The Telecom Electronic Manufacturing Services (EMS) market has emerged as a crucial sector within the broader telecommunications industry, providing essential support for the design, manufacturing, and assembly of electronic components and devices used in telecommunications infrastructure. EMS companies play a pivotal role in enabling telecommunications companies to efficiently produce high-quality equipment while focusing on their core competencies such as network deployment, service provision, and innovation. As the demand for advanced telecom infrastructure continues to surge globally, the Telecom EMS market has witnessed significant growth, driven by various factors such as technological advancements, increasing network complexity, globalization, and the need for cost-effective manufacturing solutions.

Key Points

- Asia-Pacific contributed the largest share of the market in 2023.

- North America is estimated to expand at the fastest CAGR between 2024 and 2033.

- By services, the electronic manufacturing segment dominated the market with the largest share in 2023.

- By services, the electronic design & engineering segment is anticipated to grow at a remarkable CAGR during the forecast period.

Growth Factors:

Several key growth factors are propelling the expansion of the Telecom EMS market. Firstly, the rapid evolution of telecommunications technologies, including 5G deployment, Internet of Things (IoT), and cloud computing, has heightened the demand for sophisticated electronic components and equipment. Telecom EMS providers are uniquely positioned to cater to these demands by offering specialized manufacturing capabilities and expertise in producing complex telecom hardware. Additionally, the globalization of telecom operations and the expansion of network infrastructure in emerging markets have fueled the need for scalable and flexible manufacturing solutions, further driving the growth of the Telecom EMS market.

Get a Sample: https://www.precedenceresearch.com/sample/3861

Moreover, the increasing complexity of telecom equipment, coupled with shrinking product lifecycles, has intensified the reliance on EMS companies for efficient product development and time-to-market strategies. Telecom OEMs (Original Equipment Manufacturers) are increasingly outsourcing their manufacturing processes to EMS providers to leverage their expertise, resources, and supply chain efficiencies. Furthermore, the rising emphasis on cost optimization and operational efficiency within the telecom industry has led to a greater adoption of outsourcing strategies, with EMS providers offering competitive pricing and value-added services to their clients.

Trends:

Several notable trends are shaping the Telecom EMS market landscape. One prominent trend is the convergence of telecommunications with other industries such as automotive, healthcare, and smart infrastructure. This convergence has led to the development of integrated solutions that require customized manufacturing expertise, driving demand for specialized EMS services. Additionally, there is a growing focus on sustainability and environmental responsibility across the telecom sector, prompting EMS providers to adopt eco-friendly manufacturing practices and offer green solutions to their clients.

Another significant trend is the rise of contract manufacturing and strategic partnerships within the Telecom EMS market. Telecom OEMs are increasingly collaborating with EMS providers to streamline their supply chains, reduce production costs, and gain access to advanced manufacturing technologies. This trend has led to a proliferation of joint ventures, alliances, and mergers within the industry, facilitating greater synergy and innovation across the value chain. Moreover, the advent of digital transformation and Industry 4.0 technologies has revolutionized the manufacturing processes within the Telecom EMS market, enabling greater automation, connectivity, and real-time data analytics.

Telecom Electronic Manufacturing Services Market Scope

| Report Coverage | Details |

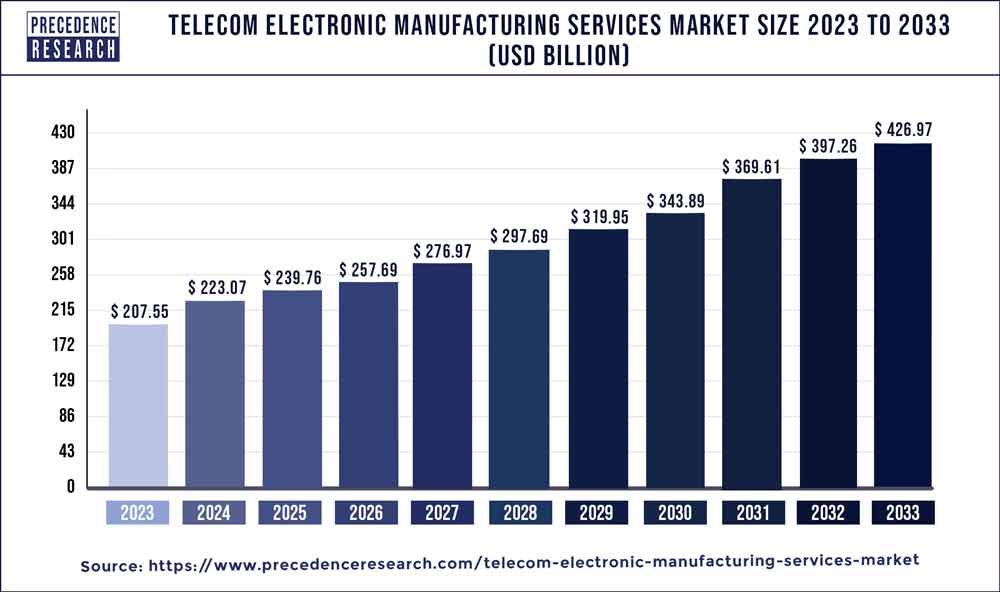

| Growth Rate from 2024 to 2033 | CAGR of 7.48% |

| Global Market Size in 2023 | USD 207.55 Billion |

| Global Market Size by 2033 | USD 426.97 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Advanced manufacturing capabilities and expertise in telecom electronics.

