxidant-rich supplements for skin elasticity, hair strength, and anti-aging benefits. Major wellness brands have started launching tocotrienol-infused functional beverages and topical ointments, expanding the market’s scope from conventional supplements to holistic lifestyle products.

Why Do Palm Oil & Gamma Tocotrienol Continue to Lead?

Palm oil takes the largest market share thanks to cost, abundance, and mature extraction technologies—Malaysia and Indonesia continue to lead worldwide supply. Meanwhile, gamma tocotrienol remains most favored in clinical applications for heart and cognitive health, making it the top choice for manufacturers and healthcare practitioners.

Tocotrienol Market Segmentation Analysis

Source Segmentation

-

Dominant: Palm oil

-

Fastest Growing: Annatto (non-GMO, palm-free; popular in North America and Europe)

Product Type Segmentation

-

Leader: Gamma tocotrienol (cardioprotective & neuroprotective)

-

Growth Segment: Delta tocotrienol (targeted anti-cancer & cholesterol-lowering)

Form Segmentation

-

Dominant: Capsules & softgels (retail-friendly, high shelf life)

-

Growth Segment: Powder/granules (for functional food fortification)

Application Segmentation

-

Dominant: Dietary supplements

-

Growth Segment: Cosmetics & personal care (beauty-from-within demand)

Distribution Channel

-

Leader: Offline retail (pharmacist-driven trust)

-

Growth Channel: Online retail (e-commerce upgrade, influencer marketing)

End-Use Industry

-

Dominant: Healthcare & pharmaceuticals (chronic disease prevention)

-

Growth Sector: Food & beverages (fortified products, meal replacements)

Regional Trends

-

Asia Pacific: Dominant in supply chain, R&D, and nutraceutical manufacturing. Malaysia excels in GMP-grade extraction and logistics.

-

North America: Fastest-growing, driven by clinical research, consumer awareness, and premium supplement demand. Regulatory clarity and clean label trends drive innovation.

Tocotrienol Market Companies

- BASF SE

- BTSA Biotechnologías Aplicados SA

- American River Nutrition, Inc.

- Eisai Co., Ltd.

- Vance Group Ltd.

- ExcelVite

- Davos Life Science

- SourceOne Global Partners

- Cayman Chemical

- Orochem Technologies Inc.

- A.C. Grace Company

- Parchem

- Sime Darby Oils Nutrition.

- Supervitamins Sdn. Bhd.

- SOP Nutraceuticals

What are the Main Challenges and Cost Pressures?

The market’s main constraints include high production and extraction expenses, agricultural susceptibility (such as Southeast Asia’s weather-related palm supply disruptions), and mounting sustainability and compliance costs.

Case Example: Malaysian Palm Extractors Transform Supply

Malaysian palm oil processors, leveraging proximity to raw materials and advanced extraction facilities, have implemented traceability standards and GMP-grade manufacturing. These improvements have accelerated supply chain efficiencies, reduced costs, and enabled premium placement for tocotrienol ingredients in nutraceutical and beauty products worldwide.

Read Also: Digestive Diamine Oxidase Enzyme for Supplements Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Multi-Access Edge Computing Market Size to Reach USD 259.50 Billion by 2034 - September 12, 2025

- Storage Area Network Market Size to Surpass USD 36.63 Billion by 2034 - September 12, 2025

- Ambient Computing Market Size to Reach USD 448.89 Billion by 2034 - September 12, 2025