- Flexibility and scalability to accommodate varying production demands.

- Global footprint and diversified customer base.

- Strong relationships with telecom OEMs and strategic partners.

- Continuous investment in R&D and technological innovation.

Weaknesses:

- Vulnerability to fluctuations in the telecom market.

- Dependence on key customers for a significant portion of revenue.

- Intensive capital requirements for upgrading manufacturing facilities.

- Exposure to geopolitical risks and supply chain disruptions.

- Intense competition from both domestic and international EMS providers.

Opportunities:

- Expansion into emerging markets with growing telecom infrastructure needs.

- Diversification into adjacent industries such as automotive and IoT.

- Offering value-added services such as design engineering and aftermarket support.

- Embracing sustainability initiatives to attract environmentally conscious customers.

- Leveraging digitalization and automation to enhance operational efficiency.

Threats:

- Price pressure and margin erosion due to intense competition.

- Regulatory uncertainties and compliance challenges in different markets.

- Disruption of supply chains due to geopolitical tensions or natural disasters.

- Rapid technological obsolescence and short product lifecycles.

- Potential cybersecurity risks associated with connected telecom devices.

Read Also: Smart Infrastructure Market Size to Worth USD 2,414.28 Bn By 2033

Recent Developments

- In August of 2022, Celestica Inc., a company specializing in design, manufacturing, and supply chain solutions for innovative companies, unveiled a range of new storage solutions. Notable among these are the Athena G2, a state-of-the-art 2U rackmount NVMe storage array; the Nebula G2, an all-flash storage expansion featuring PCIe 4.0 NVMe SSDs; and the Titan G2, an advanced 4U dense storage array. These cutting-edge products provide unmatched flexibility and customizable options to meet the rigorous demands of contemporary applications, whether deployed on-premises or in public clouds.

- In June 2022, Flex announced its strategic initiative to bolster its presence in the automotive industry by expanding its operations in Jalisco, Mexico. The forthcoming project involves the construction of a cutting-edge facility spanning 145,000 square feet. This state-of-the-art facility is poised to become a pivotal manufacturing hub in the region, with a focus on producing advanced electronic components to propel the advancement of electric and autonomous vehicles.

- In March 2021, PleXUs, a leader in complex product design, manufacturing, supply chain, and aftermarket services, initiated the construction of a cutting-edge manufacturing facility in Bangkok, Thailand. Covering an impressive 400,000 square feet, this new facility comprises two production and warehousing levels along with four office space levels. Demonstrating a commitment to upholding environmental, social, and governance (ESG) best practices, PleXUs has seamlessly integrated various energy-efficient and green building initiatives into the facility’s design.

Competitive Landscape:

The Telecom EMS market is characterized by intense competition and a diverse ecosystem of players ranging from multinational corporations to niche providers. Key players in the market include Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation, Benchmark Electronics Inc., and Plexus Corp., among others. These companies compete based on factors such as manufacturing capabilities, technological expertise, global reach, pricing strategies, and customer relationships. Additionally, the market is witnessing the emergence of new entrants and startups focusing on specialized services such as PCB (Printed Circuit Board) assembly, RF (Radio Frequency) testing, and logistics management.

Strategic partnerships and acquisitions are common within the Telecom EMS market as companies seek to enhance their capabilities, expand their geographic presence, and diversify their service offerings. Furthermore, differentiation through innovation and value-added services such as design engineering, prototyping, and supply chain management has become essential for maintaining a competitive edge in the market. Overall, the Telecom EMS landscape is dynamic and evolving, driven by technological advancements, changing customer preferences, and shifting market dynamics.

Telecom Electronic Manufacturing Services Market Companies

- Foxconn Technology Group

- Jabil Inc.

- Flex Ltd.

- Celestica Inc.

- Benchmark Electronics, Inc.

- Sanmina Corporation

- Plexus Corp.

- Kimball Electronics, Inc.

- Wistron Corporation

- Universal Scientific Industrial Co., Ltd. (USI)

- Zollner Elektronik AG

- Venture Corporation Limited

- SIIX Corporation

- Elcoteq SE

- SMTC Corporation

Segments Covered in the Report:

By Services

- Electronic Design & Engineering

- Electronics Assembly

- Electronic Manufacturing

- Supply Chain Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024